Innovative Instruments and Mechanisms

Innovative trading mechanisms

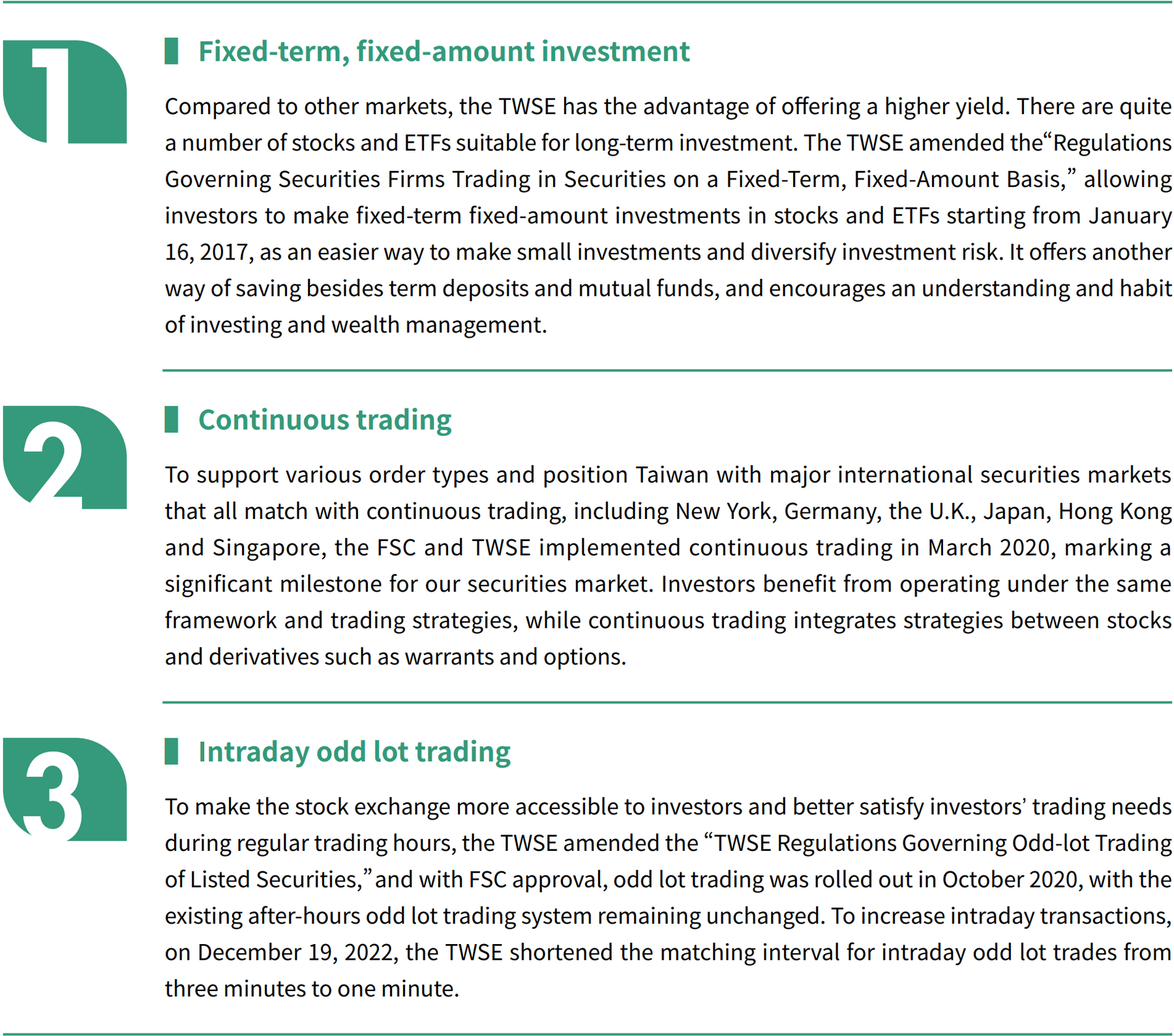

Through unwavering innovation, the TWSE offers investors multiple trading channels, and has continued to develop its digital transaction system. The various improvements made to trading mechanisms have expanded trading hours and given rise to innumerable trading strategies. More importantly, significant strides toward financial inclusion have been made with the participation of younger investors through fixed-term fixed-amount investment and intraday odd lot trading.

