Trading Mechanism Introduction

- Regular Trading

- Warrant Trading

- After-Hour Fixed-Price Trading

- Intraday odd lot trading

- After-Hour Odd Lot Trading

- Block Trading

- Auction

- Reverse Auction

- Registered Central Government Bonds and Foreign Bonds

- Omnibus Trading Account

- Suspending and Resuming Trading of Securities

- Summary of Trading

1. Regular Trading

- Applicable Time

- Order Placing Hours 8:30-13:30

Effected from Feb. 20, 2012, whenever the reference price of certain stocks rises or falls more than 3.5 percent of the last reference price one minute before the close (1:29 pm-1:30 pm), investors are allowed to add, modify or cancel their orders of that stock from 1:31 pm to 1:33 pm. - Trading Hours 9:00-13:30

Effected from Feb. 20, 2012, whenever the reference price of certain stocks rises or falls more than 3.5 percent of the last reference price one minute before the close (1:29 pm-1:30 pm), the orders of that stock will be matched at 1:33 pm for closing, instead of 1:30 pm.

- Order Placing Hours 8:30-13:30

- Trading Units

Orders may be in one Trading Units or multiples Trading Units as shown in the following tables. Orders below 1,000 shares are considered as odd-lot orders.

Types of securities Trading units 1. stocks, a primary listing of a foreign stock, certificate of payment or document of title to new shares, certificate of entitlement to new shares and special shares with call warrants. 1,000 shares 2. Stock Warrant, Securities Investment Trust Funds closed-end beneficiary certificate, REITs, depository receipt, ETF comprising only domestic securities, ETF comprising foreign securities, Futures ETF, Leveraged or Inverse ETF、company warrant、ETN comprising only domestic securities, ETN comprising foreign securities, Leveraged or Inverse ETN 1,000 units 3. a secondary listing of a foreign stock, offshore ETF Not limited for 1000 shares(units) 4. Convertible Bond, Central Registered Government Bond, Corporate Bond, Corporate Bond with Warrant par value of NT$ 100,000. - Daily Price Fluctuation Limit

- Limits on call (put) warrants for which the underlying is a domestic single

stock or an exchange-traded securities investment trust fund announced by

the TWSE shall be calculated as follows:

- For call warrants

Limit-up price = Auction reference price at market opening for the given day + (Limit-up price of the underlying security for the given day –Auction reference price at market opening for the underlying security for the given day) × Exercise ratio

Limit-down price = Auction reference price at market opening for the given day - (Auction reference price at market opening for the underlying security for the given day - Limit-down price of the underlying security for the given day) × Exercise ratio - For put warrants

Limit-up price = Auction reference price at market opening for the given day + (Auction reference price at market opening for the underlying security for the given day – Limit-down price of the underlying security for the given day) × Exercise ratio

Limit-down price = Auction reference price at market opening for the given day – (Limit-up price of the underlying security for the given day – Auction reference price at market opening for the underlying security for the given day) × Exercise ratio

- For call warrants

- Fluctuation limits on call (put) basket warrants shall be calculated for each underlying security within the basket using the following formulas: (1) (Limit-up price of each underlying security in the basket for the given day –Auction reference price at market opening for each underlying security for the given day) × Sum of exercise ratios for each underlying security in the basket; and (2) (Auction reference price at market opening for each underlying security for the given day – Limit-down price of each underlying security for the given day) × Sum of the exercise ratios for each underlying security in the basket. The larger of these two figures shall be plugged into the formulas in the preceding sub-paragraph to calculate the daily fluctuation limits.

- Limits on index call (put) warrants for which the underlying is an index as

announced by the TWSE shall be calculated using one of the following two

formulas:

- Limit-up price for call (put) warrants = Auction reference price at market opening for the given day + (Closing index of the underlying index on the previous day × corresponding monetary value per index point × Exercise ratio × 10%).

- Limit-down price for call (put) warrants =Auction reference price at market opening for the given day - (Closing index of the underlying index on the previous day × corresponding monetary value per index point × Exercise ratio × 10%).

- No price fluctuation limit is imposed on call (put) warrants for which the underlying is an exchange-traded fund with foreign component securities, or an offshore exchange-traded fund, or a foreign security, or a foreign index.

Price variation limit is increased to 10% on June 1st, 2015, and account collateral maintenance ratio of margin trading has been adjusted to 130% since May 4th, 2015.

For more detail information, please see the attachment.

Types of securities Price limit Stocks/ Foreign Stock primary listing / Securities Investment Trust Fund Closed-end Beneficiary Certificates/REITs/TDRs /ETF comprising only domestic securities/ Futures ETF / Certificate of Entitlement to New Shares/ Certificate of Payment of Shares /Convertible Bonds/ ETN comprising only domestic securities 10 percent above and below the auction reference price at market opening for the given day. For a Leveraged or Inverse ETF of which the component securities of the underlying index are all domestic securities/ Leveraged or Inverse ETN of which the component securities of the underlying index are all domestic securities The relevant daily price fluctuation limit for the beneficial certificates is 10 percent multiplied by the multiple of the fund. Warrants Preferred Shares with Warrants Limit-up price = Auction reference price at market opening for the given day *(1+10%) + (Limit-up price of the underlying security for the given day –Auction reference price at market opening for the underlying security for the given day) × Exercise ratio

Limit-down price = Auction reference price at market opening for the given day *(1-10%)- (Auction reference price at market opening for the underlying security for the given day - Limit-down price of the underlying security for the given day) × Exercise ratioCorporate Bonds with Warrants Limit-up price = Auction reference price at market opening for the given day *(1+5%) + (Limit-up price of the underlying security for the given day –Auction reference price at market opening for the underlying security for the given day) × Exercise ratio

Limit-down price = Auction reference price at market opening for the given day *(1-5%)- (Auction reference price at market opening for the underlying security for the given day - Limit-down price of the underlying security for the given day) × Exercise ratioCompany Warrants Limit-up price = Auction reference price at market opening for the given day + (Limit-up price of the underlying security for the given day –Auction reference price at market opening for the underlying security for the given day) × Exercise ratio

Limit-down price = Auction reference price at market opening for the given day - (Auction reference price at market opening for the underlying security for the given day - Limit-down price of the underlying security for the given day) × Exercise ratioCorporate Bonds 5 percent above and below the auction reference price at market opening for the given day. Government Bonds/Foreign Bonds/ Foreign Stocks secondary listing/ newly listed common stocks on the first 5 days/ETF comprising foreign securities/offshore ETF / Leveraged or Inverse ETF of which the component securities of the underlying index contain one or more foreign securities/ ETN comprising foreign securities / Leveraged or Inverse ETN of which the component securities of the underlying index contain one or more foreign securities No price fluctuation limit. - Limits on call (put) warrants for which the underlying is a domestic single

stock or an exchange-traded securities investment trust fund announced by

the TWSE shall be calculated as follows:

- Daily Price Fluctuation Limit

Price Range *Equity Product Stock Warrant & company warrant Convertible Bond & Corporate Bond with Warrant ETF comprising only domestic securities, ETF comprising foreign securities, futures ETF, leveraged or inverse ETF, offshore ETF & REITs ETN comprising only domestic securities, ETN comprising foreign securities, leveraged or inverse ETN Corporate Bond Foreign Bond Central Registered Government Bond 0.01<=P<5 0.01 0.01 0.05 0.01 0.05 0.01 (-- foreign currency) 0.01 5<=P<10 0.05 10<=P<50 0.05 0.10 50<=P<100 0.10 0.50 0.05 100<=P<150 0.50 1.00 150<=P<500 1.00 500<=P<1000 1.00 5.00 1000 and above 5.00 5.00 The tick increment of price quotes for block trades is 0.01.

*Equity Products include stocks, certificate of entitlement to new shares, securities investment trust funds closed-end beneficiary certificate, depository receipt, foreign stocks, certificate of payment or document of title to new shares, and special shares with call warrants.

**Ticks for foreign bonds are determined by foreign currencies. - Orders types:

New order types such as market order, Immediate or Cancel (IOC), and Fill or Kill (FOK) are available only during the continuous trading sessions. These provide investors with more options when placing orders.

- Market orders

When placing a market order, the investor does not need to specify a certain price, and the order may be settled within the price fluctuation range of the securities of the day.- How to place a market order

- Market orders will only be accepted during the continuous trading session, and will not be accepted at the call auction session (opening, closing or when intraday volatility interruption is triggered). When the intraday volatility interruption takes place or during the closing session, all market orders remaining in the order book will be automatically deleted by the TWSE and securities firms will be notified of the deletion.

- When placing a market order, the investor does not need to specify a certain price.

- Restrictions on market orders:

- For securities which are restricted to place at a price lower than the closing price of the previous business day, these are not available for short selling with market orders.

- For securities in the first five days of their IPO and those not subject to price fluctuation limits, market orders will not be accepted: The reason is the securities in these two categories are not subject to any price fluctuation limits. For these securities, transactions could take place at any price. In order for the trade price to reach beyond investors’ expectations, there are regulations in place that exclude market orders from trading of these securities.

- Securities that the TWSE has listed as disposition securities or listed under the altered-trading-method category: These securities are to be traded by call auction and market orders are not applicable.

- Matching rules for market orders

- A market order executes at the best available price. If, after the matching, there are market orders remaining in the order book, they will always be listed as the top priority. Even if there are limit orders that are subject to upper and lower price fluctuation limits in the order book, market orders will still be the top priority.

- "Prior to matching a trade" subject to a market order, the "reference price shall be converted" based on the following principles, with the converted price as its order price:

- In the case of market buy orders, the converted reference price shall be the most recent trade price of the applicable securities (or auction reference price at market open in the absence of a most recent trade price), the highest buy order price in the order book, or the highest sell order price in the order book, whichever is higher.

- In the case of market sell orders, the converted reference price shall be the most recent trade price of the applicable securities (or auction reference price at market open in the absence of a most recent trade price), the lowest buy order price in the order book, or the lowest sell order price in the order book, whichever is lower.

