Dual-Currency ETF Trading

Launch of Dual-Currency Trading Mechanism for Exchange-Traded Funds (ETFs)1.Product overview

| In order to provide investors with a more diverse range of products and asset allocation instruments in different currencies, the Taiwan Stock Exchange (TWSE) has launched a new dual-currency trading mechanism for ETFs (DCT-ETF(s)). Related legislative amendments were announced and implemented on 8 March 2016, and the trading system was launched on 8 August 2016. |

| Under this mechanism, the issuer of a duly approved TWD ETF is allowed to list beneficial certificates denominated in an additional currency. The ETF will then be listed and traded on the market in dual currencies. During the initial phase, the DCT-ETFs are available only in TWD and CNY. |

| TWD ETFs and CNY ETFs have separate ticker symbols, order matching is conducted separately, investors can submit orders separately, and clearing and settlement are handled separately, i.e. TWD ETFs are traded and settled in TWD, while CNY ETFs are traded and settled in CNY. In addition to buying and selling the DCT- ETFs on the market, investors can also convert TWD ETFs they hold to CNY ETFs, and CNY ETFs to TWD ETFs. Once a conversion has successfully been made, the converted ETF shares can immediately be sold on the market. |

| DCT-ETFs provides investors with a more diverse range of asset allocation instruments and enables investors to convert between TWD and CNY whenever the need arises, creating enhanced flexibility. |

2.Investors required to sign risk disclosure statements before a first trade

| IBefore a securities firm accepts an investor's brokerage order to trade an ETF denominated in an additional currency for the first time, it must obtain a signed risk disclosure statement from the investor, but this requirement does not apply to the following investors: professional institutional investors; privately placed securities investment trust funds managed by a securities investment trust enterprise; futures trust funds offered by futures trust enterprises to parties that meet certain qualifications; discretionary investment accounts managed by a securities investment trust enterprise or securities investment consulting enterprise or by a securities investment consulting enterprise run as a side business by a securities broker; or discretionary investment accounts managed by a managed futures enterprise. |

3.Trading system overview

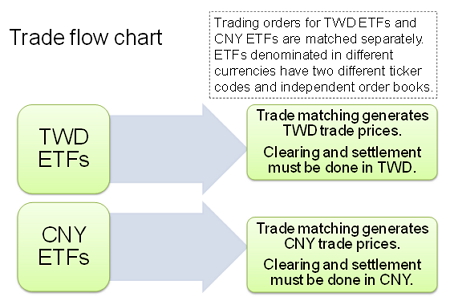

| (1) | Transaction process: |

| A TWD ETF and a CNY ETF will have separate ticker codes, and matching and settlement of orders will be handled separately. | |

|

|

| (2) | Trading hours: |

| The trading hours for CNY ETFs are the same as the trading hours for currently existing TWD ETFs regardless of the trading method (e.g. ordinary trading, block trading, after-market fixed-price trading, odd-lot trading). | |

| (3) | Tick size: |

| The tick size for CNY ETFs is the same as that for currently existing TWD ETFs. If the market price per beneficial unit is less than CNY50, the tick size is CNY0.01; if the market price per beneficial unit is CNY50 or greater, the tick size is CNY0.05. | |

| (4) | Trading unit: |

| The trading unit for CNY ETFs is the same as that for TWD ETFs. | |

| (5) | Price limits and circuit breakers: |

| CNY ETFs have the same price limits as those for TWD ETFs, and also are subject to circuit breakers. | |

| (6) | Auction reference price at market opening on first day of trading: |

| The net value per beneficial unit of a given TWD ETF, after it has been converted at the applicable exchange rate to the CNY equivalent, is taken as the basis in calculating the auction reference price and the price limits at market opening on the first day of trading of CNY ETFs. |

| (7) | Procedures for distribution of gains (ex dividend trading): |

| For a CNY ETF, gains are still distributed in TWD. The TWD amount of an earnings distribution after it has been converted at the applicable exchange rate to the CNY equivalent, will be taken as the basis in calculating the auction reference price and the price limits at market opening on the first day of ex dividend trading of CNY ETFs. |

| (8) | Restrictions applying to CNY ETFs: |

|

A. A CNY ETF may not be used in margin purchases, short sales, day trades, money borrowing or lending in connection with securities business, money borrowing or lending for unrestricted purposes, securities settlement financing, money lending secured by securities, or securities borrowing and lending transactions, nor may they be used as collateral or as the underlying securities of warrants. B. A CNY ETF may not be created or redeemed in the primary market. |

| (9) | Exchange rates: |

| (For converting between TWD and CNY) |

| Content | Time of exchange rate (The term "posted exchange rate" means the exchange rate provided by Cathay United Bank at 3:30 p.m.) |

| Total dollar amount of quotes for brokered or proprietary trades | Conversion is done using the exchange rate posted by the TWSE on the preceding day. |

| Standards for the total amounts of reported daily sales of securities subject to disposition measures | Article 6 of the Taiwan Stock Exchange Corporation Directions for Announcement or Notice of Attention to Trading Information and Dispositions includes a provision that places restrictions on the "amounts of reported daily sales or purchases of a given security...." With respect to a CNY ETF, such restrictions apply to amounts as converted to TWD using the exchange rate posted by the TWSE on the preceding day. |

| Standards for block trade amounts | Conversion is done using the exchange rate posted by the TWSE on the preceding day. |

| Intraday net asset value (IOPV) | Issuer does conversion using the current exchange rate. |

| Reference net value at close of market | Issuer does conversion using the current day's exchange rate. |

| Cash collateral for settlement-coverage securities borrowing | Conversion on the day of the securities loan is done using the exchange rate posted by the TWSE on the preceding day. |

| Default amounts | Conversion of the amount of defaults occurring on a single reporting day is done using the exchange rate posted by the TWSE on the same day. |

| Out-trade amounts | Conversion on the trade date is done using the exchange rate posted by the TWSE on the preceding day. |

4.Advance collection of price:

5.Conversion system:

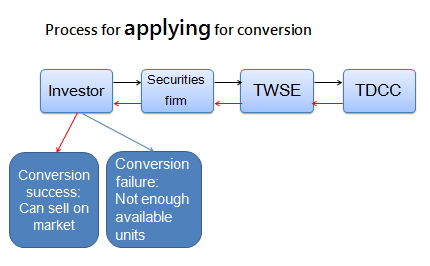

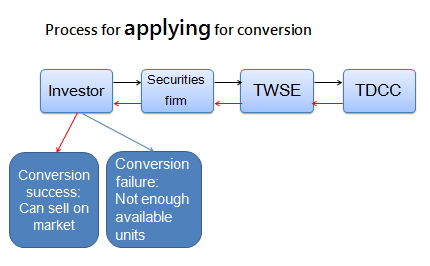

| (1) | Process for applying for conversion: |

| When an investor applies with a securities broker to convert between ETF currency denominations, the securities broker will use an online system to apply with the TWSE for the conversion. The TWSE will then notify the Taiwan Depository & Clearing Corporation (TDCC) to confirm that the number of units to be converted as per the application is fewer than or equal to the available number of units in the depository account. The TDCC will then use the TWSE system to report that the conversion applied for by the securities broker has been successfully completed. If it has been successfully completed, the investor can immediately sell the units on the market. | |

|

|

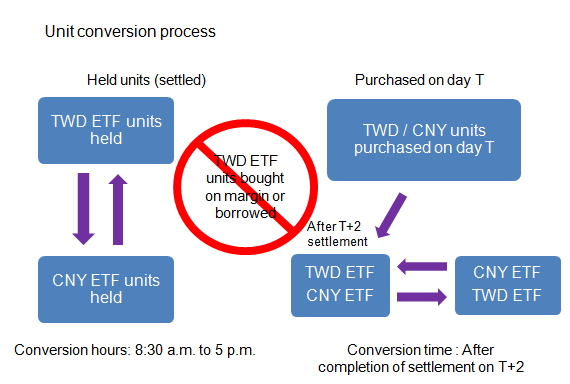

| (2) | Conversion hours: |

| 8:30 a.m. to 5 p.m. | |

| (3) | Conversion ratio and quantity: |

| The conversion ratio is one-to-one, i.e. a single TWD ETF unit can be converted into a single CNY ETF unit, and vice versa. The conversion quantity must be an integral multiple of the trading unit, and must not exceed the available number of units in the depository account. | |

| (4) | Conversion of units: |

|

Units that are convertible: A. Units currently held: Can be converted at any time during conversion hours. B. Units purchased on day T: Cannot be converted until completion of settlement and book-entry transfer on T+2. Investors are not permitted to apply for conversion of TWD ETF positions bought on margin or borrowed.

|

|

| (5) | Number of conversions: |

| The number of times an investor is allowed to convert between TWD and CNY ETFs on a single day is not subject to any restrictions. Following successful conversion, the investor is not allowed to delete or alter the conversion, and is allowed only to apply to convert in the opposite direction. |