-

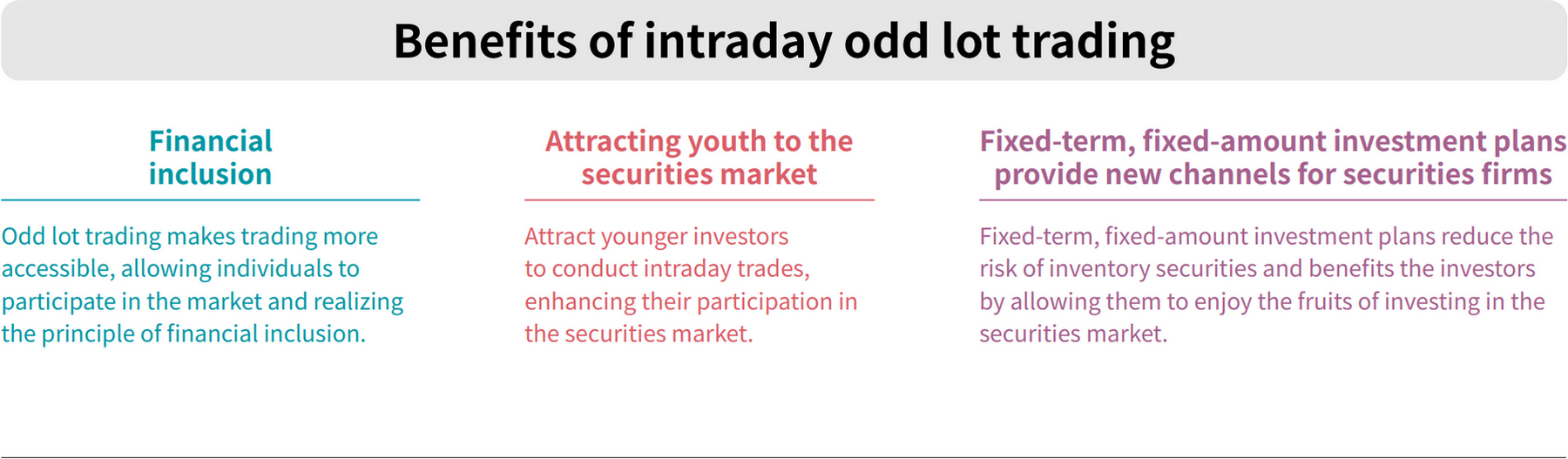

The introduction of odd lot trading during regular hours is aimed at making high-value stocks more affordable for individual investors, thereby enhancing their participation in the securities market, and boosting accessibility and turnover in the securities market.

-

Market making system

The TWSE launched the market-making system in 2021, aiming to boost the trading volume of securities of great potential, outstanding quality, and low liquidity. However, other issues factor into a stock's appeal, including company performance, industry outlook, topicality, and the investor's own needs.

The market making operates by cross selection among all stocks in combination with good-quality, low-liquidity stocks. The TWSE sets the selection criteria for eligible stocks based on quantitative and qualitative conditions, including profitability, trading volume, turnover rate, and dividend distribution. Currently, eight securities companies have applied to be market makers and one security company serves as an exchange incentive program participant. With the active participation of market makers and securities firms, the aim is to energize the overall market and boost market momentum.

This year, the TWSE incorporated ESG criteria into market-making and incentivized market makers to participate. From the launch on July 1, 2022 to year-end 2022, stocks targeted by securities firms were outperforming the market, with their average daily trading value more than doubling compared to levels from six months before ESG market-making incentives were put in place.

Innovative diverse products

In addition to urging domestic companies to implement CSR, the TWSE also intends to expand the scale of the securities market and satisfy investors' needs for diverse products. As the main operator of the domestic stock market, the TWSE is dedicated to evaluating and promoting various financial products with innovative concepts.

-

Exchange Traded Notes (ETNs)

An exchange traded note, or ETN, is a security issued by a securities firm that pays a return at maturity based on the performance of the underlying index. It is traded in the securities market, and is subscribed and sold back in cash by investors.

To properly manage the financial market globalization and to satisfy investors' demand for diverse investment and trading instruments, the TWSE researched and analyzed various global market practices, and developed ETNs with the FSC, TPEx and Taiwan Securities Association. The listing and trading regulations were announced in 2018. In April 2019, the TWSE and TPEx held a joint TWSE/TPEx ETN listing ceremony and the first batch of seven ETNs was listed on the TWSE.

The year 2022 saw a total of four ETNs listed for trading. These products allow investors to participate in business opportunities in Taiwan's IC design and green energy industries, and provides an instrument in the covered call strategy.