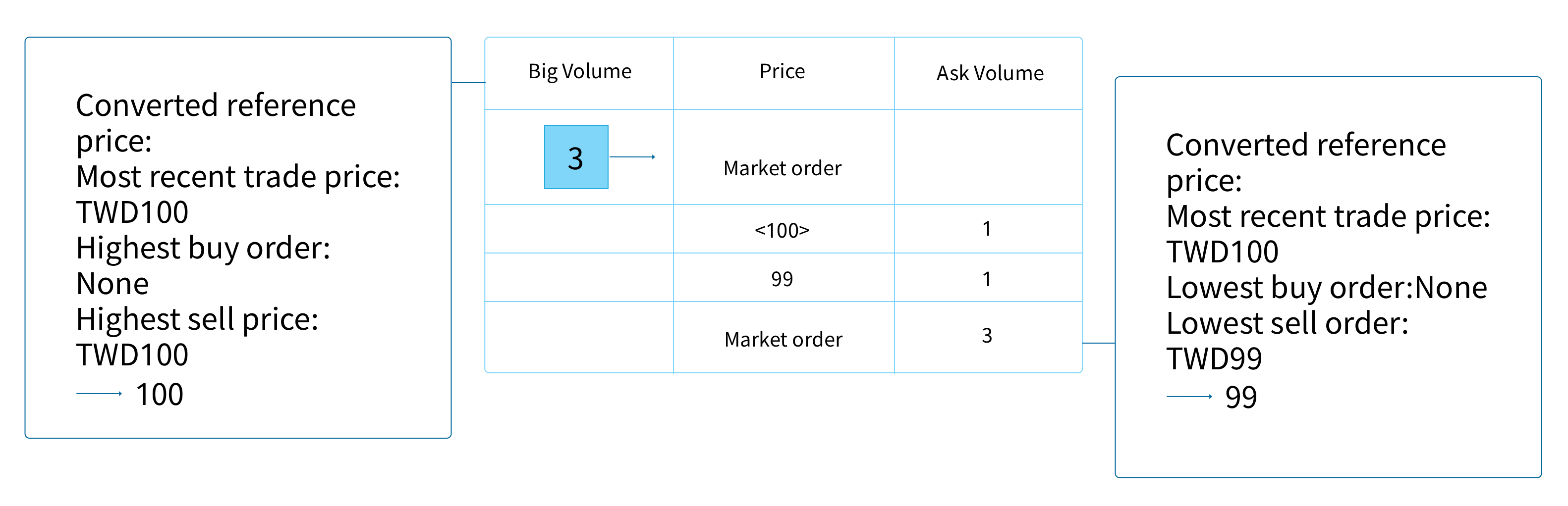

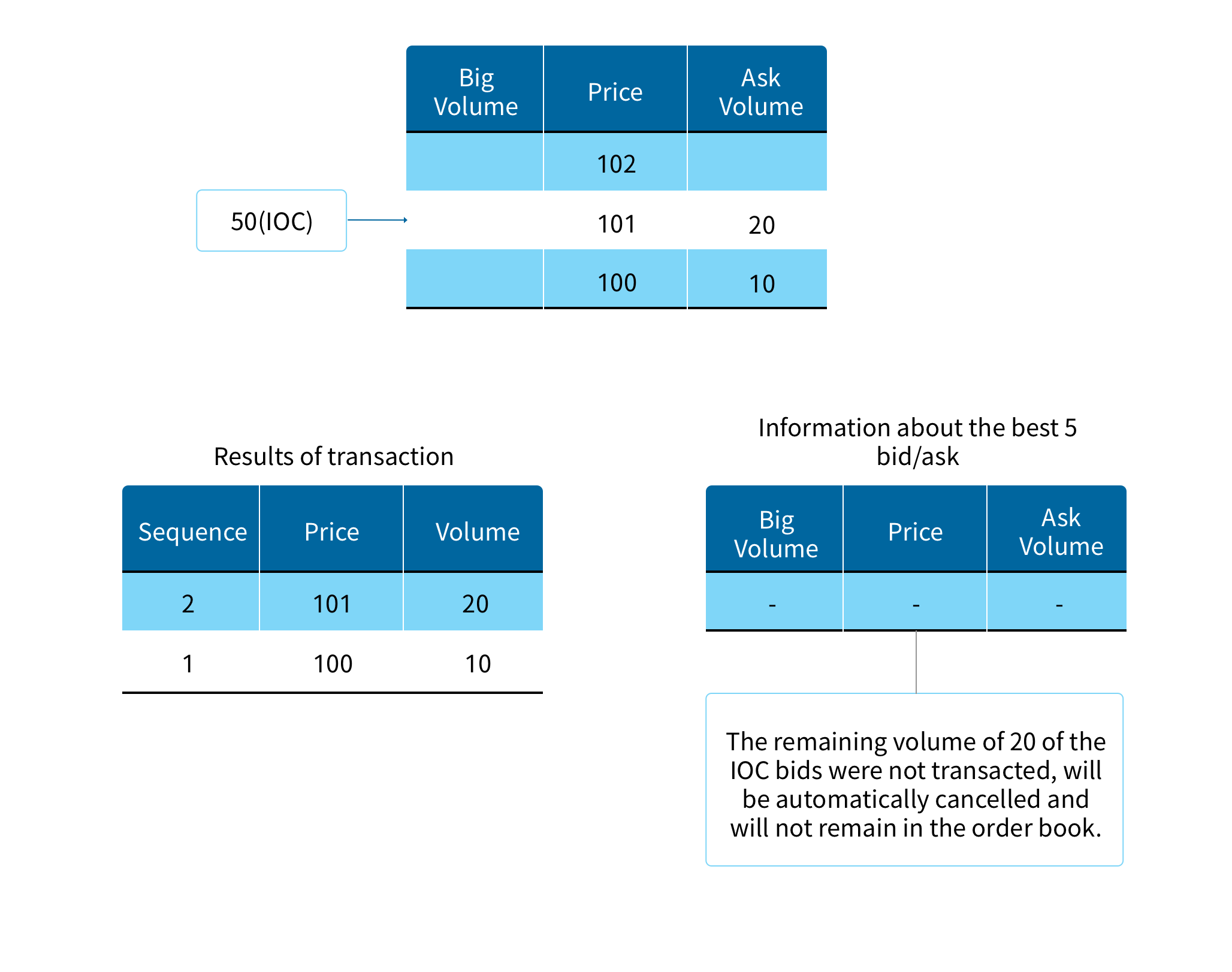

Example: The most recent trade price is TWD100. In the order book, the volume of market sell order was 3, limit sell order at TWD99 was 1, and limit sell order at TWD100 was 1.

Now there is a new market buy order of volume 3.

Based on the matching principle for continuous trading, transactions are taking place at the price offered by the counterparty in an appropriate order:

In this example, the market orders remaining in the order book are sold at the converted reference price of TWD99 and the volume of 3. The market orders executed before the limit orders despite that the limit sell orders are offered at the same price of TWD99.

- How to place a market order

-

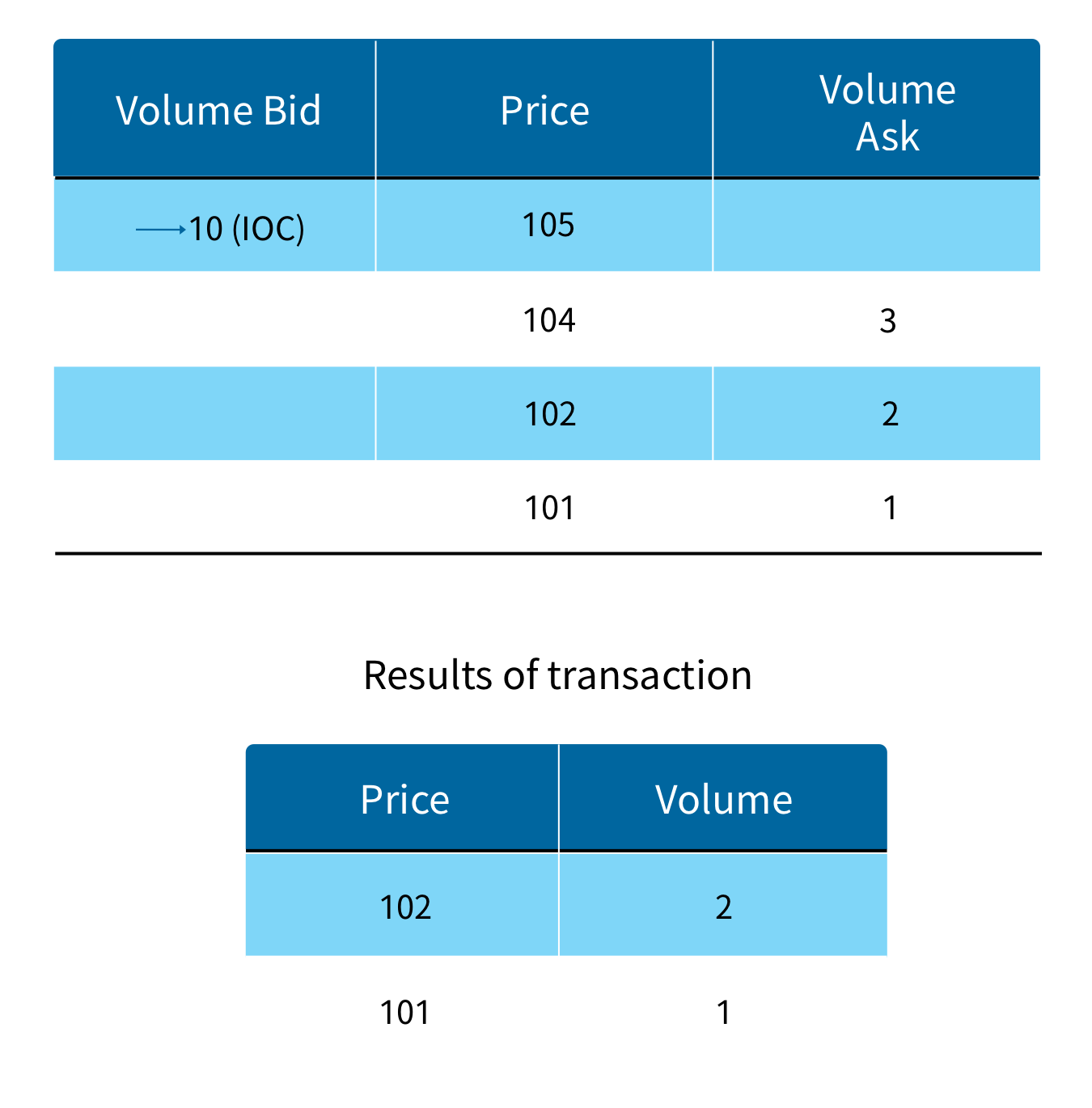

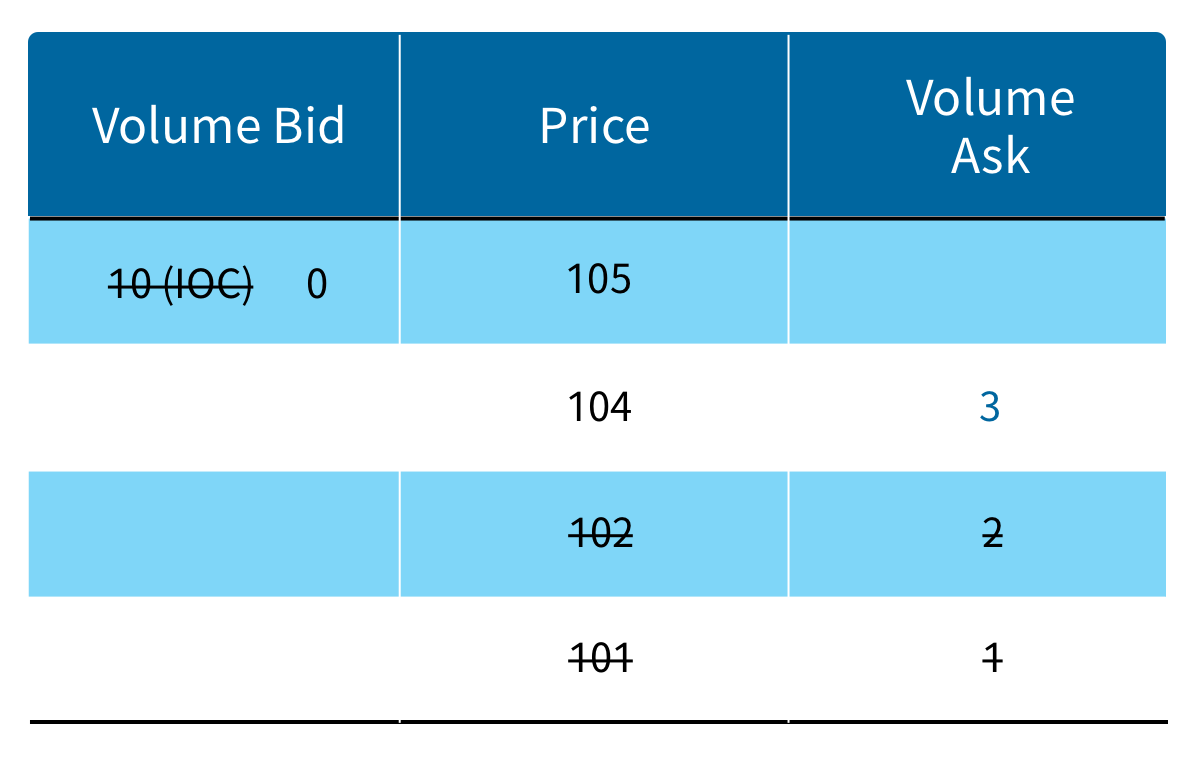

Immediate or cancel (IOC) order

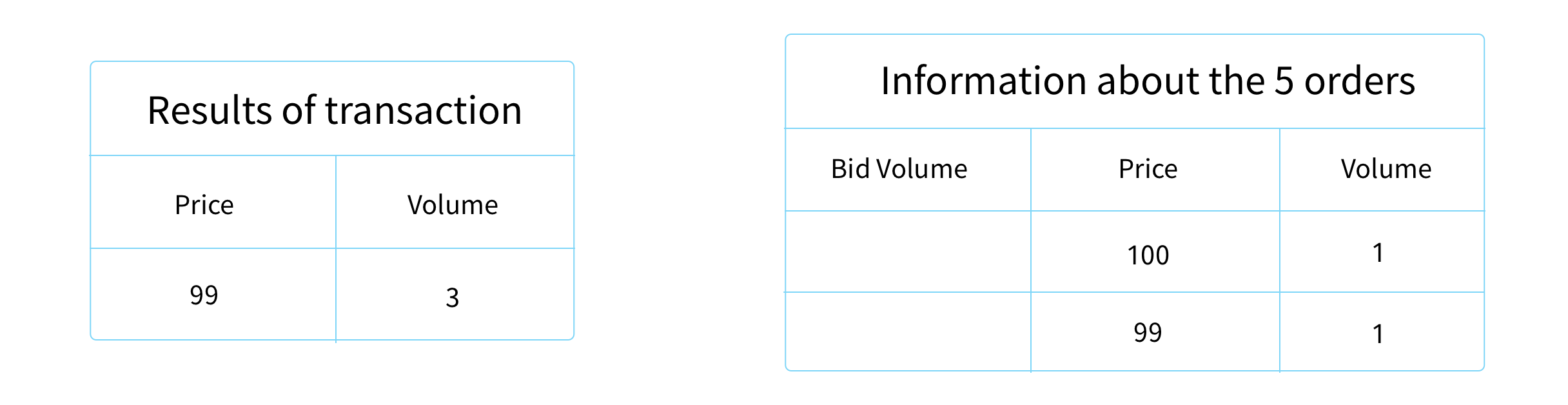

An immediate or cancel (IOC) order is an order to buy or sell a security that executes all or part immediately and cancels any unfilled portion of the order. For example, if the volume of an IOC order is 10, and only 5 are available , these 5 will be traded and the other 5 will be automatically cancelled.

- An IOC order will be accepted only during the continuous trading session, and this type of order will not remain in the order book. No IOC order will be accepted at opening, closing or when intraday volatility interruption is triggered.

- When order prices are being taken into account, an IOC order can be a limit IOC order or a market IOC order.

