Stability of the Securities Market

With various financial instruments and trading mechanisms being introduced to the market in recent years and rising levels of financial literacy, the TWSE actively facilitates the operations and supervision of the securities market, promotes digital transformation and SupTech, drives TWSE-listed companies to enhance information disclosure, offers investor services and establishes a safe and stable trading platform under the supervision of the Securities and Futures Bureau, aiming to lower investment risk and misconduct to maintain the sustainable and stable operation of the stock market.

Securities market surveillance and management

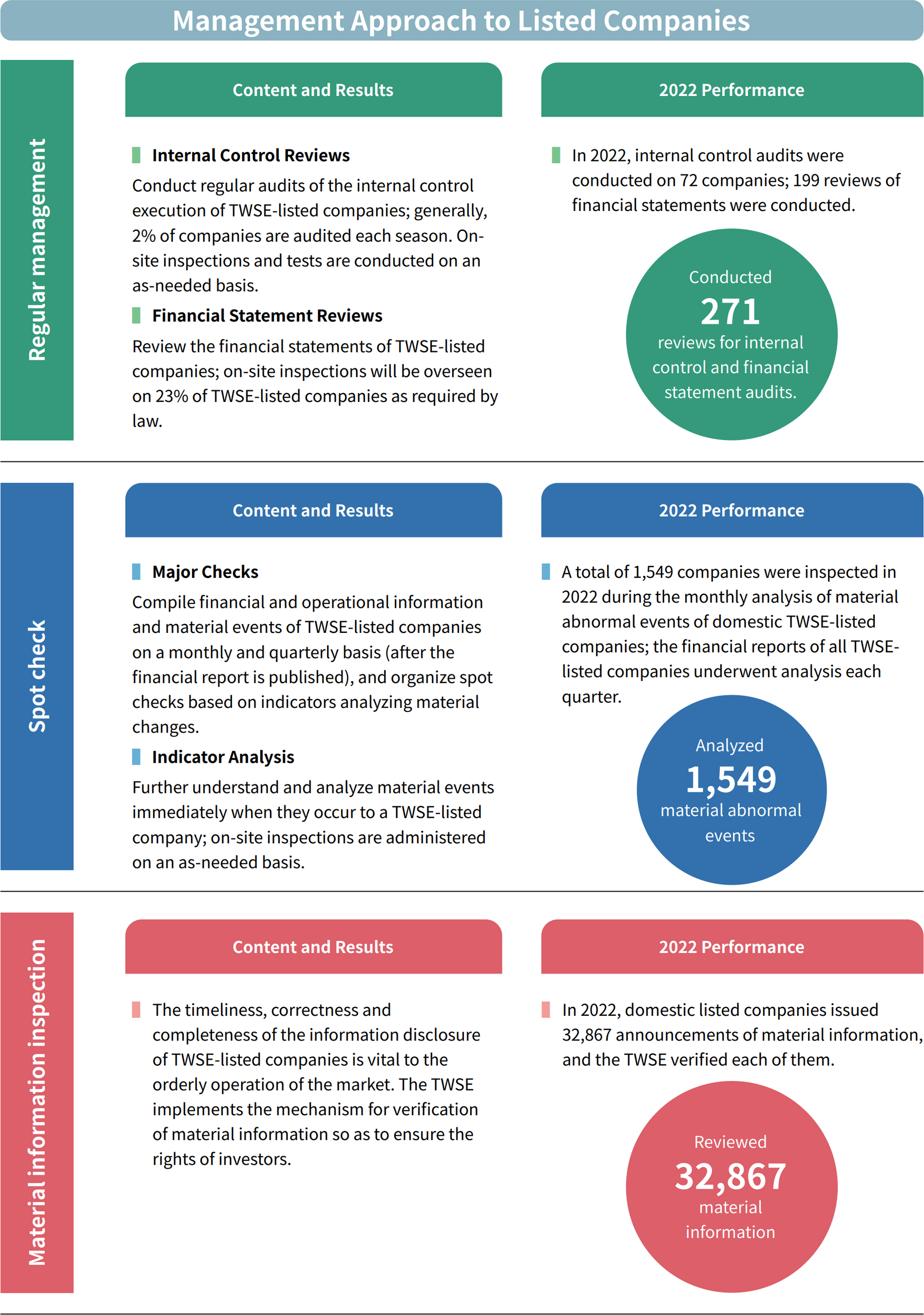

The TWSE contributes to the safe and sound operation of the securities market, supports the stable performance of TWSE-listed companies and the government's policy execution. To achieve steady operation, the TWSE has complete policies and procedures for the main stock market participants (TWSE-listed companies, investors and securities firms). In the mid- to long-term, the TWSE expects that the use of SupTech will reduce manual operations and boost supervision efficiency of regular management.