6.Clearing and settlement:

| (1) | Settlement accounts: |

| Securities firms and investors must each open a foreign currency settlement account. | |

|

|

| (2) | Settlement currencies: |

| Settlement is made in the currency in which an ETF is listed and traded, i.e. a TWD ETF is settled in TWD, and a CNY ETF is settled in CNY. | |

| (3) | Time of clearing and settlement: |

| The times are the same as for TWD ETFs. A securities firm delivers securities to the TWSE on T+2 at 10 a.m., and delivers payment on T+2 at 11 a.m. An investor delivers both payment and securities to the securities firm on T+2 at 10 a.m. | |

| (4) | Handling fees and processing fees: |

| Handling fees and processing fees are collected in the currency in which the ETF units are traded on the market, i.e. those for a TWD ETF are collected in TWD, and those for a CNY ETF are collected in CNY. | |

| (5) | Securities transaction tax: |

| Securities transaction taxes for securities dealers' trades in CNY ETFs, and securities transaction tax for CNY ETF trades collected by securities brokers, must be converted to TWD at the actual deal rate and then paid into the national treasury. There is no need to include such amounts in a securities firm's accumulated exchange settlement amount for the current year. The securities firm must aggregate the CNY taxes payable on the security in question as of the day of settlement, round the figure to the second decimal place, then take the actual amount of CNY to be sold for TWD on the settlement date (T+2) or on the next business day thereafter (T+3), and round the NT dollar amount to the first decimal place. The amount thus obtained must be paid as a securities transaction tax. On T+2 or T+3, the securities firm must report to the TWSE the exchange rate used to calculate the actual amount to be sold for TWD in order to pay the securities transaction tax. |

7.Bear in mind the following when trading ETFs denominated in an additional currency

| (1) | Currency risk and spread risk |

| After a CNY ETF has been listed, it is traded, cleared, and settled in a separate currency denomination from the TWD ETF. Trading prices can be affected by such things as market demand and exchange rate volatility, with the result that prices rise or fall. There is thus a spread risk between the two currencies. | |

| (2) | Daily CNY settlement limit for individuals |

| An investor is not allowed to place an order to purchase units of CNY ETFs until it has been confirmed that the security firm has collected the full CNY amount in advance. There is a daily CNY20,000 settlement limit for individuals. |

8.Frequently asked questions

| (1) | How does an investor buy and sell CNY ETFs? |

| Answer: Before placing orders with a securities firm to trade CNY ETFs, an investor must first open a foreign currency settlement account and sign a risk disclosure statement. | |

| (2) | How does an investor identify a CNY ETF? |

| Answer: The first five symbols in an ETF ticker code constitute a five-digit serial number. If the sixth digit is the letter K, or the sixth digit of a leveraged ETF is M, or the sixth digit of an inverse ETF is S, it indicates that the ETF is traded in a foreign currency (including CNY ETFs). If a currently listed ETF with a four-digit or six-digit ticker code has an additional currency denomination listed, the ticker code in principle is handled as follows:

If the ticker code is 0050, for example, the ticker code for the ETF denominated in the additional currency will be 00500K. If the ticker code if 006205, the ticker code for the ETF denominated in the additional currency will be 00625K. In addition, the abbreviated name of an ETF is 16 bits long. The naming principle calls for identification of the issuer, the underlying index (or product), and attributes of the ETF (in that order). |

|

| (3) | How does an investor apply to convert between TWD and CNY ETFs? |

| A: An investor can apply to convert TWD ETFs or CNY ETFs that the investor holds. The investor starts the process by applying with a securities broker. The securities broker then uses an online system to apply with the TWSE for the conversion. The TWSE then notifies the TDCC to confirm that there are enough units of the ETF in the depository account at the securities firm. The TWSE then notifies the securities firm that the conversion has been completed, and the securities firm notifies the investor. But if the TDCC finds that there are not enough units of the ETF in the investor's depository account, the TWSE system notifies the securities firm, which in turn notifies the investor that the conversion has failed. | |

| (4) | Is there any sort of linkage between the prices of the TWD ETF and the CNY ETF? |

| A: The TWD ETF and the CNY ETF are actually a single ETF that trades in two different currencies, so one might reasonably expect there to be a definite linkage between their price movements. However, due to differences in market demand, exchange rate fluctuations, and other such factors, the possibility of differences between the trading prices of the two does exist. |