Introduction

ETF Definition、Categories

I. ETF Definition

ETF, the abbreviation of Exchange Traded Fund, is an open-end fund issued by securities investment trust enterprises (SITEs) or futures trust enterprises (FTEs) to track, simulate or replicate the performance of an underlying index and is traded on a stock exchange. After listed, an ETF can be created/redeemed in the primary market, or traded through brokers at any time during the trading hours in the secondary market.

II. ETF Categories

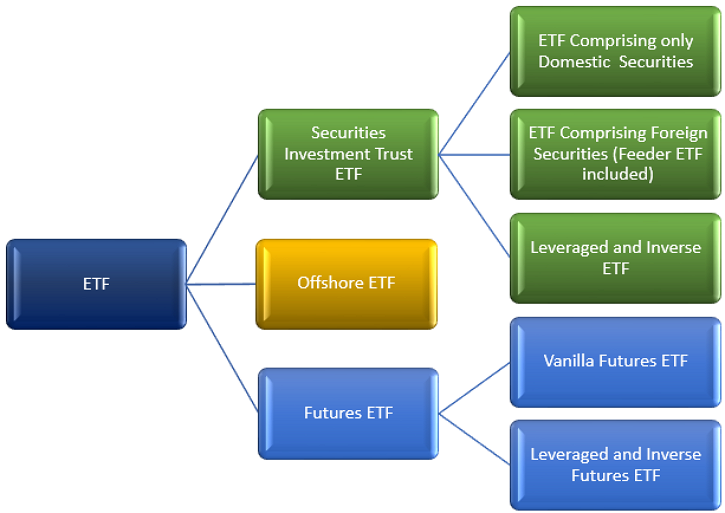

Based on Taiwan’s legal framework, listed ETFs can be classified into three categories; securities investment trust ETF, futures ETF, and offshore ETF.

- “Securities investment trust ETF”: Refers to ETFs offered and issued by domestic securities investment trust enterprises (SITEs), and listed and traded on a stock exchange in accordance with the Regulations Governing Securities Investment Trust Funds.

- “ETF comprising only domestic securities”: Refers to an ETF in which the component securities of its underlying index are all domestic securities.

- “ETF comprising foreign securities”: Refers to an ETF in which the component securities of its underlying index contain one or more foreign securities; “Feeder ETF” refers to an ETF issued by a domestic SITE that solely invests in a foreign ETF.

- “Leveraged and inverse ETF”: Refers to an ETF which tracks, simulates or replicates a multiple of the performance of its underlying index (“Leveraged ETF”) or a multiple of the inverse performance of its underlying index (“Inverse ETF”).

- “Offshore ETF”: Refers to a foreign ETF which is issued by an offshore fund institution and cross-listed on the Taiwan’s stock exchange.

- “Futures ETF”: Refers to an ETF offered, issued, and listed for trading in Taiwan by domestic futures trust enterprises (FTEs) in accordance with the Regulations Governing Futures Trust Funds.

- “Vanilla futures ETF”: Refers to an ETF tracking the performance of a futures index by investing in futures contracts.

- “Leveraged and inverse futures ETF”: Refers to an ETF which tracks, simulates or replicates a multiple of the performance of its underlying futures index (“Leveraged futures ETF”) or a multiple of the inverse performance of its underlying futures index (“Inverse futures ETF”).

ETF Risks

I. General investment risks:

- Market risk: Prices of ETFs may fluctuate because of various factors that affect the market, such as economy, politics, currency, or laws.

- Concentration Risk: ETFs typically have minimal exposure to individual risk because of the diversified holdings. However, some ETFs may have a large portion of holdings in a small number of stocks; others may be highly targeted to specific investments such as a particular sector or a single commodity.

- Liquidity risk: ETF liquidity providers are responsible for providing trading quotations of ETFs to facilitate investors to trade ETFs. Although most ETFs have one or more liquidity providers, if a liquidity provider fails to carry out its duties or ceases to perform its responsibilities of offering quotations, investors may have the risk of being unable to buy or sell ETFs.

- Discount/Premium risk: Determined by market demand and supply, ETF prices may inevitably fall below or rise above its net asset value (“NAV”), causing discounts or premiums to the NAV. With large discounts or premiums, an ETF may trade away from its fair value. In addition, premiums or discounts may arise because the ETF and its underlying holdings trade in different time zones.

- Tracking error risk: Tracking error is the difference between the ETF return and the return of its underlying index. There are numerous reasons for tracking errors, including the fees and expenses of the fund, the difference between the fund assets and its underlying index constituents, the difference among trading currency, investment currency and the fund-denominated currency, stock or cash dividends of component securities under the ETF portfolio, and tracking tools and replication strategies adopted by fund managers. All of which can lead to a gap between the performance of the net asset value of ETF and its underlying index.

- Delisting risk: ETF issuers shall apply to the regulator for approval to terminate the contract and delist if, among other things, the ETF’s asset size or NAV falls below a specified level.

II. Additional risks that must be taken into consideration for ETFs comprising foreign securities, feeder ETFs, and offshore ETFs:

- Price volatility risk:

- There is no fluctuation limit on prices of offshore ETFs, ETFs comprising foreign securities, and feeder ETFs, which may result in a higher price volatility.

- Trading hours in Taiwan are different from those of offshore markets. If a material incident takes place in offshore markets after the close of the Taiwan market, it will cause a delay in reflection of market prices of offshore ETFs, ETFs comprising foreign securities, and feeder ETFs listed in Taiwan.