-

TWSE-listed companies

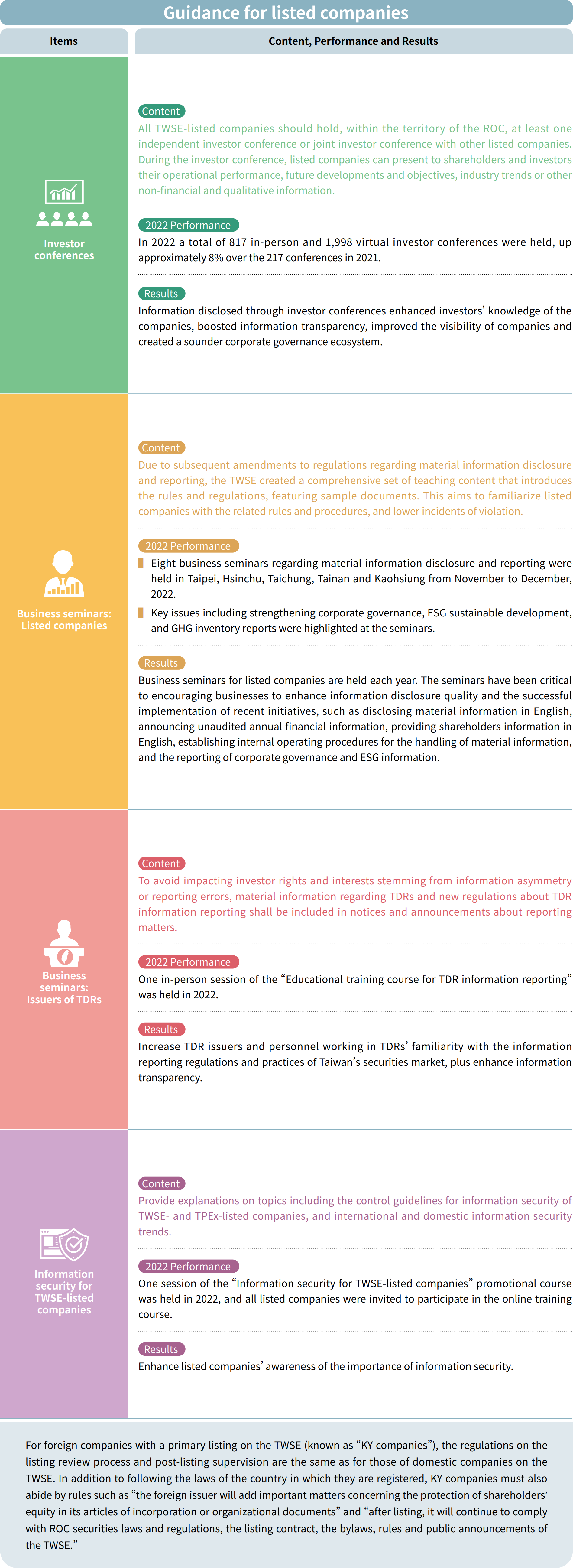

Listed companies are indispensable to the sturdy development of the economy and society. The TWSE assists enterprises in promotion, supervision, services, information management, the drafting and implementation of listing regulations and other matters related to securities listings and the supervision of TWSE-listed group companies.