Example

-

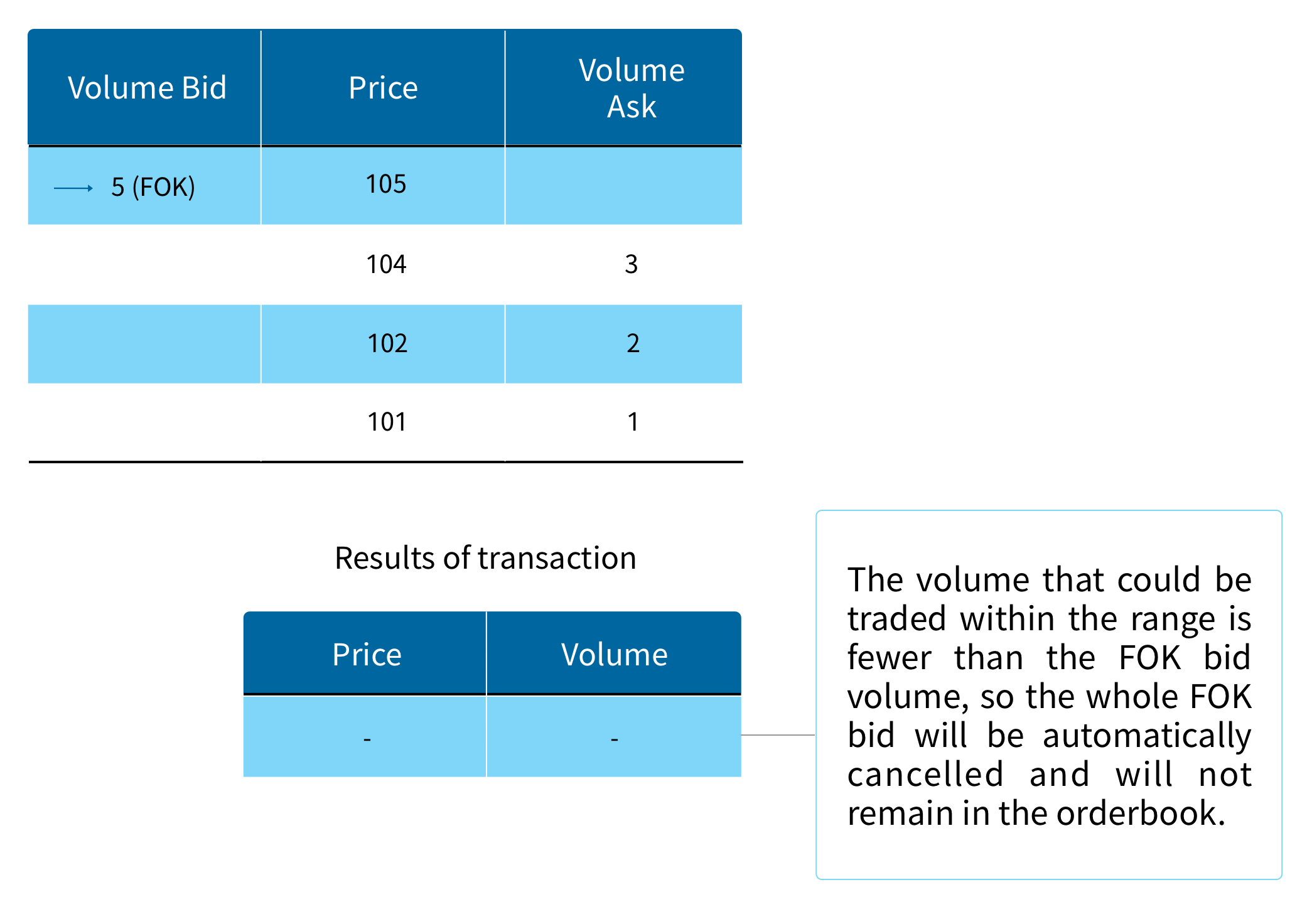

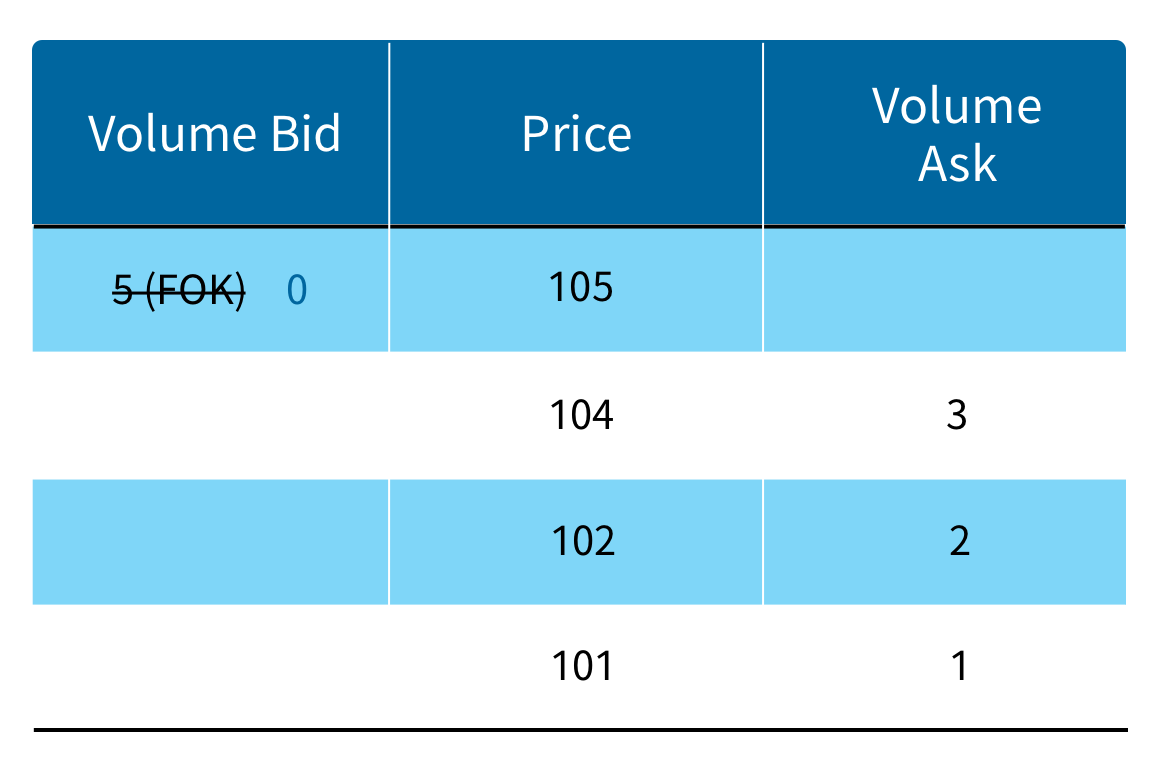

Fill or kill (FOK) order

A fill or kill (FOK) order is an order for which a transaction is executed immediately and completely or not at all. For example, if the volume of an FOK order is 10, and only 5 are available, all 10 will be cancelled and not traded.

- An FOK order may only be accepted during the continuous trading session, and the order will not remain in the order book. No FOK order will be accepted at opening, closing or when intraday volatility interruption is triggered.

- When order prices are being taken into account, an FOK order can be a limited FOK order or a market FOK order.

Example

Incorporating the current limit order and Rest of Day (ROD) with the new orders types mentioned above, there are six new order types listed as below.

Price Duration New Applicable session 1 Limit order ROD Opening and closing session, continuous trading session, during intra-day volatility interruption 2 Limit order IOC NEW Continuous trading session 3 Limit order FOK NEW Continuous trading session 4 Market order ROD NEW Continuous trading session 5 Market order IOC NEW Continuous trading session 6 Market order FOK NEW Continuous trading session - Market orders

-

Addition of the order price change feature:

In the current system, an investor who wants to change the order price has to cancel the order and place a new one. After continuous trading is online, a new order feature is added to allow an investor to directly change the order price to reduce the amount of information. Please note, however, when an order price is changed, the order time shall become the time when the price was changed.

Example: Investor A placed an ROD bid volume one of Share X for a price of TWD100 at 9:01 am. Price of Share A continued to go up. At 9:30 am, Investor A decided to change the price to TWD105 and he did that using the order price change feature, and the order time was also changed from 9:01 am to 9:30 am.

→ The order price change feature basically combines two actions, "cancel an order" and "place a new order", into one. So the order time should naturally be the time when the new order is placed. In other words, the time of the order price change is the time when the order price is changed.

- Restriction on use of the order price change:

For securities which are restricted to place at a price lower than the closing price of the previous business day, their price shall not be changed to be lower than closing price of the previous business when short selling.

- Restriction on use of the order price change:

- Matching

All securities listed on the Exchange are traded through Fully Automated Securities Trading (FAST).Investors can place orders in person, by phone or internet. Orders are entered via terminals on securities firms’ premises into TWSE’s main computer and are processed and executed by the trading system using a price-time priority precedence hierarchy. In special cases, listed stocks may be traded through negotiation, auction, tender offer or other means. All Securities are executed on a continuous basis during intraday regular trading sessions, and are matched by call auction at the opening and closing of the regular trading session.

Matching methods on regular trading period:

Order Types:Limit order, Market order, Rest of day(ROD), Immediate or Cancel(IOC), and Fill or Kill(FOK) are available during the continuous trading sessions. However, investors could only place Limit ROD during call auction session. In order to limit extreme price fluctuation, intra-day volatility interruption is in place. Whenever the trading system detects that the potential execution price of a specific stock will fall out of a specified range (+/-3.5%) as compared to the weighted average traded price over the preceding five minutes (reference price), matching for that stock is postponed for two minutes. The suspended stock will resume trading with a call auction, then return to continuous trading.Period Matching Methods Opening session 8:30 - 9:00

(or first matching after 9:02 in case of postponement of securities market open)Call auction Intraday trading session 9:00 - 13:25 Continuous trading Intraday Volatility Interruption Call auction 13:25 - 13:30

(or 13:33 in case of postponement of securities market close)Call auction - How the measures are implemented:

- 9:00-9:05:The basis is the opening price generated by call auction, or auction reference price at market opening in the absence of an opening price for the first matching.

- After 9:05:The weighted average price is calculated based on transactions taking place in the five minutes before an order (only trade prices of continuous trading are being considered, not the opening price generated by call auction). If there is no trade price during the five minutes, the basis is the most recent trade price, or auction reference price at market opening in the absence of a recent trade price.

- Volatility Interruption measures:For individual stocks, starting the first matching after 9:00 am, if the intraday volatility interruption measures are triggered, during the first five minutes after the intraday volatility interruption, the basis shall be the trade price of the call auction, or the most recent trade price in the absence of trade price of the call auction, for that intraday volatility interruption session. After the five minutes, calculation of rolling weight average prices will resume.

Example: The stock has an opening price of TWD100 at 9:00 am. At 9:01 am, has a trade price at TWD100 of volume 1; at 9:02 am, has a trade price at TWD101 of volume 4; at 9:03 am, has a trade price at TWD102 of volume 5. If the potential trade price at 9:05:01 am is TWD105:

- Because 9:05:01 am is past the five minutes after the first matching, the reference price is the "weighted average price for the first five minutes". The reference price is the weighted average price, taking into account all trade prices and number of transacted volume between 9:00.01 am ~9:05:01 am, which is TWD101.4 (TWD100*1+ TWD101*4 + TWD102*5) ÷ (1 + 4 + 5). Compared with the price, the potential trade price TWD105 exceeds by 3.5%, which triggers intraday volatility interruption when matching is suspended until 9:07:01 am. At 9:07:01 am, orders are matched by call auction. After that, continuous trading resumes.

- At 9:07:01 am, if based on the result of call auction matching the trade price is TWD104, the reference price for the next five minutes (until 9:12:01 am) will be TWD104. After 9:12:01 am, calculation of the 5-minute weighted average price resumes.

- Intraday Volatility Interruption for various types of orders

Investors can add limit ROD orders during intra-day volatility interruption. However, market order, IOC, and FOK are not accepted. After continuous trading, types of orders increase and each order may have multiple trade prices. With the characteristics of orders being considered, only limit rest of day (ROD) orders may trigger intraday volatility interruption. For all other orders, if prices exceed the range, it could partially be traded within the range, and partially be automatically canceled because of a price exceeding the range.

When the intra-day volatility interruption is triggered, the matching system will automatically delete existing market orders. During the intra-day volatility, trading information will be disclosed every five seconds, same as the opening and closing session.

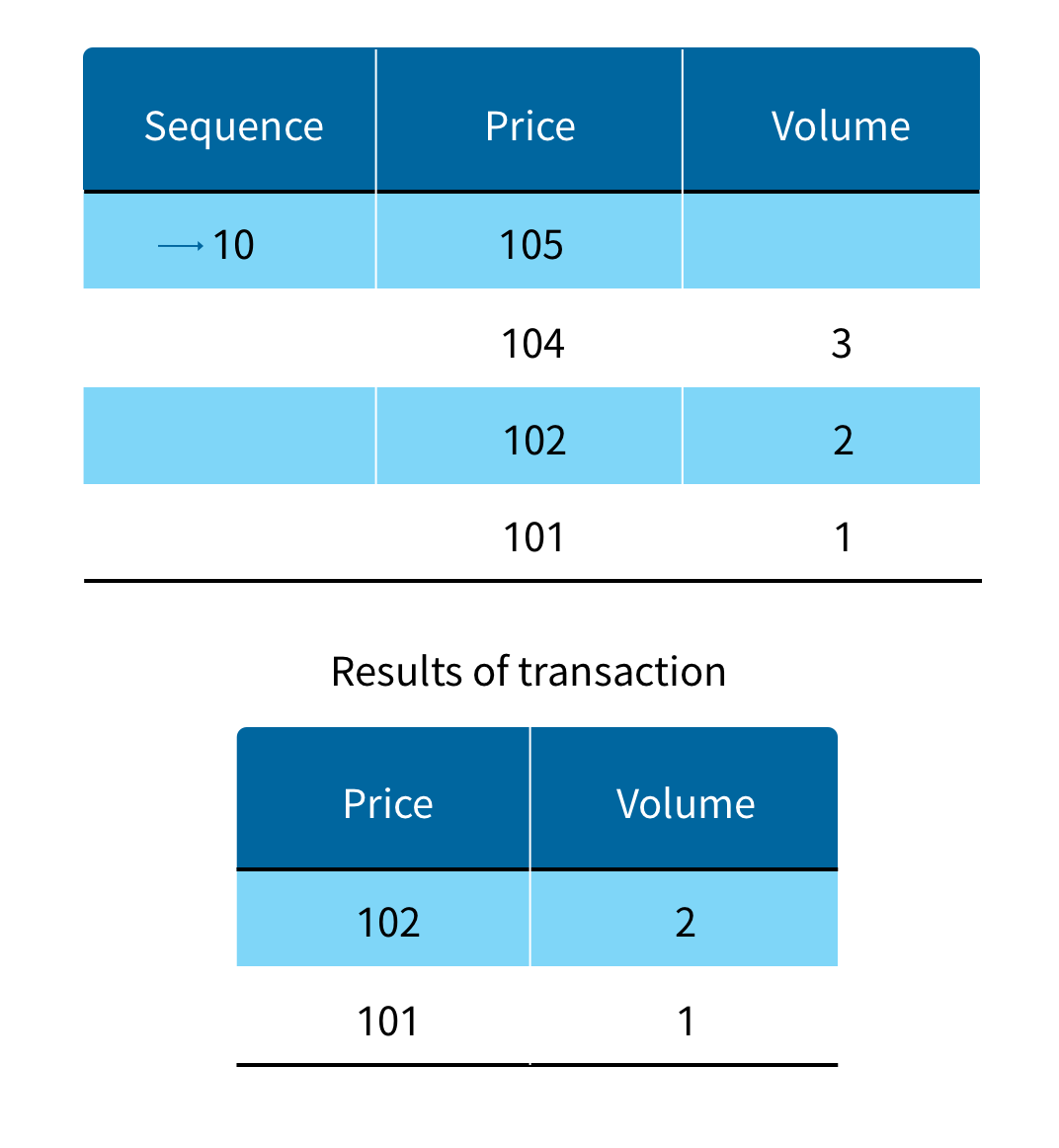

Limit ROD order - Example

If the reference price is TWD100 and the maximum and minimum prices that trigger intraday volatility interruption are TWD103.5 and TWD96.5, and the new ROD bid is at TWD105 with volume 10:

After intraday volatility interruption is triggered, matching is postponed for two minutes and then the trade is matched by call auction.

(What an order book looks like when intraday volatility interruption are triggered)

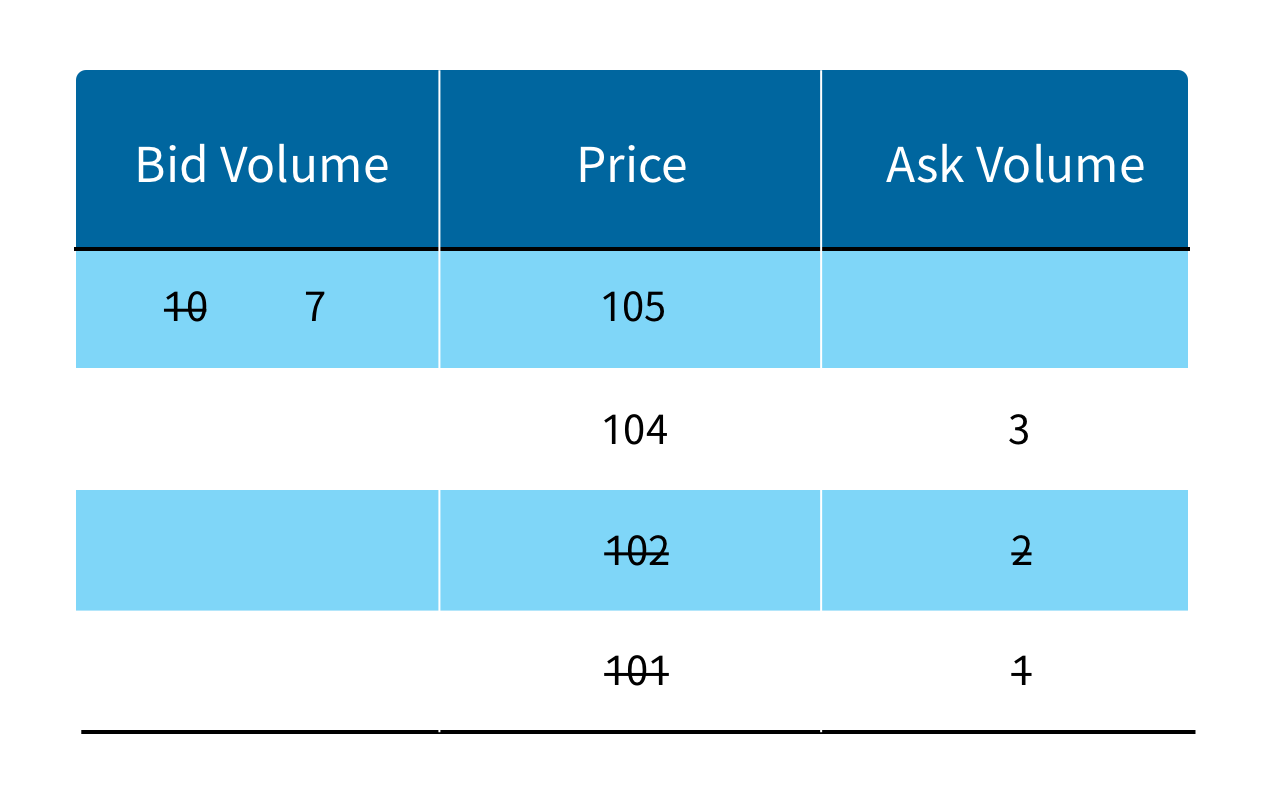

Market ROD order - Example

If the reference price is TWD100 and the maximum and minimum prices that trigger intraday volatility interruption are TWD103.5 and TWD96.5, and the new ROD market order would like to bid with volume 10:

Intraday volatility interruption will not be triggered. The remaining market orders will automatically be canceled.

(What an order book looks like after the transaction.)

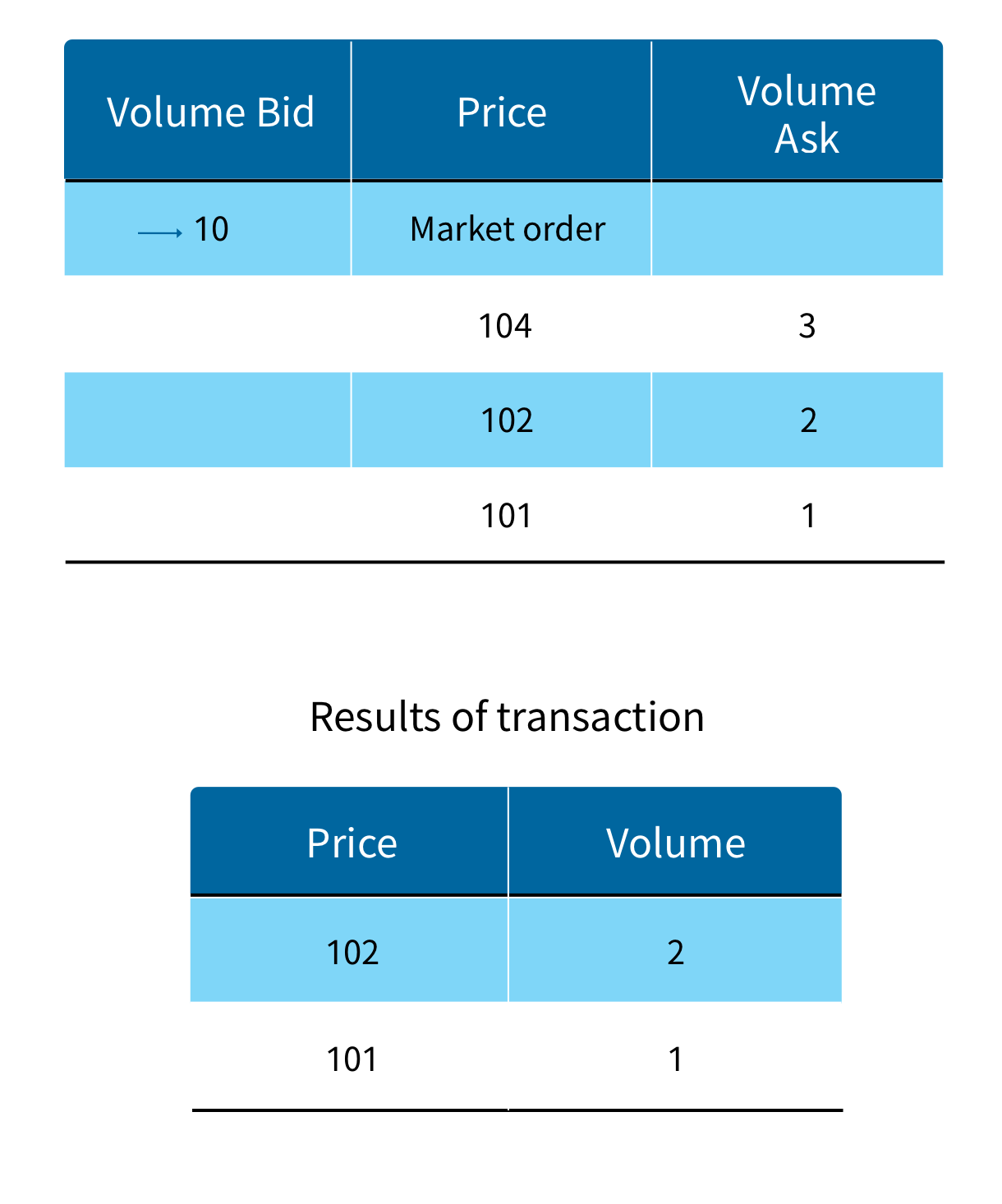

IOC order - Example

If the reference price is TWD100 and the maximum and minimum prices that trigger intraday volatility interruption are TWD103.5 and TWD96.5, and the new IOC bid is at TWD105 of volume 10:

Intraday volatility interruption will not be triggered. The remaining IOC orders will automatically be canceled.

(What an order book looks like after the transaction.)

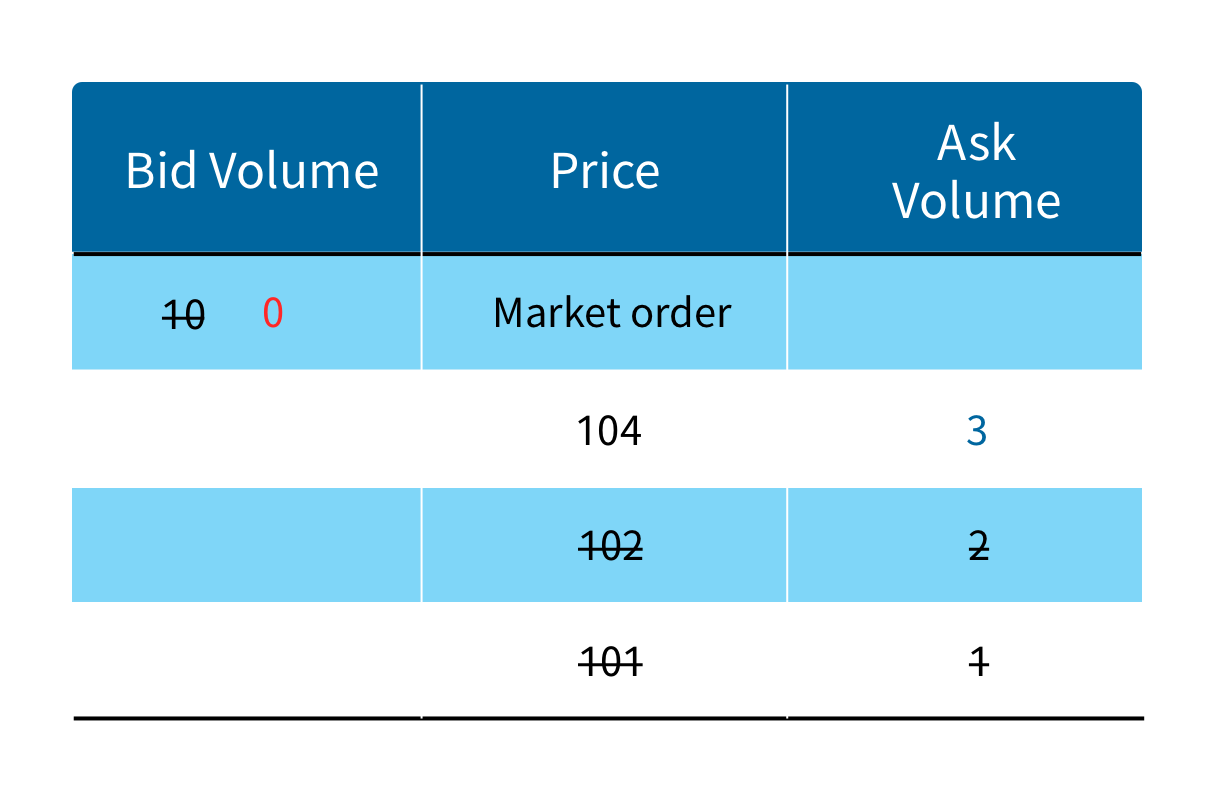

FOK order - Example

If the reference price is TWD100 and the maximum and minimum prices that trigger intraday volatility interruption are TWD103.5 and TWD96.5, and the new FOK bid is at TWD105 of volume 5:

Intraday volatility interruption will not be triggered. The FOK order will automatically be canceled.

(What the order book looks like.)

Exceptions to circumstances when intraday volatility interruption is not triggered- First matching after 9:00 am.

- Securities with the auction reference price at market open lower than TWD1: For these securities, when their price goes up or down for one or two tick sizes, the price fluctuation exceeds 3.5%. To avoid frequent triggering of intraday volatility interruption that would reduce matching efficiency, the intraday volatility interruption does not apply to these securities.

- Call (put) warrants: Because of the characteristics of these commodities, their daily price fluctuation limits are calculated based on the maximum price fluctuation of their underlying securities and may be at multiples of price fluctuation limits. Given the characteristics in the trading of these commodities, the intraday volatility interruption is not applicable.

- For IPO securities in the first five trading days when they are not subject to daily price fluctuation limits: In order to allow IPO common shares to have a price that fully reflects their reasonable value and to meet the market demand, IPO common shares, not including OTC shares that become listed at the exchange or other securities that are not common shares, in the first five trading days after the IPO, there are no daily price fluctuation limits and therefore these intraday volatility interruptions will not be triggered during this period of time.

- How the measures are implemented:

- Real-time trading information disclosure

Trading price, volume, best 5 bid/ask price and volume are disclosed on a “real time” basis, and a “5-second snapshot” is also provided. This allows market participants to make an informed judgment when placing orders. This information can be accessed at:

https://mis.twse.com.tw/stock/index.jsp?lang=en_us - Information Disclosure before Market Opening and Closing Summary

Taiwan Stock Exchange (hereinafter TWSE) and Taipei Exchange (hereinafter TPEX) will disclose simulated transaction prices, simulated trading volumes, simulated best five bid/ask prices, and simulated bid/ask volumes for investors’ reference in making orders before market opening (08:30-09:00) and during the last five minutes before market closing (13:25-13:30).

If in the last 1 minute before market opening (08:59-09:00) or closing(13:29-13:30), there is a volatile change of a securities reference price that reaches a specific rate simulated by the order-matching system, market opening will be temporarily suspended 2 minutes for those individual stocks.

During suspension, investors’ new limit ROD orders, cancellations and revision requests will continue to be accepted and information of simulated transaction prices, simulated trading volumes, and simulated best five reported bid/ask prices and volumes will continually be disclosed to provide investors with an opportunity to consider adding, cancelling or altering an order of a stock with high price volatility before market opening.

For more detail information, please see the attachment.

-

Transaction Cost and Taxes

Commission Rate Securities firms can set up their own commission schedule according to their strategy. For customers charged with rate higher than the 0.1425% standard rate, the securities firm must take appropriate means to notify them of such before order placement. For foreigners and overseas Chinese, the notification can take place before settlement/delivery. Securities Transaction Tax Type of Product Tax Rate Stocks/Certificate of Entitlement to New Share from Convertible Bond/ Preferred Shares with Warrants 0.3% of the value traded is levied from the seller. The Securities transaction tax on stock day trading is 0.15% from April 28, 2017 to December 31, 2024. Beneficiary Certificates /ETF/Warrants / TDRs/Company Warrants 0.1% of the value traded is levied from the seller. Bonds/Corporate Bonds/REITs/ Bond with Warrants Tax exempted Taxation on Dividends Resident Beneficiary Non-resident Beneficiary Dividends are included in the consolidated income. 21% (JAN 1,2018). Capital Gains Tax Income tax on gains derived from the securities transactions ceased to be imposed.

2. Warrant Trading

- Matching

Orders for warrants are executed either through call auction or through continuous trading. - Applicable Time

- Orders are executed on a continuous basis during intraday regular trading sessions.

- Orders are still matched by call auction at the opening and closing of the regular trading session.

- Warrants are subject to trading by call auction as a result of dispositional measures or full cash settlement requirement during regular trading sessions, following the prescribed cycle time frame (e.g. every 5, 10, or 30 minutes).

- Principles of Continuous Trading

- Principles for Determining Execution Prices

In continuous trading, buy and sell orders are executed on an order-by-order basis. The execution price is determined according to the following principles:

-

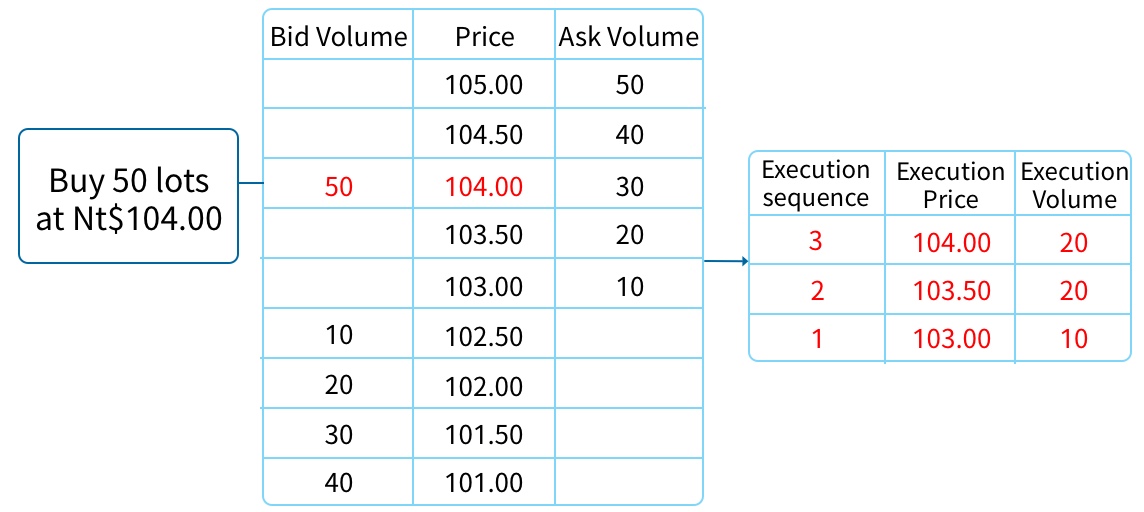

If a bid quote is placed at a price higher than or equal to the lowest price of

unexecuted ask quotes, the bid quote will be executed against one or more of these ask

quotes, in ascending order of ask price, until the bid quote is completely satisfied, or

until the price of the bid quote is lower than the price of unexecuted ask quotes.

Please see Figure 1.1 for an illustrative example.

Figure 1.1

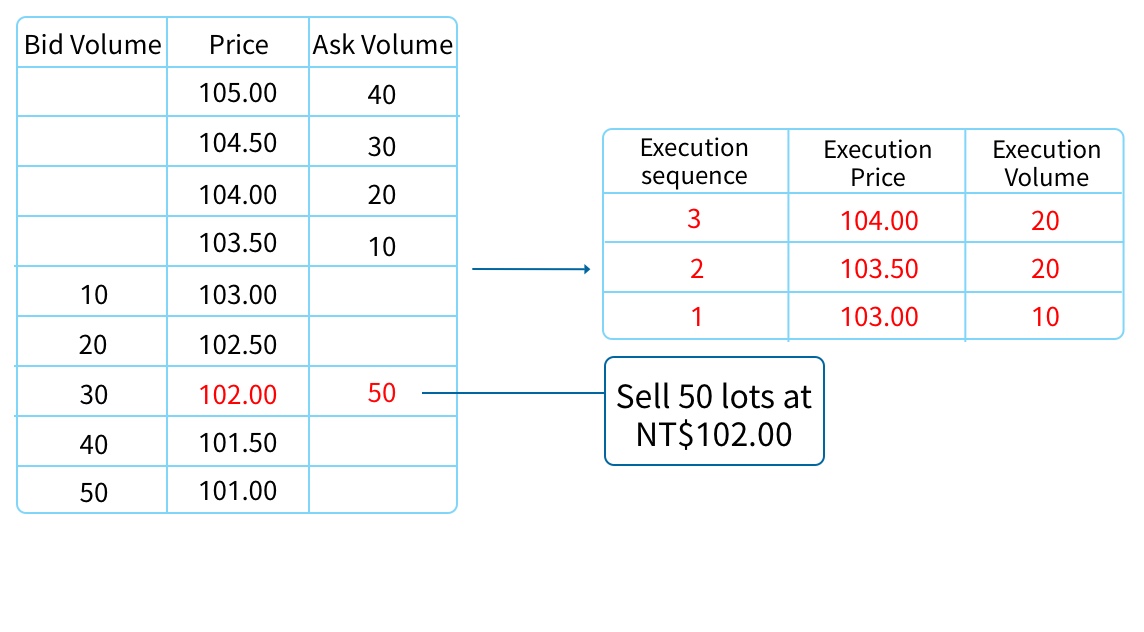

- If an ask quote is placed at a price lower than or equal to the highest price of

unexecuted bid quotes, the ask quote will be executed against one or more of these bid

quotes, in descending order of bid price, until the ask quote is completely satisfied,

or until price of the ask quote is higher than the prices of unexecuted bid quotes.

Please see Figure 1.2 for an illustrative example.

Figure 1.2

-

If a bid quote is placed at a price higher than or equal to the lowest price of

unexecuted ask quotes, the bid quote will be executed against one or more of these ask

quotes, in ascending order of ask price, until the bid quote is completely satisfied, or

until the price of the bid quote is lower than the price of unexecuted ask quotes.

- Principles for order execution priority

Orders is matched and executed sequentially based on the principles of price priority and time priority.- Principle of price priority: Bid quotes with higher prices take precedence over those with lower prices, and ask quotes with lower prices take precedence over those with higher prices. If two or more quotes are placed at the same price, order execution will be determined according to the principle of time priority.

- Principle of time priority: Quotes placed before market opening take precedence over

those placed after market opening. Quotes placed before market opening are sequenced

randomly by computer, while those placed after market opening is determined by time they

are placed.

- Principles for Determining Execution Prices

- Intra-day Volatility Interruption

To allow the trading prices of warrants to move in line with the prices of underlyings, no intra-day volatility interruption will be taken for warrants. - Disclosure of information on the prices and volumes of executed and unexecuted bid and ask quotes

- The execution prices and volumes are disclosed in real time when orders are matched. A further disclosure is made after the final matching, indicating the prices and volumes of the five highest unexecuted bid quotes and five lowest unexecuted ask quotes.

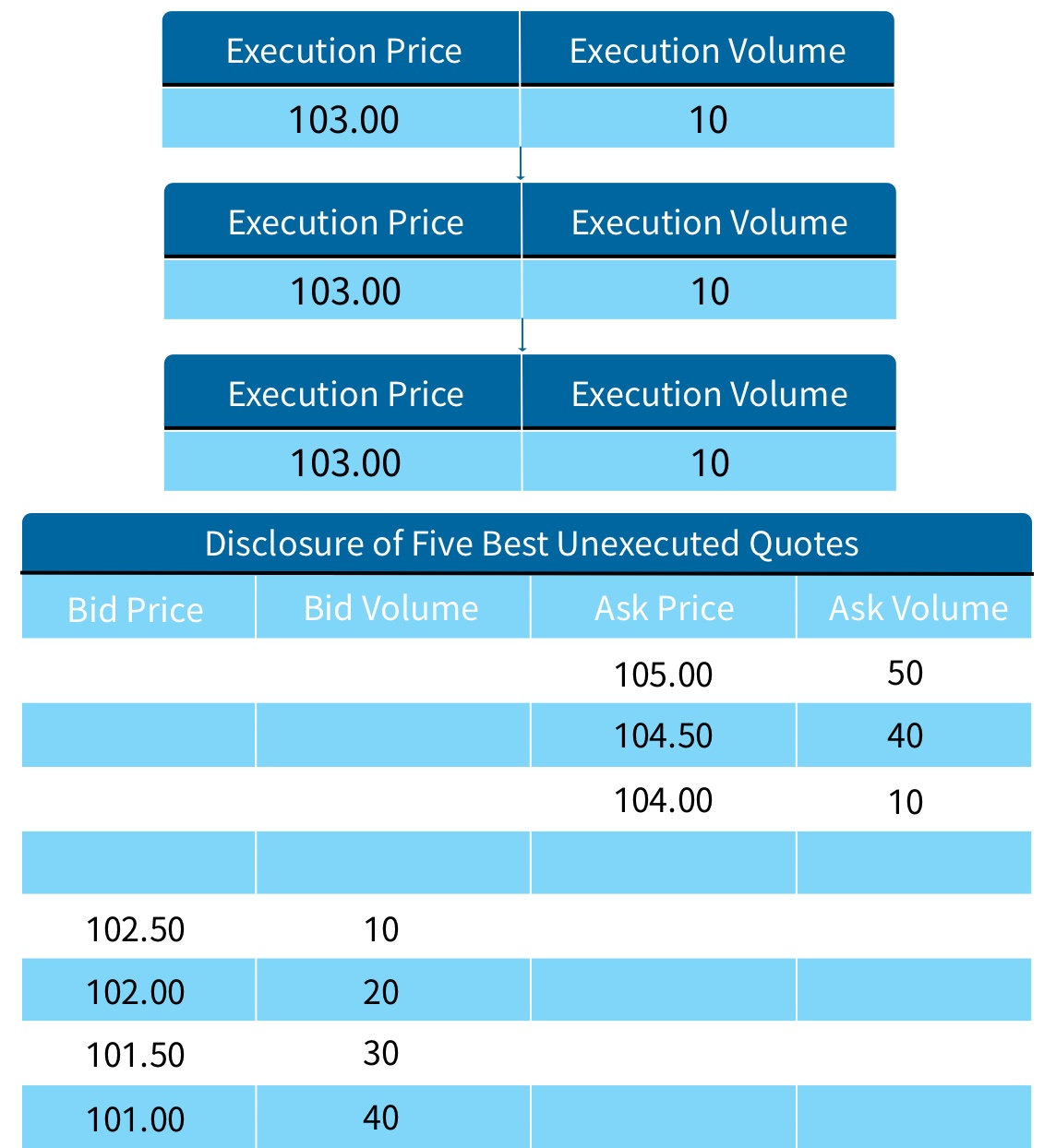

- Take an example from the matching status given in Figure 1.1. After the buy order is executed,

three

separate, real-time disclosures are made on the execution prices and volumes, namely

NT$103.00/10 lots

for the first matching, NT$103.50/20 lots for the second matching, and NT$104.00/20 lots for the

third

matching. At the time of the third disclosure, a further disclosure is made simultaneously,

disclosing

the prices and volumes of five best unexecuted bid and ask quotes, which in this case are,

respectively,

NT$102.50/10 lots, NT$102.00/20 lots, NT$101.50/30 lots, and NT$101.00/40 lots for unexecuted

bid

quotes, and NT$104.00/10 lots, NT$104.50/40 lots, and NT$105.00/50 lots for unexecuted ask

quotes. The

information disclosure is shown in Figure 1.3.