- Foreign exchange risk: Portfolios of ETFs comprising foreign securities, feeder ETFs and offshore ETFs are mainly foreign currency-denominated assets. The fluctuations of foreign exchange rates in the fund-denominated currency, trading currency, and investment currency will affect the performance of the ETF.

III. Additional risks that must be taken into consideration for futures ETFs:

- Futures rollover risk: Futures ETFs track futures indices. Fund managers will roll over futures contracts on a periodical basis according to the rules of the underlying indices. When there is a contango between the near-dated and long-dated futures (long-dated futures are pricier than near-dated futures), fund managers must buy at a higher price (long-dated futures) and sell at a lower price (near-dated futures). Possible loss caused by futures rollover is inevitable.

- Time difference risk of investing in European or the US markets: The net asset value of futures ETFs tracking foreign futures indices is calculated based on the closing prices of the futures contracts of European or US markets, so the risk caused by time difference exists. The TWSE requires companies to adequately disclose relevant information and add warnings.

- Basis risk: Futures ETFs track futures indices, not spot indices. Investors shall notice the possible contingent difference between the returns of these two.

IV. Additional risks that must be taken into consideration for leveraged and inverse ETFs:

- Futures basis may affect the tracking error: Fund managers typically use futures to achieve the stated leverage and inverse returns. Future basis (the difference between cash price and futures price) and the fund manager’s portfolio management ability may affect the tracking error of ETFs.

- Daily dynamic rebalance may affect returns: Because dynamic rebalance is required on a daily basis, trading expenses incurred may affect the return of the ETF. The gap between indicative net asset value (iNAV) and net asset value (NAV) may be higher than that of traditional vanilla ETF.

- Leverage and inverse effects are limited to daily basis: Leveraged and inverse securities trust ETFs and leveraged and inverse futures ETFs seek a multiple or inverse return on a daily basis. Due to market volatility and the compounding effects of daily returns, the long-term return of leveraged and inverse ETFs will deviate from the multiple or inverse return of vanilla indices.

Glossary

1. Participating Dealer:

A securities firm that has signed a participant agreement with a securities investment trust enterprise (hereinafter referred to as “SITE”) that issues exchange-traded fund (ETF) beneficial certificates for the operation of creation and redemption of the ETF beneficial certificates for its own account or on behalf of its customers.

2. Custodian Institution:

A financial institution that has signed a trust agreement with a SITE that issues beneficial certificates of an ETF.

3. Applicant:

A customer who engages in creation or redemption of ETF beneficial certificates or a participating dealer that engages in creation or redemption of ETF beneficial certificates.

4. Portfolio Composition File, or PCF:

A list prepared and published by a SITE each day based on the reference data of the underlying index forwarded by the index provider, which indicates the portfolio of securities and estimated cash component that would be required to apply for in-kind creation or redemption of one creation unit of beneficial certificate on the next trading day.

5. In-kind Creation:

The participating dealer for its own account or on behalf of its customer delivering a portfolio of securities and the cash component per basket required for one creation unit as published on the PCF as notified by the SITE, or their integer multiples to the SITE in exchange for ETF beneficial certificates.

6. In-kind Redemption:

The participating dealer for its own account or on behalf of its customer delivering ETF beneficial certificates to the SITE in exchange for a portfolio of securities and cash component per basket as published on the PCF as notified by the SITE for one creation unit or its integer multiples.

7. Cash Creation:

The participating dealer for its own account or on behalf of its customer delivering cash to the SITE in exchange for ETF beneficial certificates; the calculation basis for the monetary amount and units of the creation shall comply with the trust agreement.

8. Cash Redemption:

The participating dealer for its own account or on behalf of its customer delivering ETF beneficial certificates to the SITE in exchange for cash; the calculation basis for the monetary amount of the redemption shall comply with the trust agreement.

9. Aggregate Creation:

The situation where no more than three applicants who, based on their mutual agreement, combine their individual holding of securities into a portfolio of securities required for one creation unit as published on the PCF or its integer multiples, designate one among them as payer of cash payment required, and jointly appoint one participating dealer (if one of the applicants is a participating dealer with a proprietary trading said applicant shall be the participating dealer) to create ETF beneficial certificates from a SITE.

10. Minimum In-kind Creation:

The situation where a participating dealer may, with the consent of the SITE, create the beneficial certificates of ETF with domestic components securities for its own account by delivering at least 90% of the kind of securities required with more than 90% of the aggregate market value of creation basket for the in-kind creation, and paying a deposit for the shortfall, and then purchasing or borrowing the insufficient quantity of securities on the next trading day and delivering the securities to the custodian institution.

11. Cash In-lieu:

The practice where the in-kind creation or redemption of ETF beneficial certificates by an applicant may be tendered in cash as determined by the SITE if a specific security included in the portfolio of securities as published on the PCF is in any of the following situations:

- The applicant is restricted by law to hold or transfer said specific security.

- The trading of the said security has been stopped on the exchange.

- The said security may be substituted by cash as published on PCF by the SITE.

- The SITE does not own the said security or has insufficient shares of the security and is unable to borrow sufficient shares to deliver to the applicant when the applicant redeems the ETF beneficial certificates in-kind.

- Situations in which the trust agreement of the securities investment ETF provides that cash in-lieu is permitted.

12. Cash Payment:

The amount equivalent to the cash component multiplied by the number of creation or redemption units.

13. Shortfall:

The securities in the portfolio of securities published on the PCF not delivered by a participating dealer when it transacts on “minimum in-kind creation” basis.