-

Securities firms

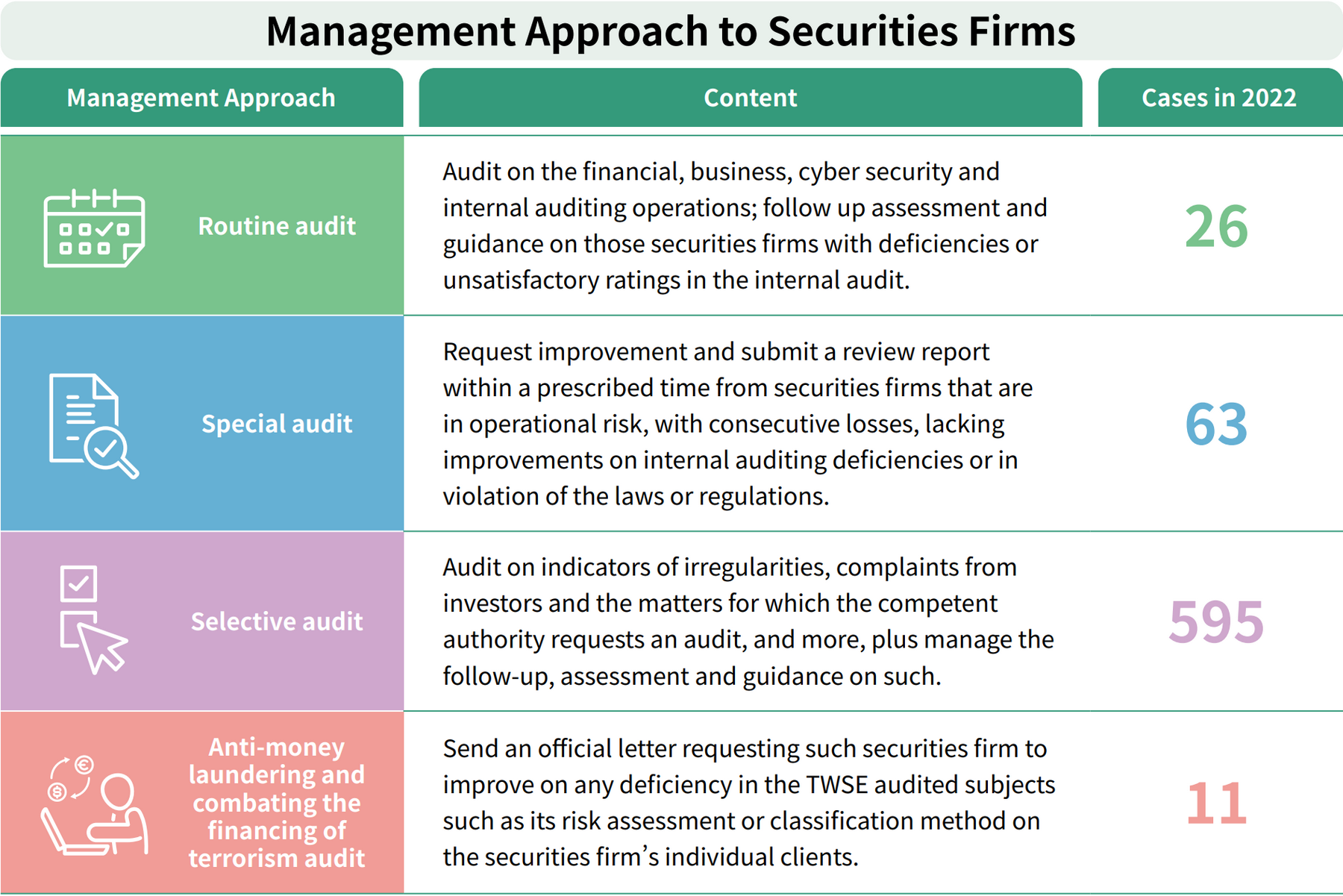

Securities firms are chartered securities institutions. Once a securities firm encounters a severe crisis, it will not only endanger its clients, but also affect the operation of the securities market. Therefore, to ensure that securities firms are financially sound and compliant with relevant rules and regulations, the TWSE establishes regulations governing securities firms, their internal control, and internal auditing standards, as well as promoting the understanding of these regulations. The TWSE reviews securities firms' finances, operations, information security, and internal audit systems, and provides follow-up guidance on any deficiencies found in the review. This also includes matters of registration, management, and penalties in cases of violation for securities firms and their personnel.

-

Cyber security protection and management mechanisms

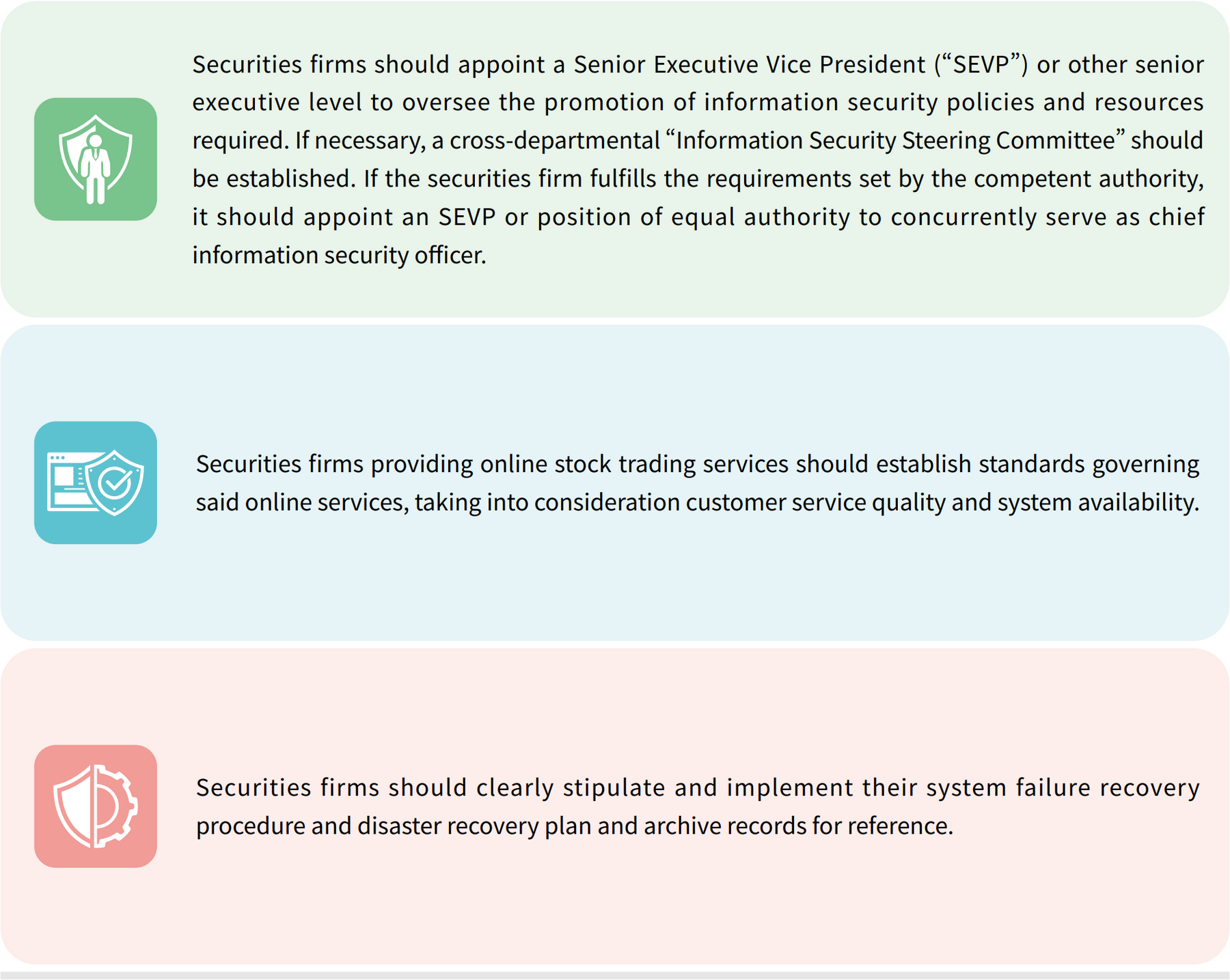

As internet security becomes an increasingly important aspect of the international finance industry, the TWSE requests that securities firms take the following precautions to ensure the secure operations of online transactions and the stability of the securities market.

-

Market surveillance

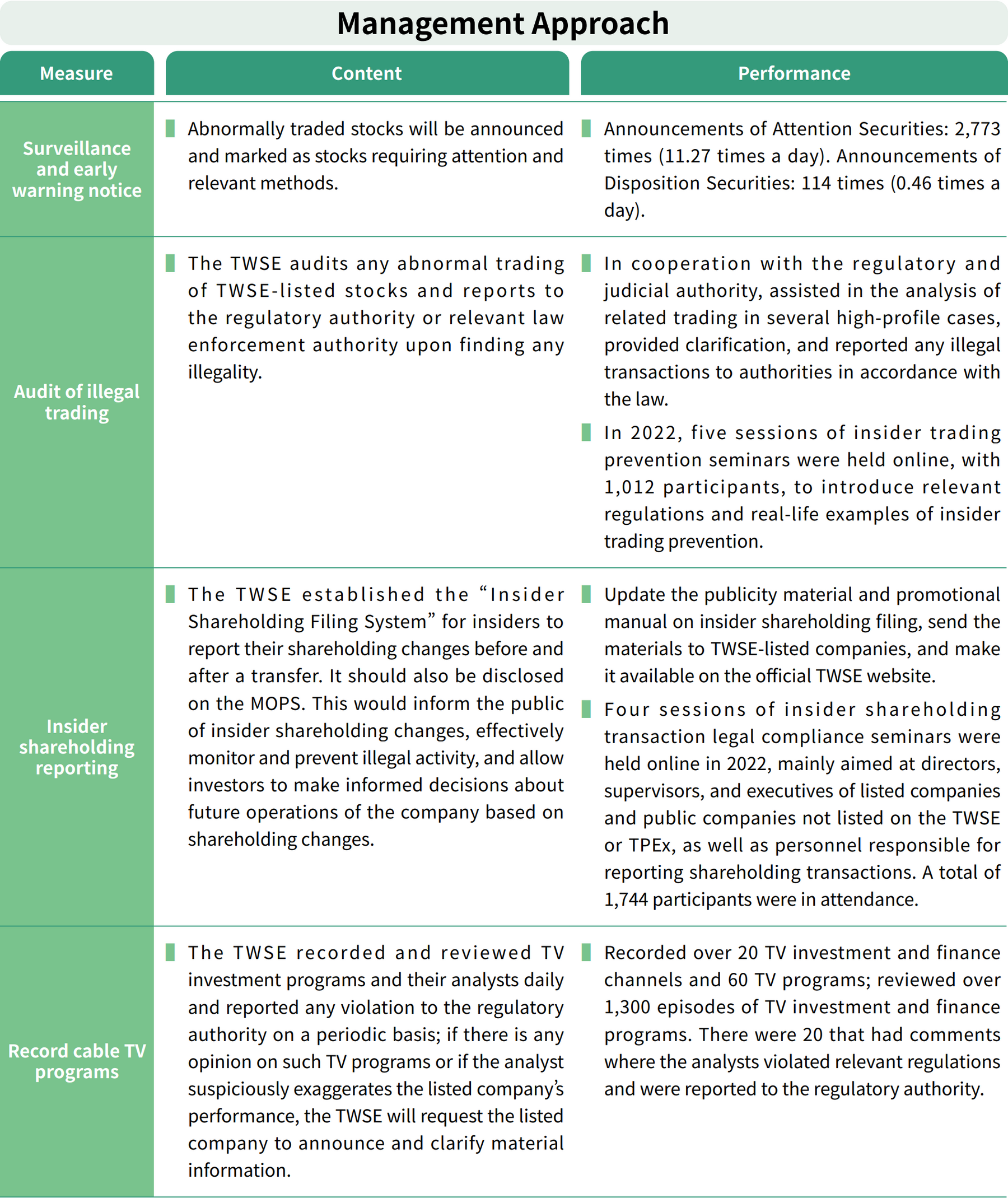

The TWSE carries out front-line surveillance of the stock market under FSC supervision, and the main operations include: public announcement of abnormally traded stocks, audit of suspected insider trading or abnormal manipulation of stock prices, processing the filing of insider shareholding changes and reviewing TV investment programs and their analysts for any violations against relevant regulations. The goal of market surveillance system is to maintain the stock market's security and fairness.

Innovative listing business

In terms of economic development and industrial trends, some innovative domestic businesses, though not yet profitable, show strong operational capabilities and are in need of funding. Hence, the TWSE currently offers alternative listing rules and platforms to assist large-scale companies meeting certain conditions to list on the TWSE. In addition, the TWSE introduced "Cornerstone Investor" mechanisms to facilitate domestic and foreign unicorn enterprises in raising funds from the securities market.

-

Alternative listing

Many innovative companies operate with a promising business model or offer goods or services with great potential, but are not yet profitable despite reaching a certain size. In March 2018, the TWSE amended rules allowing companies of a large market capitalization to be exempted from the profitability requirement in their listing applications. The goal of alternative listing is to support innovative enterprises and expand the role of the Taiwan capital market to bridge the needs of fundraising and investment.

-

"Cornerstone Investor" mechanisms

In the context of an IPO, cornerstone investors, typically large institutions with a wealth of investment experience and financial resources, agree to subscribe for a certain amount of shares at a fixed price, which accounts for part of a company's IPO offering in advance of the investor roadshow. Detailed information of cornerstone investors shall be comprehensively disclosed in the prospectus. In recent years, relevant regulations are still under amendment so as to position Taiwan's underwriting system with global practices and better meet the industry's needs for cornerstone investors.