Figure 1.3

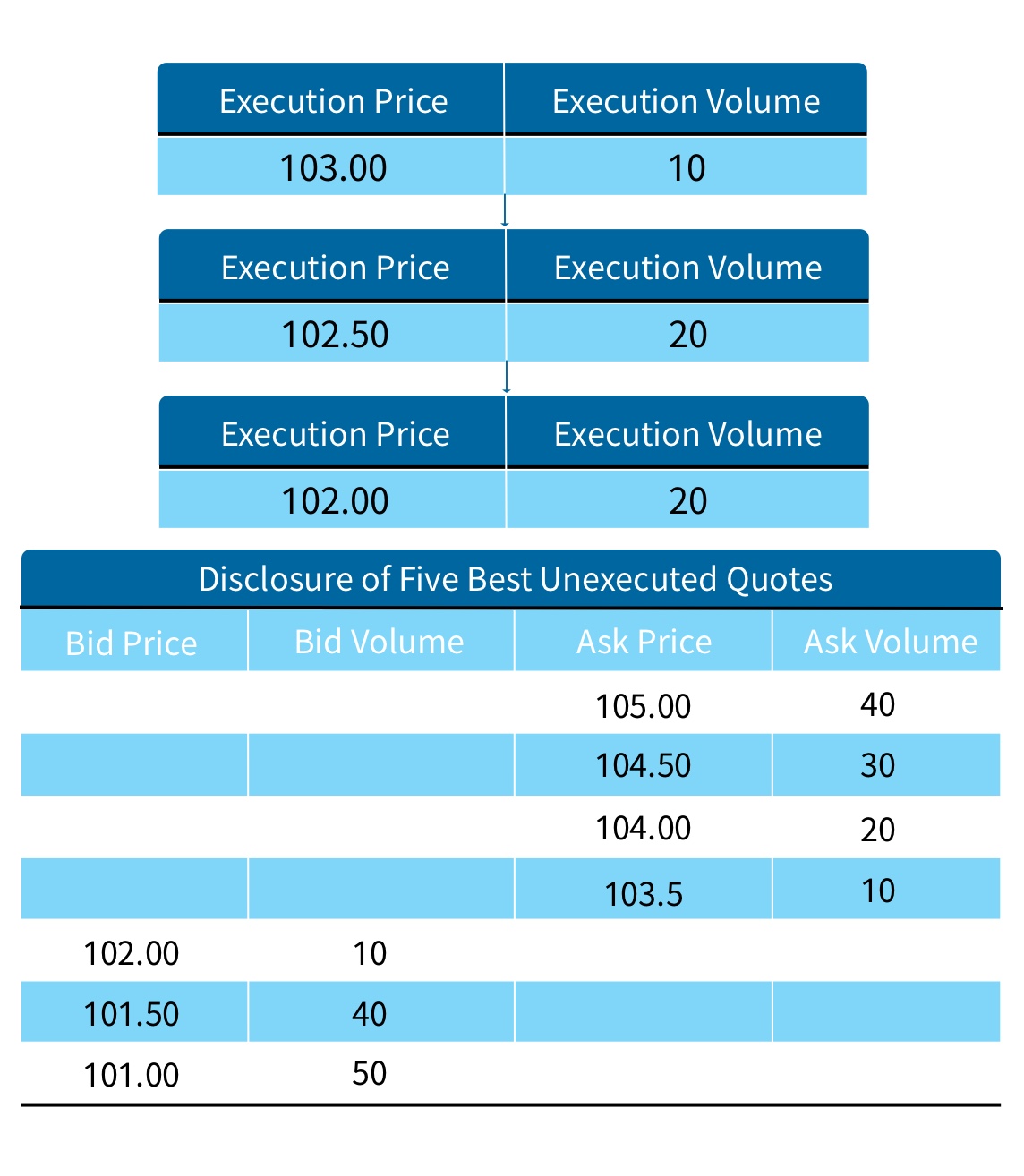

- Take another example from the matching status given in Figure 1.2. After the sell order is

executed, three separate, real-time disclosures are made on the execution prices and volumes,

namely NT$103.00/10 lots for the first matching, NT$102.50/20 lots for the second matching, and

NT$102.00/20 lots for the third matching. At the time of the third disclosure, a further

disclosure is made simultaneously, disclosing the prices and volumes of five best unexecuted bid

and ask quotes, which in this case are, respectively, NT$102.00/10 lots, NT$101.50/40 lots,

NT$101.00/50 lots for unexecuted bid quotes, and NT$103.50/10 lots, NT$104.00/20 lots,

NT$104.50/30 lots, NT$105.00/40 lots for unexecuted ask quotes. The disclosure information is

shown in Figure 1.4.

Figure 1.4

- The system of continuous trading for warrants was implemented on 28 June 2010.

3.After-Hour Fixed-Price Trading

- Trading Hours: Quotations on behalf of the principals shall be submitted between 2:00 p.m. and 2:30 p.m. The matching and execution thereof shall be conducted through an automated computer system at 2:30 p.m. of the same day.

- Trading Units: The same as for regular trading.

- Daily Price Fluctuation Limit: The trade price shall be the closing price of the security in the morning of the day when the quotation is made (the trade price of the last transaction). If there is no trade price for a given security in the morning of the current day, the after-hour fixed-price trading of the security shall be temporarily suspended.

- Smallest Units for Price Increase/Decrease (Tick Size) The same as for regular trading.

- Price of the Orders: The trade price shall be the closing price of the security on the date when the quotation is made. It shall only be valid for the current day.

- Advance Collection of Payments/Securities: The same as for regular trading.

- Matching Method

- Matching Method : The subject matter of the trading shall be the TWSE-listed securities other than government bonds. The trade price shall be the closing price of the security in the morning of the date when the quotation is made (the trade price of the last transaction). If there is no trade price for a given security in the morning of the current day, the after-hour fixed-price trading of the security shall be temporarily suspended.

- Priority for Trade Execution: Trades shall be prioritized in a computer-determined random order.

- Disclosure of Volume and Price information :

- Prior to the matching of after-hour fixed-price trading quotes, the aggregate volume of trading quotes of all securities submitted during the day shall be disclosed (The volume of trading quotes of individual securities shall not be disclosed.)

- After the matching of after-hour fixed-price trading quotes, the volume of trades executed for all securities and individual securities shall both be disclosed.

- Others

- After-hour fixed-price trades shall be tabulated together with the trades executed during market trading hours on the same trading day into a consolidated Settlement Calculation Statement, and shall be settled as normal settlement trades.

- Margin purchase and short sale of the same security by a principal during market trading hours and in after-hour fixed-price trading respectively on the same trading day may be settled by offsetting of the margin purchasing and short selling.

- After the close of market trading hours, the TWSE shall produce a securities market report in accordance with regulations. After the close of after-hour fixed-price trading, the TWSE shall further produce and make public a consolidated securities market report including trades executed during market trading hours

4.Intraday odd lot trading

- Background

To make the Taiwan Stock Exchange more accessible to the public and to better satisfy investors' trading needs, Taiwan Stock Exchange Corporation (“TWSE”) has amended the “Taiwan Stock Exchange Corporation Regulations Governing Odd-lot Trading of Listed Securities” with the approval of the Financial Supervisory Commission (“FSC”). The regulations were released to the securities firms on February 26, 2020. Investors will be able to do intraday odd lot trading starting on October 26, 2020. The existing after-hours odd lot trading system will remain unchanged.

- Introduction

Item Description Quote time 9 am to 1:30 pm To keep odd lot trading from interfering with the opening for regular trading, securities firms will start entering quotes into the exchange at 9 am, and the first call auction will be executed at 9:10 am. Call auction The first call auction is executed at 9:10 am, followed by periodic call auctions in 1-minute intervals. Order execution priority: - Price priority principle: Higher-priced buy orders shall have priority over lower-priced buy orders. Lower-priced sell orders shall have priority over higher-priced sell orders. Where orders are placed at the same price, priority shall be based on the time priority principle.

- Time priority principle: For orders placed before the first call auction, priority shall be determined randomly by the computer system. For orders placed after the first call auction, priority shall be determined by the order in which the orders are entered.

Quote range and fluctuation Same as regular trading on every business day (9 am to 1:30 pm on the day; limited to 10% above or below the reference price on the day) Given there are no price fluctuation limits for newly listed stocks on the first five days of listing, there will be no price fluctuation limits for odd lot quotes in the same period. Order placement To avoid trade disputes arising from clerical error at securities firms, order placement and confirmation of odd lot trades must be conducted electronically, except where the principal is a professional institutional investor. Order type Day orders only Closing and order removal Outstanding intraday odd lot orders will not be carried forward to the after-hours odd lot session. Disclosure - Market data: Following each match after the first call auction, market information including the trading price and volume and the best five bid/ask prices and volumes will be disclosed to the public.

- Simulated market information during the session: The first disclosure will be executed at 9:00:10 am, followed by simulated matching in 5-second intervals until 1:30 pm. Simulated trading prices and volumes, and the best five bid/ask prices and volumes will be disclosed.

Intra-day volatility interruption system In order to prevent trading prices from exceeding investors' expectations as a result of drastic price volatility, except for newly listed securities not yet subject to price fluctuation limits and securities for which the reference price is lower than NT$1, price stabilization measures will be in place for intraday odd lot trading from the first successful match to a certain interval before the quote time ends (1:25 pm). If the potential execution price before matching rises or falls by over 3.5% in comparison with the last trading price, the TWSE will instantly delay the current matching by two minutes and continue to accept key-in, cancellation and changes of buy/sell orders within the delayed matching period, and then match orders sequentially after the current delayed matching period comes to an end. The price stabilization measures delay matching, and disclose to investors simulated matching trading prices and volumes and the best five bid/ask prices and volumes in 10-second intervals. - Comparison of intraday after-market odd lot trading

- Differences

Item Intraday odd lot trading After-market odd lot trading Implementation date October 26, 2020 To remain in effect Trading hours 9 am to 1:30 pm 1:40 pm to 2:30 pm Call auction The first call auction is executed at 9:10 am, followed by periodic call auctions in 1-minute intervals. Matching takes place only once at 2:30 pm. Order execution priority - Price priority

- Time priority if prices are the same (computer generated random priority for the first call auction).

- Price priority

- Computer generated random priority if prices are the same.

Disclosure - Market Data: Following each match, market information including the trading price and volume and the best five bid/ask prices and volumes will be disclosed to the public.

- Simulated market information disclosure: Simulated trading price and volume and the best five bid/ask prices and volumes will be disclosed in 5-second intervals between 9:00 am and 1:30 pm.

Simulated best trading price will be disclosed in 30-second intervals in the last five minutes (between 2:25 pm and 2:30 pm) of the quote. Advance collection of payments/securities Payments/securities collected in advance with those for regular orders: - Disposal of securities (by advance collection of payments/securities)

- Securities subject to change of trading method

Disposal of securities (by advance collection of payments/securities) must have payments/securities collected in advance with those for regular orders. - To keep from interfering with the existing processes, securities subject to change of trading method will remain unchanged after-market odd lot trading without advance collection of payments/securities.

Order placement - Rule: To be processed electronically.

- Exception: Non-electronic orders may be accepted from professional institutional investors.

No format requirement Intra-day volatility interruption system - Time: Between the first call auction (9:10 am) and 1:25 pm.

- Benchmark: Any given simulated execution price fluctuates beyond 3.5% from the previous execution price prior to each match.

- When the benchmark is reached, the current matching will be delayed by two minutes, during which period orders may be added, reduced, or deleted. Orders will be matched at the end of the delay.

None Closing and order removal Outstanding orders will not be carried forward to the after-hours odd lot session. None - Similarities

Item Intraday odd lot trading After-market odd lot trading Target investment Stocks, TDRs, ETFs, and beneficiary certificates - Odd lot trading not permitted for call (put) warrants and ETNs.

Trade unit 1 - 999 shares Quote range and fluctuation Same as regular trading on every business day (9 am to 1:30 pm on the day; limited to 10% above or below the reference price on the day) Given there are no price fluctuation limits for newly listed stocks on the first five days of listing, there will be no price fluctuation limits for odd lot quotes in the same period. Order type Day orders (ROD) only Order change Reduction and cancellation permitted. Price change not allowed. Trade restriction Margin trade and short sales not permitted.

- Differences

5.After-Hour Odd Lot Trading

- Trading period: 1:40~2:30 pm

- Range of prices: same with the regular trading.

- Match method: on a one-time call auction basis after 2:30 pm, with a report of which to be delivered to the securities firms by computer.

- Information disclosure: during the 5 minutes before the end of the time for placing Odd-Lot transaction orders (i.e. 2:25 to 2:30 pm), the best buying and selling price for the Odd-Lot transactions calculated on a trial basis pursuant to the call auction rules will be disclosed in TWSE’s Market Information System at https://mis.twse.com.tw/stock/index.jsp?lang=en_us, and the cycle of updating the disclosed information will be the same as the timeframe for updating the matched transaction in the regular exchange.

6.Block Trading

- Non-paired Trade

- Term of Settlement

The settlement date of a block trade is the second business day after the transaction date, same with the regular trading. - Trading Period

9:00 am to 5:00 pm. - Types of Mandate

For non-paired trade and paired trade, trades for spot securities and sale of borrowed securities in block trading are acceptable, whereas neither day-trade for spot securities nor margin purchases or short sales for securities. - Minimum Amount/Volume

- For a single security: at least 500 trading units, or more than NT$15 million;

- For a basket of stocks: at least 5 types of stocks and more than NT$15 million.

- Range of Prices

Same with the regular trading. - The price increment (up/down tick)

For non-paired trade and paired trade, the price increment is NT$0.01. - Matching Method by Continuous Auction

- For a single security:

The time/price priority for matching shall be based on the following principles whenever a buying or selling order enters the system:

Incoming buying (selling) orders whose prices are greater (less) than or equal to the lowest (highest) previously entered selling (buying) orders will be matched and executed at the individual ask (bid) prices sequentially from the lowest (highest) to the highest (lowest); if two or more quotes show identical ask (bid) prices, they will be matched and executed sequentially in chronological order until all buying (selling) orders are satisfied or until the price of the current incoming buying (selling) order is lower (higher) than the ask (bid) prices of unexecuted selling (buying) orders.

- For a basket of stocks:

The stock codes, unit prices, and volumes of incoming buying (or selling) orders shall all be identical to those of the previously entered selling (or buying) orders; the orders are then executed with selling (or buying) orders sequentially in chronological order.

- For a single security:

- Pre-Collection of Purchase Price /Securities

- A securities firm may decide at its own discretion whether or not to require the pre-collection in full or a certain percentage of the purchase price/securities depending on the circumstances.

- Where a securities firm accepts the mandate to quote sales of securities in block trades, such securities firm, whether to pre-check the investors’ position, shall conform to the article 79-1 of Operating rules of the Taiwan stock exchange corporation.

- Restrictions on the Amount of Orders Which a Securities Firm May Accept The amount of buying and selling orders shall be monitored and controlled along with the mandated buying and selling amount for regular trading session.

- Methods of Monitoring and Controlling the Amount Invested by Foreigners

When monitoring and controlling regular trading session, where the quoted buying order is from a foreigner, the corresponding purchase amount shall be deducted from the amount which may be invested by foreigners, whereas where the quoted selling order is from a foreigner, the corresponding sale amount shall be added to the amount which may be invested by foreigners after the selling order is executed.

- Information Disclosure

- TWSE's MIS website will in real time post the range of the quoted ask or bid price of each individual order for non-paired trade and the most updated information on unexecuted and executed prices and trading volumes, which will be transmitted to the information vendors in real time.

- After 5:00pm, the trading volumes and executed prices will be included in the trading records of the then current day.

- Clearance and Settlement

The settlement date of a block trade is the second business day after the transaction date, same with the regular trading

- Term of Settlement

- Paired Trade

- Method for Quoting

In a paired trade, a buying order and a selling order of the same stock(s) with same volume in the same price may be quoted by the same securities firm or by a number of securities firms. - Trading Period

Pre-opening trading hours: 8:00 am to 8:30 am. 9:00 am to 5:00 pm. - Minimum Amount

- For a single security: at least 500 trading units, or more than NT$15 million;

- For a basket of stocks: at least 5 types of stocks and more than NT$15 million.

- Price Range

Same with the regular trading - Pre-Collection of Purchase Price/Securities Method

- A securities firm may decide at its own discretion whether to require the pre-collection in full or in a certain percentage of the purchase price/securities depending on the circumstances.

- Where a securities firm accepts the mandate to quote sales of securities in block trades, such securities firm, whether to pre-check the investors’ position, shall conform to the article 79-1 of TWSE business rule.

- Method for Matching

Transactions shall be executed according to the term of volumes and prices quoted by the buyer and the seller. - Restrictions on the Amount in Respect of Which a Securities Firm May Accept Orders

To be monitored and controlled along with non-paired trade; provided that in the case of a paired trade under a buying order and a selling order of the same stock(s) with same volume in the same price, which will be settled at the same securities firm and the net amount of buying and selling orders is zero, such mandated buying and selling amount shall not be subject to monitoring and control as pertaining to the amount in respect of which the securities firm may accept orders. - Method of Monitoring and Controlling the Amount to be Invested by Foreigners

Where buying and selling securities firms complete a quoted paired trade, the basis for calculation shall be the net volume of such buying and selling by foreigners quoted by the securities firms, and the net buying volume shall be deducted from the amount which may be invested by foreigners, whereas if such paired trade is completed, the net selling volume shall be added to the amount which may be invested by foreigners. - Disclosure of Trading Information

- After a transaction is completed, TWSE's MIS website will in real time post the information on executed prices and trading volumes, which will be transmitted to information vendors by way of making public announcements on the market. Trading price data from this pre-opening session(8:00 am - 8:30am) will be disclosed after 9:00 am.

- After 5:00pm, the trading volumes and executed prices will be included in the trading records of the then current day.

- Clearance and Settlement

The settlement shall be conducted in combination with non-paired trade.

- Method for Quoting

- Comparison Table Between Non-paired Trade and Paired Trade

Items Non-paired Trade Paired Trade Trading Period 9:00am to 5:00pm

In case of settlement on T Day, the quote shall be completed by 1:50pm.- Pre-opening trading hours: 8:00am to 8:30am

- 9:00am to 5:00pm

In case of settlement on T Day, the quote shall be completed by 1:50pm.

Method for Quoting - It is optional for investors to conduct settlement on T Day or T+2 Days.

- Where a securities firm accepts the mandate to quote sales of securities in block trades, such securities firm, whether to pre-check the investors’ position, shall conform to the article 79-1 of Operating rules of the Taiwan stock exchange corporation.

- It is optional for investors to conduct settlement on T Day or T+2 Days.

- Where a securities firm accepts the mandate to quote sales of securities in block trades, such securities firm, whether to pre-check the investors’ position, shall conform to the article 79-1 of Operating rules of the Taiwan stock exchange corporation.

Minimum Amount/Volume - For a single security: at least 500 trading units or more than NT$15 million.

- For a basket of stocks: at least 5 types of stocks and more than NT$15 million.

- For a single security: at least 500 trading units or more than NT$15 million.

- For a basket of stocks: at least 5 types of stocks and more than NT$15 million.

Range of Quoted Prices Same with the regular trading

(Within 10% of the "auction reference price at market opening of the regular trading session for the then current day.)Same with the regular trading

(Within 10% of the "auction reference price at market opening of the regular trading session for the then current day.)Types of Mandate - Trades for spot securities and sale of borrowed securities are acceptable.

- Daily offsetting, margin purchases or short sales for securities are not permissible.

- Trades for spot securities and sale of borrowed securities are acceptable.

- Daily offsetting, margin purchases or short sales for securities are not permissible.

Principles for Mandate and Matching - Orders will be executed on continuous auction in real time.

- A block trade of a basket of stocks will be executed only when the types of stocks, unit prices and volumes of the stocks at a buying order and a selling order are identical.

- An order will be valid only during the trading period when the order is placed.

To be executed according to the term of volumes and prices quoted by the buyer and the seller. Information Disclosure - TWSE's MIS website will in real time post information on the range of quoted bid and ask prices, and the unexecuted prices and executed prices and trading volumes.

- TWSE will in real time transmit the information on the executed prices and trading volumes to the information vendors by way of making public announcements on the market.

- After 5:00pm, the trading volumes and executed prices will be included in the trading records of the then current day.

- Trading price data from this pre-opening session(8:00 am – 8:30am) will be disclosed after 9:00 am.

- Except that the unexecuted prices and volumes will not be posted, the measures are the same as those for non-paired trade.

Clearance and Settlement T+2 T+2

7.Auction

- Trading Hours: Bids must be submitted between 3:00 pm and 4:00 p.m.; transactions shall be completed on the day of the bid.

- Trading Units: The securities shall be auctioned in lots equivalent to the security's trading unit and multiples thereof as determined by the Auction Principal.

- Daily Price Fluctuation Limit:

-

Auction Base Price: Except for the release of state-owned shares, the auction base price shall

be limited to a range of 15 percent above or below the auction reference price at market opening

on the day of auction. For securities on which no price fluctuation limit is imposed, the base

price may be limited to a range of 15 percent above or below the closing price on the day of the

auction. For securities whose auction base price is calculated based on the closing price on the

day of auction, if no closing price is available on the day of auction, the base price shall be

calculated from a price determined by one of the following principles and limited to a range of

15 percent above or below the price from which it is calculated:

- When, on the day of auction, the highest bid price at market close is higher than the auction reference price at market opening, the base price shall be calculated based on that highest bid price.

- When, on the day of auction, the lowest ask price at market close is lower than the auction reference price at market opening, the base price shall be calculated based on that lowest ask price.

- When neither of the above circumstances applies, the base price shall be calculated based on the auction reference price at market opening.

- There is no restriction on the range of the auction bids. However, only bidding consignments

which are higher than the base price may be executed.

-

Auction Base Price: Except for the release of state-owned shares, the auction base price shall

be limited to a range of 15 percent above or below the auction reference price at market opening

on the day of auction. For securities on which no price fluctuation limit is imposed, the base

price may be limited to a range of 15 percent above or below the closing price on the day of the

auction. For securities whose auction base price is calculated based on the closing price on the

day of auction, if no closing price is available on the day of auction, the base price shall be

calculated from a price determined by one of the following principles and limited to a range of

15 percent above or below the price from which it is calculated:

- Fluctuation Unit: The same as for regular trading.

- Price of the Orders: The same as for regular trading.

- Advance Collection of Funds and Securities: Shall be prescribed by the auction principal.

- Matching Methods for Competitive Bidding: The auction principal may select one of the following methods:

- Where bidding securities firms enter bids that are higher than the announced auction base price, the cut-off price shall be the lowest bid at which all of the auctioned shares can be sold. The entire volume of all bids higher than the cut-off price shall be transacted at the cut-off price. If the volume of bids at the cut-off price cannot be satisfied in full, the bids shall be satisfied according to the ratio of the bid volumes until no whole lot remains. If there is a remainder, it shall be allotted in the order of a computer-generated random sequence, with only one lot allotted to each consignment. However, when the volume of bids above the auction base price falls short of the auctioned volume, all bids above the auction base price shall be transacted at the lowest bid above the auction base price.

- Where bidding securities firms enter bids that are higher than the announced auction base price,

their bids shall be transacted pursuant to Article 9 if the bid volumes are less than the limit

announced by the TWSE.

- Higher bids shall be transacted first.

- Where bids are quoted at the same price, they shall be satisfied according to the ratio of the bid volumes until the entire lot is sold. If there is a remainder, it shall be allotted in the order of a computer-generated random sequence, with only one lot allotted to each consignment.

- Where bidding securities firms enter bids that are higher than the announced auction base price, the entire volume of all bids higher than the base price shall be transacted at the base price when the volume is within the limit announced by the TWSE. When the total volume of bids above the base price exceeds the volume announced by the TWSE, the bids shall be satisfied according to the ratio of the bid volumes until the entire lot is sold. If there is a remainder, it shall be allotted in the order of a computer-generated random sequence, with only one lot allotted to each consignment.

- Others

- Application Procedures for Auction: The application for auction of securities on behalf of an auction principal shall be carried out by the contracted securities broker; or by a securities dealer with its own securities. After consignments or applications are agreed to or acknowledged by the TWSE, the TWSE shall publicly announce the auction requirements 3 days prior to the auction date.

- Limits on the Bids Volume: The volume of securities auctioned may not be less than two million shares (units). However, auctions of state-owned shares will not be subject to this restriction.

- Announcement of the Auction Base Price: The announcement of the auction base price shall be determined by the auction principal, whether at the beginning of the auction or at the closing of the bidding. The auction base price shall be announced through the Market Information System. If the base price is announced at the auction venue by the applicant securities broker, the TWSE shall be informed of the price by sealed letter. The auction base price and the auction bids shall be expressed on a per-unit basis.

- Settlement: Settlements shall be executed according to normal settlement procedures.

- Suspension of the Auction: Open bidding for the auctioned securities listed by TWSE may be suspended during auction period (except for those tendered by Securities Finance Enterprises to effect settlement or return securities).

8.Reverse Auction

- Trading Hours: For the purchase of securities through reverse auction, the quotations shall be submitted between 3:00 p.m. and 4:00 p.m. and the trades shall be executed on the date of the quotation.

- Trading Units: The securities shall be purchased in lots equivalent to the security's trading unit and multiples thereof as determined by the Principal.

- Daily Price Fluctuation Limit:

-

Floor price for a reverse auction: Limited to within a range of 15 percent above or below the

auction reference price at market opening on the current day, provided that if there is no price

fluctuation limit for a given security, at the time of application a floor price limited to

within 15 percent above or below the closing price on the reverse auction date may be selected.

At the commencement of the reverse auction, the securities firm that applies for the reverse

auction shall deliver a sealed letter containing the reverse auction floor price to the TWSE for

on-the-spot announcement, and such floor price shall also be published in the Market Information

System. When at the time of application the closing price on the reverse auction date has been

selected as the basis for calculating the reverse auction floor price, if no closing price for

the security is available on the day of the reverse auction, the reverse auction floor price

shall be calculated based on the price determined by the following principles, and limited to a

range of 15 percent above or below that price:

- When, on the day of auction, the highest bid price at market close is higher than the auction reference price at market opening, the highest bid price shall be adopted.

- When, on the day of auction, the lowest ask price at market close is lower than the auction reference price at market opening, the lowest ask price shall be adopted.

- There is no restriction on the range of prices quoted for the reverse auction. However, only quotations which are lower than the floor price may be executed.

-

Floor price for a reverse auction: Limited to within a range of 15 percent above or below the

auction reference price at market opening on the current day, provided that if there is no price

fluctuation limit for a given security, at the time of application a floor price limited to

within 15 percent above or below the closing price on the reverse auction date may be selected.

At the commencement of the reverse auction, the securities firm that applies for the reverse

auction shall deliver a sealed letter containing the reverse auction floor price to the TWSE for

on-the-spot announcement, and such floor price shall also be published in the Market Information

System. When at the time of application the closing price on the reverse auction date has been

selected as the basis for calculating the reverse auction floor price, if no closing price for

the security is available on the day of the reverse auction, the reverse auction floor price

shall be calculated based on the price determined by the following principles, and limited to a

range of 15 percent above or below that price:

- Smallest Units for Price Increase/Decrease (Tick Size): The same as for regular trading.

- Price of the Orders: The same as for regular trading.

- Advance Collection of Payments/Securities:

- A securities firm shall collect in advance the full price of the intended purchase from the principal when it accepts an engagement to apply for reverse auction.

- A securities firm participating in the bid-to-sell shall collect in advance the stocks from the principal when it accepts an engagement to participate in the reverse auction.

- Auction Method :

The principal initiating the reverse auction may select one of the following methods:- During the reverse auction, the highest sell quote that does not exceed the ceiling price and that satisfies the requirement of quantity to be purchased will be the successful bid-to-sell price. All of the orders having a sell quote lower than the successful bid-to-sell price will be executed at the successful bid-to-sell price. If the quantity of the sell quotes submitted at the successful bid-to-sell price exceeds what can be executed, an integral number of trading units will be distributed proportionately to such orders based on the quantity of each order. If there is a remainder afterwards, it will be distributed to these orders in a random order determined by computer for execution, with allocation to each order limited to one trading unit.

- During the reverse auction, the lower sell quotes among those not exceeding the ceiling price will have priority of execution, and the trades will be executed in sequence based on the prices quoted in the individual orders. In the case of identical sell quotes, an integral number of trading units will be distributed proportionately to such orders based on the quantity of each order. If there is a remainder afterwards, it will be distributed to these orders in a random order determined by computer for execution, with allocation to each order limited to one trading unit.

- Others

- Application Procedures for Reverse Auction: A securities firm shall submit an application to the Taiwan Stock Exchange Corporation when it accepts an engagement to apply for reverse auction. The agreement/approval from the Taiwan Stock Exchange Corporation shall be obtained. The rules for quotation for the reverse auction shall be announced three trading days before the date thereof.

- Limits on the Quantity of Reverse Auction: If the total number of issued shares (units) of the security for which the reverse auction application is filed is 20 million or less, the quantity of shares to be purchased by reverse auction may not be less than 20 percent of the total issued shares (units). If the total issued shares (units) exceed 20 million, the quantity of the excessive shares to be purchased by reverse auction may not be less than 10 percent of the total issued shares (units). This restriction, however, does not apply to a reverse auction initiated by an overseas Chinese or foreign national investor with special-case approval.

- Announcement of the Floor Price: The floor price shall be announced through the Market Information System of the Taiwan Stock Exchange Corporation at the time when the reverse auction begins. The applying securities firm shall submit the floor price to the Company, properly sealed, for announcement on the spot. The floor price and quotation for the bid-to-sell shall be calculated on basis of shares (units).

- Settlement : Settlements shall be executed according to normal settlement procedures.

- Suspension of the Reverse Auction: During the period of the reverse auction, the auction of the specific security may be suspended (except for those tendered by securities finance enterprises to effect settlement or return securities).

- For those tendered by securities finance enterprises to effect settlement or for the return of securities in the events of trade suspension caused by emergencies or natural disasters, they shall be handled separately in accordance with the relevant regulations.

- Relevant Regulations

9.Registered Central Government Bonds and Foreign Bonds

- Trading Hours: The same as for regular trading.

- Trading Units: The registered trading quantity shall be in one trading unit or its integral multiples. For the Central Government Bonds, one trading unit is NT$100,000 par value and the maximum trading units for each consignment order is ten

- Daily Price Fluctuation Limit: No restriction of increase/decrease.

- Fluctuation Unit: The unit of increase or decrease is always 10%.

- Price of the Trade Orders: Quotations for purchase and sale of the Central Government Bonds by securities firms shall be valid only on for the current session.

- Advance Collection of Funds and Securities: The same as for regular trading.

- Methods for Competitive Auction

- Methods for Competitive Auction: Competitive auction is held individually for each trade based

on the following principles:

- Where the buy order price entered is higher than or equal to the lowest sell order price previously entered, the trading orders will be satisfied from the lowest to the highest sell order price. In cases where sell orders are placed at the same price, the trading orders will be satisfied in the order of the offer time until all orders are satisfied or the buy order price entered is lower than the sell order price of an unexecuted trade.

- Where the sell order price entered is lower than or equal to the highest buy order price previously entered, the trading orders will be satisfied from the highest to the lowest buy order price. In case where buy orders are placed at the same prices, the trading orders will be satisfied in the order of offer time until all orders are satisfied or the sell order price entered is higher than the buy order price of an unexecuted trade.

- Priority for Trade Execution:

The matching sequence and execution prices shall be determined based on each buy or sell orders entered. - Disclosure of Trade Volume and Price: Trading quotes, consigned amount, execution price and volume

- Methods for Competitive Auction: Competitive auction is held individually for each trade based

on the following principles:

- Other Matters:

- Settlements: Settlements shall be executed according to normal settlement procedures.

- Ex-dividend Transactions: All trades of the Central Government Bonds executed shall be ex-dividend trading. The calculation of interest shall be based on the actual number of days between the interest-bearing commencement date for this period and the settlement date (including the beginning day and excluding the last day).

10.Omnibus Trading Account

- Qualifications of investors

- Foreign investors and offshore overseas Chinese are required to register their identification number and open a securities trading account.

- Domestic institutional investors (including domestic securities investment trust funds, government agencies, domestic banks, insurance companies and group enterprises)

- Discretionary investment customers

● After May 25, 2009

All investors (except the investors from Mainland Area) can trade through an omnibus trading account.

- Account Opening

Each broker (head office & branches) can have two OTAs under their own names. One is for domestic investors (securities trading account number: 885555+check code); the other is for foreign investors (securities trading account number: 995555+check code). The account identification code for domestic securities firms' omnibus trading accounts is "600"; the account identification code for the omnibus trading accounts of Taiwan branch offices of foreign securities firms is "403". - Authorization

If an investor has authorized a trader to conduct trades and handle allocation of trade prices and volumes, it shall provide a power of attorney to specify the allocation of trade price and volume and relevant authorized matters. However, where a same authorized trader is approved by offshore overseas Chinese or foreign investors, domestic funds, or units of a same group, the power of attorney may be waived, and the authorized trader shall provide a statement specifying the investors’ ID numbers or uniform invoice numbers, names, and other relevant information. - Transaction Type

The OTA can be used in regular, after-market fixed-price, odd-lot and margin trading. Investors are able to use the borrowed securities to trade through the omnibus trading account.

● After May 25, 2009- Investors can do the block trades which are settled on T+2 through OTA. Only the OTA should meet the size requirement of the block trade while each investor through OTA is exempt from the size requirement.

- Odd lots of different investors could be combined for trading through the OTA.

- Trading Allocation

- Securities firms should submit the post-allocation transaction statement to the TWSE between 3 pm and 6 pm on T-day. However, if the securities firm has not yet been able to complete the transaction allocation operations for an omnibus trading account with foreign principals (securities trading account number: 995555+check code), it may by 6 pm of T-day report and preserve the information not yet allocated, under the original omnibus trading account, and must report a partial adjustment of allocation with respect to the transaction information by 6 pm of T+1 day.

- If the securities firm has not yet been able to complete the transaction allocation operations by 7 pm on T-day, the TWSE will automatically preserve the information not yet allocated, under the original omnibus trading account. The securities firm must report a partial allocation adjustment with respect to the transaction information by 6 pm of T+1 day. On T+1 day, the securities firm should complete the transaction allocation operations and cannot preserve the information not yet allocated.

- By 6 pm of T+1 day, a securities firm may report a partial allocation adjustment with respect to the transaction information in accordance with operational needs, and shall report the itemized details of the trading orders of each principal or authorized trader to the TWSE.

- The price allocation may be conducted according to the agreement between the securities firm and

its customers without being subject to allocation at average price.

● After May 25, 2009- Securities firms can report a correction of the individual account to the omnibus account or report a correction of the omnibus account to the individual account on T-day and T+1 day.

- Securities firms, pursuant to the authorized trader's directions, may combine regular and after-hours fixed-price trading for allocation to investors as odd-lot or unit shares. In addition, allocations in unit shares and in odd lots shall be reported separately.

- After securities firms receive an order for a block trade through an omnibus account, the allocation information shall be reported separately along with the allocation information for regular, after-hours fixed-price, and odd-lot trades, and is not subject to the requirements of the Block Trading trade volumes, types, and amounts. However, non-OTA investors can not be allocated at average price with the block trade through OTA.

- Settlement

Investors who trade through OTA still need to settle through their own accounts. -

Regulations

-

Operating Rules of the Taiwan Stock Exchange Corporation

http://eng.selaw.com.tw/ - Taiwan Stock Exchange Corporation Operational Guidelines for Omnibus Trading Accounts

http://eng.selaw.com.tw/

-

Operating Rules of the Taiwan Stock Exchange Corporation

11.Suspending and Resuming Trading of Securities

For the purposes of reducing information asymmetry and protecting the rights and interests of investors, a trading mechanism for the suspension and resumption of securities is in place within the centralized market of the TWSE. The trading mechanism is subdivided into two types, as summarized below:

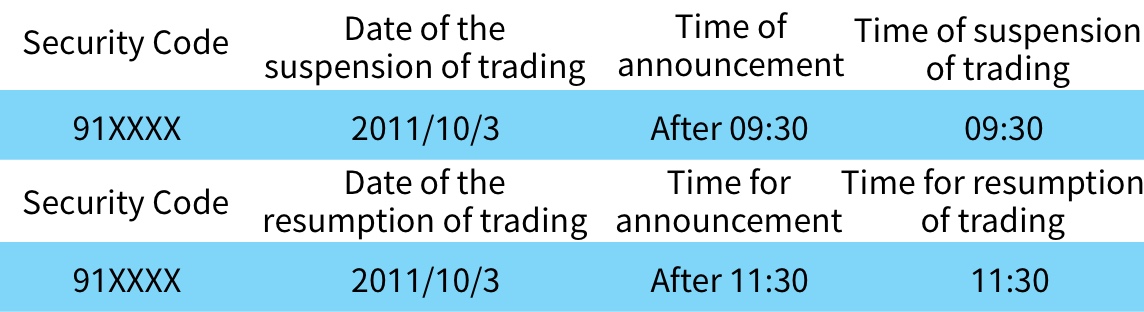

A. Suspending and Resuming Trading of TDR

Starting from October 3, 2011, when a special cause exists for a secondary listed company, such as stock price sensitive information pending announcement or the occurrence of a material event, by the securities exchange or securities market on which are listed securities represented by Taiwan Depositary Receipts, of the halting of trading thereof, the TWSE may announce halting of trading of the company's Taiwan Depositary Receipts and the relevant call (put) warrant. Upon an announcement by the securities exchange or securities market on which the securities represented by the Taiwan Depositary Receipts, of the resumption of trading thereof, the TWSE may announce the resumption of trading of the company, provided that the specific instance of halting of trading did not result in any material violation of TWSE rules in connection with material information, necessitating suspension of trading of the Taiwan Depositary Receipts.

B. Suspending and Resuming Trading during Information Assessment Period

Starting from January 15, 2016, where a listed company plans to publicly disclose or convene a board of directors meeting for a material information before 5:00 p.m. on a business day, it shall apply to the TWSE for a trading suspension. The company can apply for trading resumption after a full disclosure or explanation of the relevant information has been made. In addition, if the listed company discovers media reports or other information that may significantly affects shareholders' equity or securities prices, yet is unable to make a complete explanation on the same day, it should also apply to the TWSE for a trading suspension. If the listed company is unable to make a complete explanation and did not apply for a trading suspension on the day of the discovery, TWSE may take the initiative to suspend the securities dealings of the listed company if necessary, and resume the trading after the relevant information is fully disclosed.

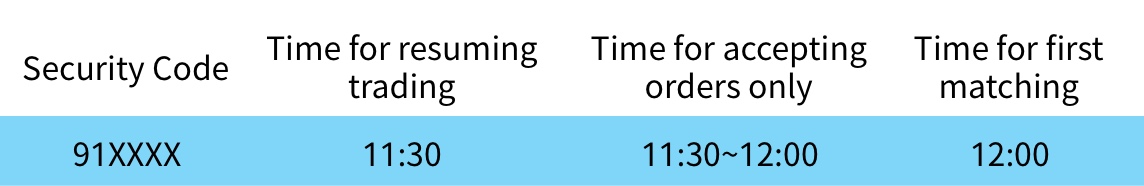

Suspending and Resuming Trading of TDR

- Applicable Securities

Taiwan Depositary Receipts (TDRs) and call (put) warrants of which the underlying securities are TDRs and foreign securities. - Applicable Trading: the following types of trading could be suspended and resumed:

- Regular trading.

- Applicable Trading: the following types of trading could be suspended and resumed:

- Securities borrowing and lending trading: newly borrowed securities and provision of collateral.

- Time to suspend/resume trading

- Trading Suspension

A trading suspension could be implemented anytime before 5:00 p.m. Given that when a trading suspension is in effect, in addition to regular trading (trading from 8:30 a.m. to 1:30 p.m.), other types of trading are also suspended, the time period that a trading suspension may be implemented would accommodate the trading session for each different type of trading. Among all types of trading, the longest trading session is that for block trading (from 8:00a.m. to 8:30 a.m. and from 9:00 a.m. to 5:00 p.m.). As such, a suspension of trading could be implemented anytime before 5:00 p.m.

For example, if the trading session is suspended at 9:30 a.m., regular trading and block trading are suspended. If the trading session is suspended at 2:10 p.m., block trading, odd-lot trading and after-market fixed-price trading are suspended. - Trading Resumption

- The resumption of trading could be implemented by 12:50 p.m. If the trading of the underlying securities is suspended due to pending announcement of sensitive stock price information, the trading could be resumed by 12:50 p.m., when the reason for trading suspension no longer exists due to full announcement of such information.