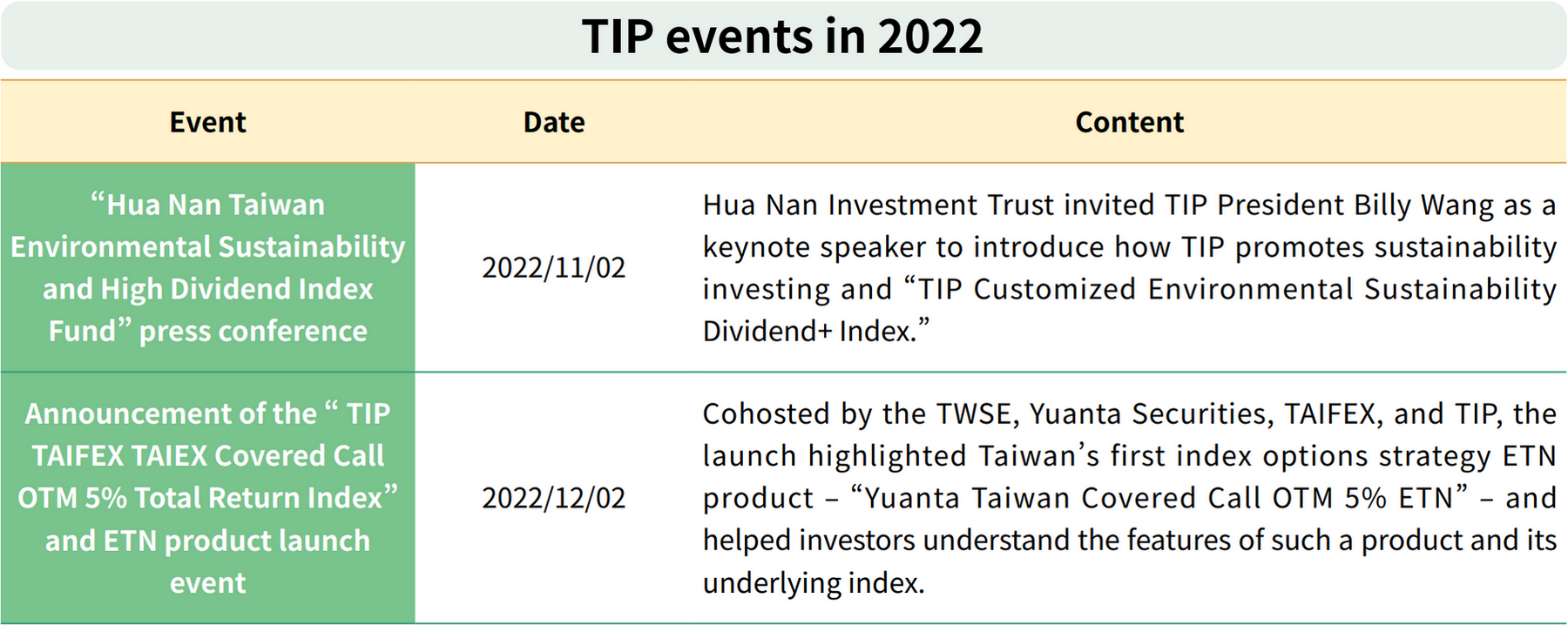

The TIP offers a diverse and expansive range of indices, including benchmark, industry, thematic, style and customized indices, to satisfy the needs of all issuers and investors for index investment products.