-

Taiwan Innovation Board

The TWSE launched the Taiwan Innovation Board ("TIB") in response to the government's policy to promote industrial development as well as to optimize the securities market to support new ventures. TIB encourages businesses with key technologies and innovative capabilities or business models to raise funds on the securities market, thereby boosting market growth and stimulating the national economy.

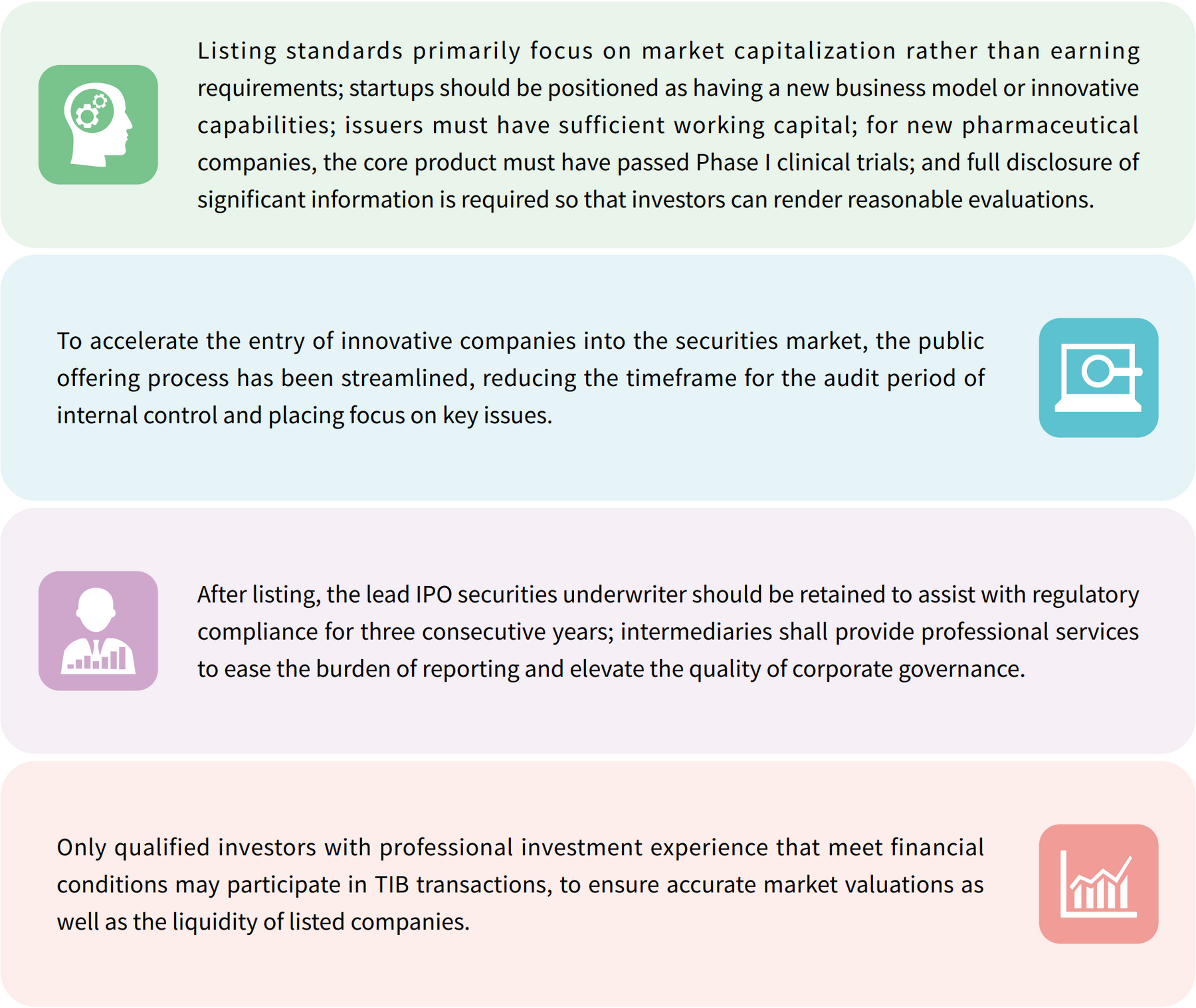

As a platform to facilitate startups, TIB differs from the main board in the following ways:

TIB, which officially launched on July 20, 2021, marks a pivotal milestone in the development of Taiwan's securities market, introducing capital into the startup ecosystem and offering new fundraising channels to encourage new ventures with high quality to stay in Taiwan. Looking ahead to 2023, it is expected that companies from various industries such as digital cloud, biotechnology and healthcare, electric vehicles, green energy and environmental protection, and semiconductor will apply for TIB listing. The TWSE will continue to promote investment through diversified channels and engage in communication with the startup ecosystem to attract more innovative and influential high-quality companies to join TIB.

Strengthen information disclosure

To protect the rights of investors and ensure that public disclosure of information will be promptly carried out following the occurrence of an event having a material effect on the price of securities or the judgment of investors 1, the TWSE established the "Taiwan Stock Exchange Corporation Procedures for Verification and Disclosure of Material Information of Companies with Listed Securities."2 In accordance with the Procedures, listed companies should input the material information or explanations on the internet information reporting system (MOPS) designated by the TWSE, within the filing time limit.

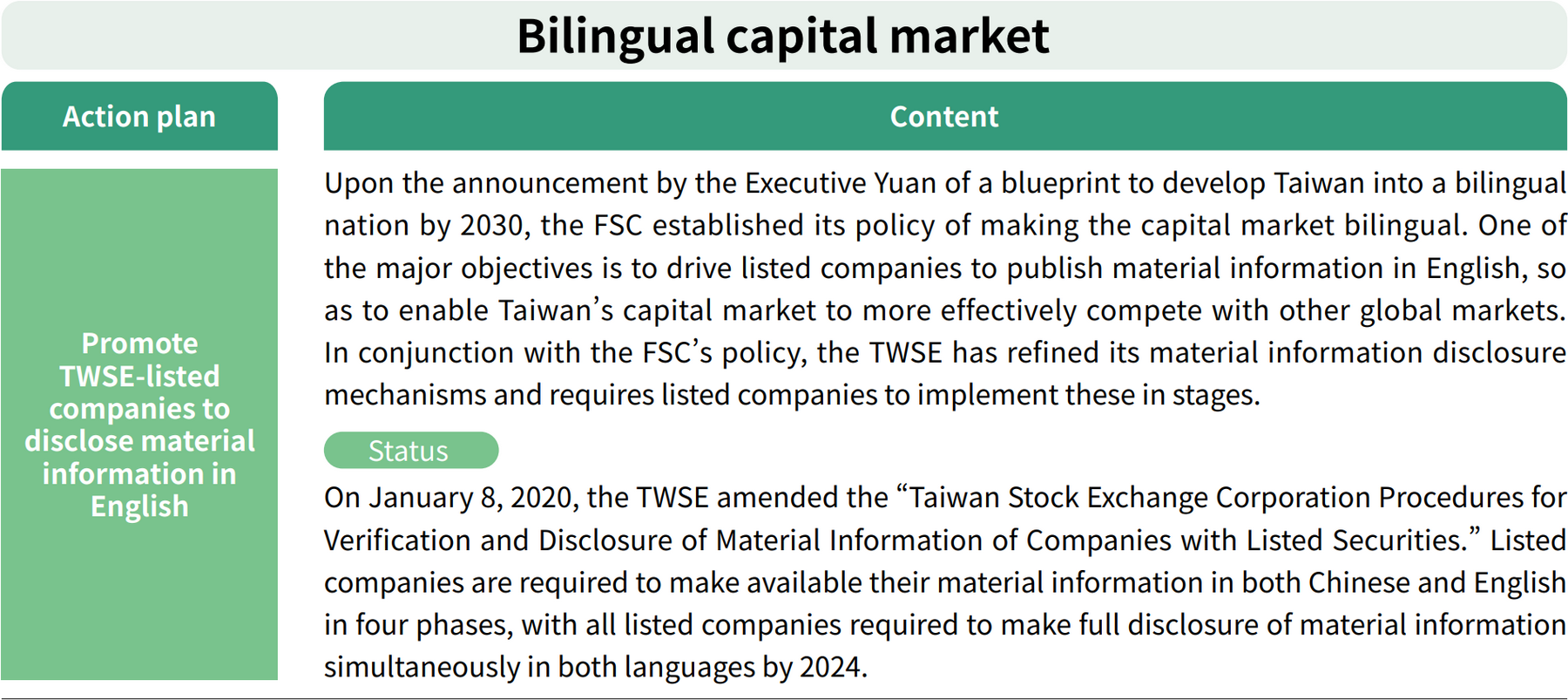

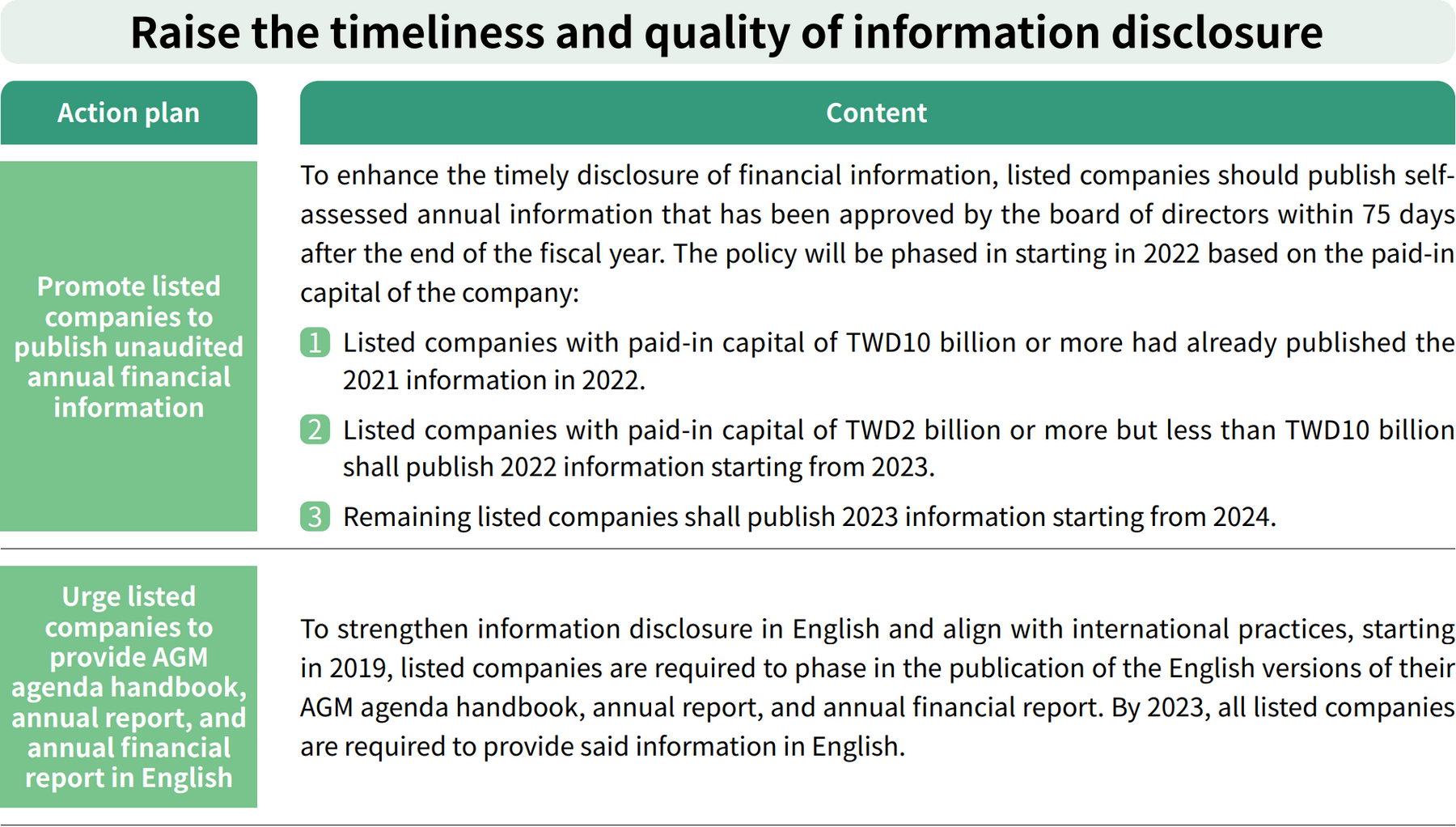

The TWSE has promoted the policies of "Bilingual Material Information Disclosure by Listed Companies" and "Publication of Unaudited Annual Financial Information by Listed Companies" to enhance the timely access of information by international investors, as detailed below:

note1: Material information to be announced by TWSE-listed companies includes financial, changes in equity, litigation, production and operations, personnel changes, distribution of dividends and resolutions by the board of directors, investor conferences, and others.

note2: http://www.selaw.com.tw/LawArticle.aspx?LawID=G0100104

Diverse information platforms