-

Taiwan Electric Vehicle-related Indices

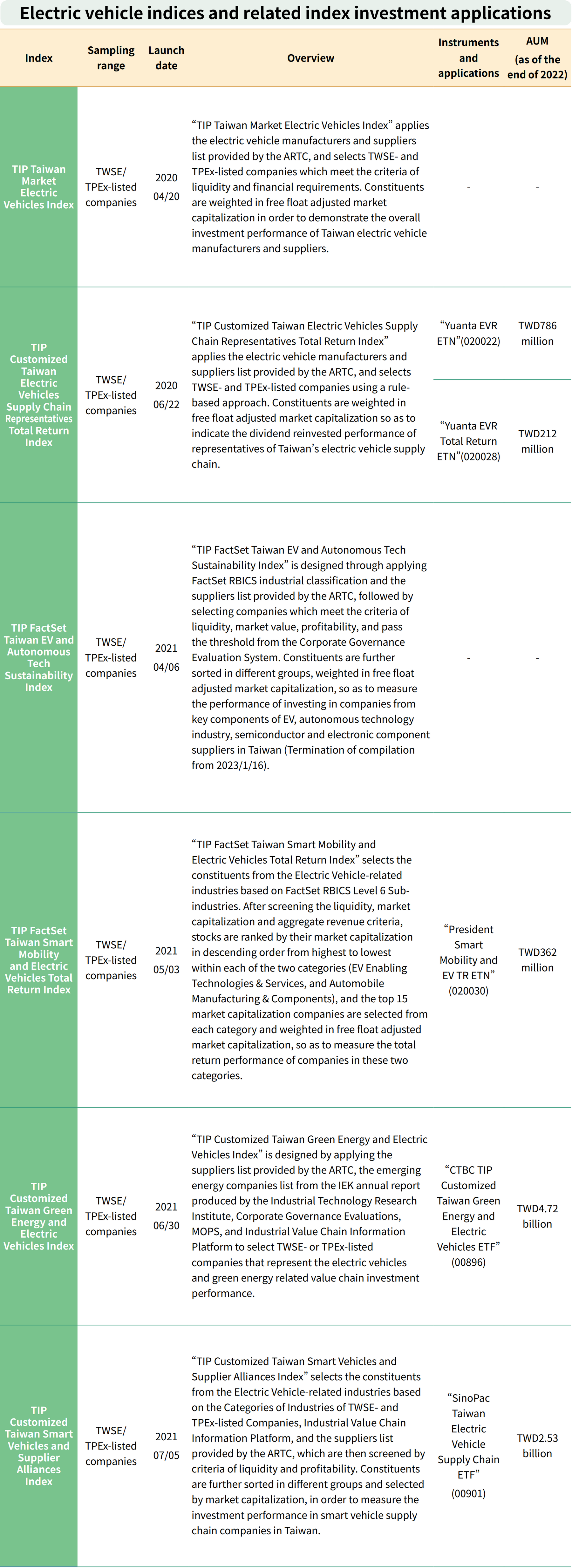

In response to the government's push to develop low-carbon industries and to promote green finance, the TWSE's fully owned subsidiary, TIP, worked with the Automotive Research & Testing Center (the "ARTC") to select constituents among the list of electric vehicle manufacturers and suppliers provided by the ARTC to launch indices related to the theme of electric vehicles. The first thematic index focused on electric automobiles in Taiwan, the "TIP Taiwan Market Electric Vehicles Index," was launched in April 2020.

So far, TIP has launched six indices relating to electric vehicles, namely the "TIP Taiwan Market Electric Vehicles Index," "TIP Customized Taiwan Electric Vehicles Supply Chain Representatives Total Return Index," "TIP FactSet Taiwan EV and Autonomous Tech Sustainability Index," "TIP FactSet Taiwan Smart Mobility and Electric Vehicles Total Return Index," "TIP Customized Taiwan Green Energy and Electric Vehicles Index," and "TIP Customized Taiwan Smart Vehicles and Suppliers Alliances Index." Furthermore, the rollout of ETFs and ETNs linked to electric vehicles have garnered significant attention from investors.

-

ESG and Sustainability Indices

In support of government policies to encourage TWSE-listed companies to value CSR, the TWSE has issued three CSR indices since 2010: the "TWSE RA Taiwan Employment Creation 99 Index," "TWSE RAFI® Taiwan High Compensation 100 Index," and "TWSE Corporate Governance 100 Index." From 2017 to the end of 2022, TIP has launched 21 ESG thematic indices. As of December 2022, a total of 24 ESG thematic indices have been launched. These indices cover various types, ranging from social and governance dimensions to diversified indices such as ESG small- and mid-cap stocks, and ESG plus sector or investment factors etc. TIP is dedicated to promoting the diverse applications of these indices. ESG-related indices have been successfully licensed for a number of products, including ETFs, ETNs, index futures, funds, and government pension funds, with a total AUM of over TWD 190 billion.

As of the end of 2022, FTSE4Good TIP Taiwan ESG Index has been licensed by the Bureau of Labor Funds, Ministry of Labor to be used as a benchmark (mandate amount TWD 42 billion), and for the "Yuanta FTSE4Good TIP Taiwan ESG ETF" (code: 00850, AUM: TWD 9.5 billion), "F4G TIP TW ESG Futures" (code: E4F), and the "SinoPac Taiwan ESG Plus Fund" (actively managed funds, AUM: TWD 429 million).

To further align with the green finance policy and to remain consistent with international developments and practices, TIP and the National Taipei University Center for Corporate Sustainability (the "Center for Corporate Sustainability") worked to develop convenient channels for investors to participate in low-carbon and sustainable enterprises. Comparing company revenue against their carbon emission, and taking into account their performance in ESG indicators on the "Taiwan Sustainability Ratings," TIP and the Center for Corporate Sustainability screen for financial soundness, ESG performance, and low-carbon emissions, selecting the top 50 stocks based on market capitalization to compile the "TIP Customized Taiwan ESG Low Carbon 50 Index" – the first of its kind in Taiwan to focus both on ESG and low carbon emission.

FTSE4Good TIP Taiwan ESG Index

TIP Taiwan Market CSR Small/Mid-Cap Index

-

Index promotion

Indices compiled solely by TIP and published on the official website shall be promoted and publicized in the following ways:

-

Taiwan sustainable investment trends forum

Due to the COVID-19 pandemic, the TWSE suspended its forum on sustainable investment trends in Taiwan in 2022. Nonetheless, TIP, peripheral agencies, collaborative partners, NGOs/NPOs, and academic institutions continued to organize events related to the discussion of sustainable investment, as are listed below: