About the Taiwan Stock Exchange

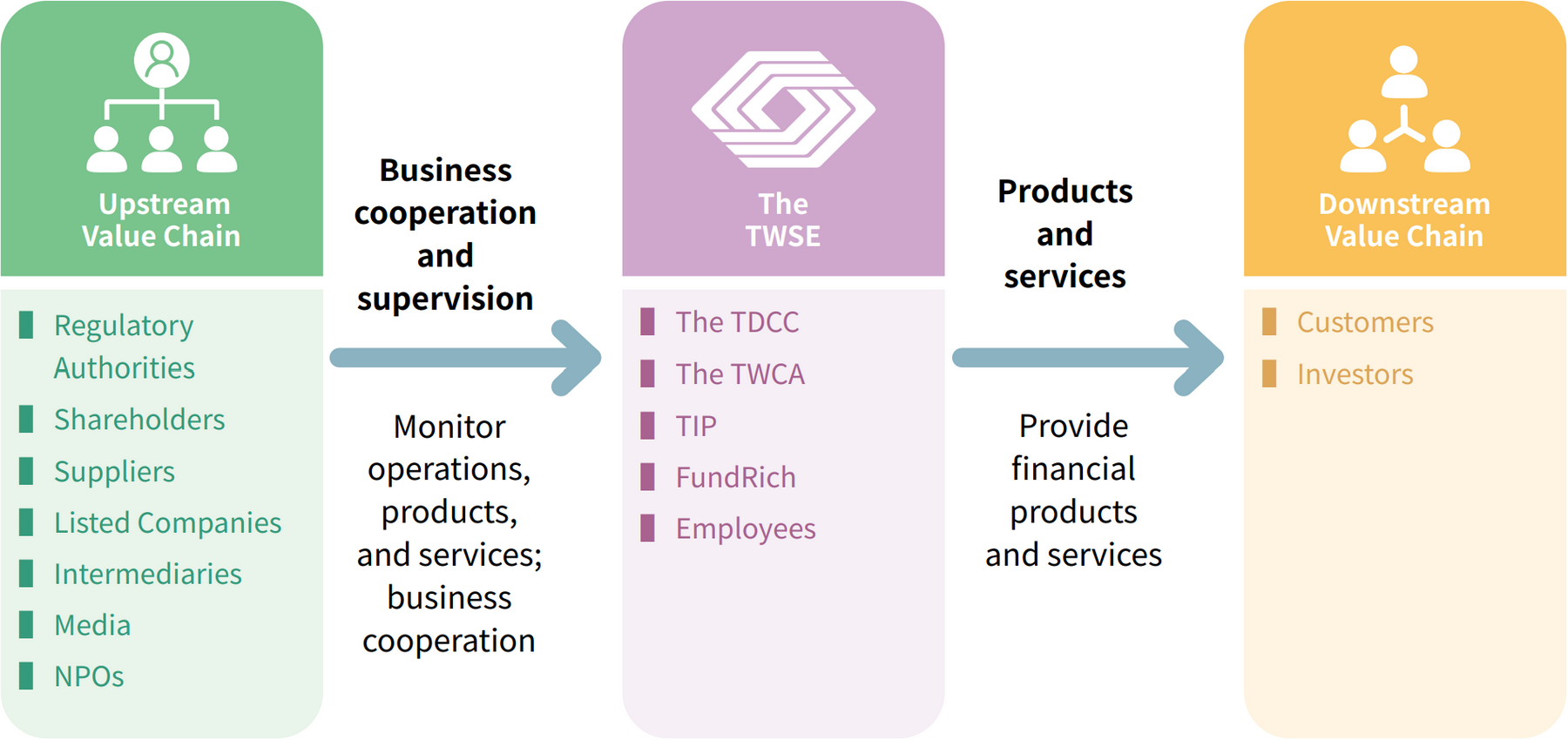

As a major operator in the Taiwan securities market and a platform for fund-raising and investment, the TWSE bears the responsibility for providing liquidity for businesses and creating investment opportunities for people. Moreover, the TWSE is strongly recognized for its key role in promoting ESG disclosure in Taiwan-listed companies in step with the competent authority's policies.

Subsidiaries

The TWSE subsidiaries are the Taiwan Depository & Clearing Corporation (the "TDCC"), Taiwan-CA Inc. (the "TWCA"), Taiwan Index Plus Corporation ("TIP") and FundRich Securities Corporation ("FundRich").

Market Overview

In 2022, global markets shrank due to the COVID-19 pandemic, Russia's invasion of Ukraine, rising geopolitical risks, and accelerated interest rate hikes by central banks worldwide. On the final business day of 2022, TAIEX closed at 14,137.69 points, down 22.40% from the year-end close of 2021, marking the third highest year-end finish in its history.

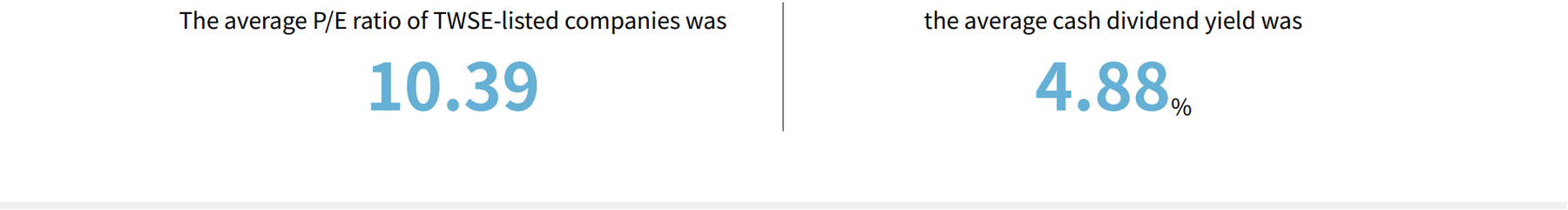

With TAIEX down more than 20% in 2022 compared to the end of 2021, the average P/E ratio of all TWSE-listed stocks shrank to 10.39, the lowest it has been in a decade. With lower valuations of Taiwan's securities, the cash dividend yield rose to 4.88%, performing quite well among major global markets.

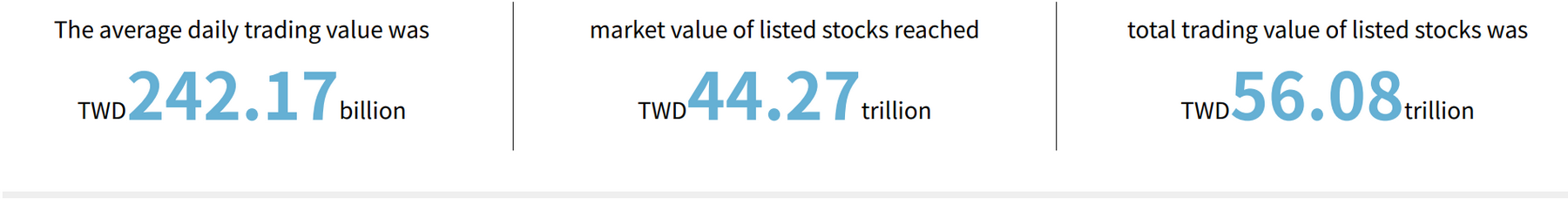

In 2022, the securities market average daily trading value was TWD 242.17 billion, a decrease of 38.14% compared with the TWD 391.46 billion of 2021. The total market capitalization of TWSE-listed stocks was TWD 44.27 trillion, with total trading value amounting to TWD 56.08 trillion, but still sitting pretty among the TWSE's top performing years.

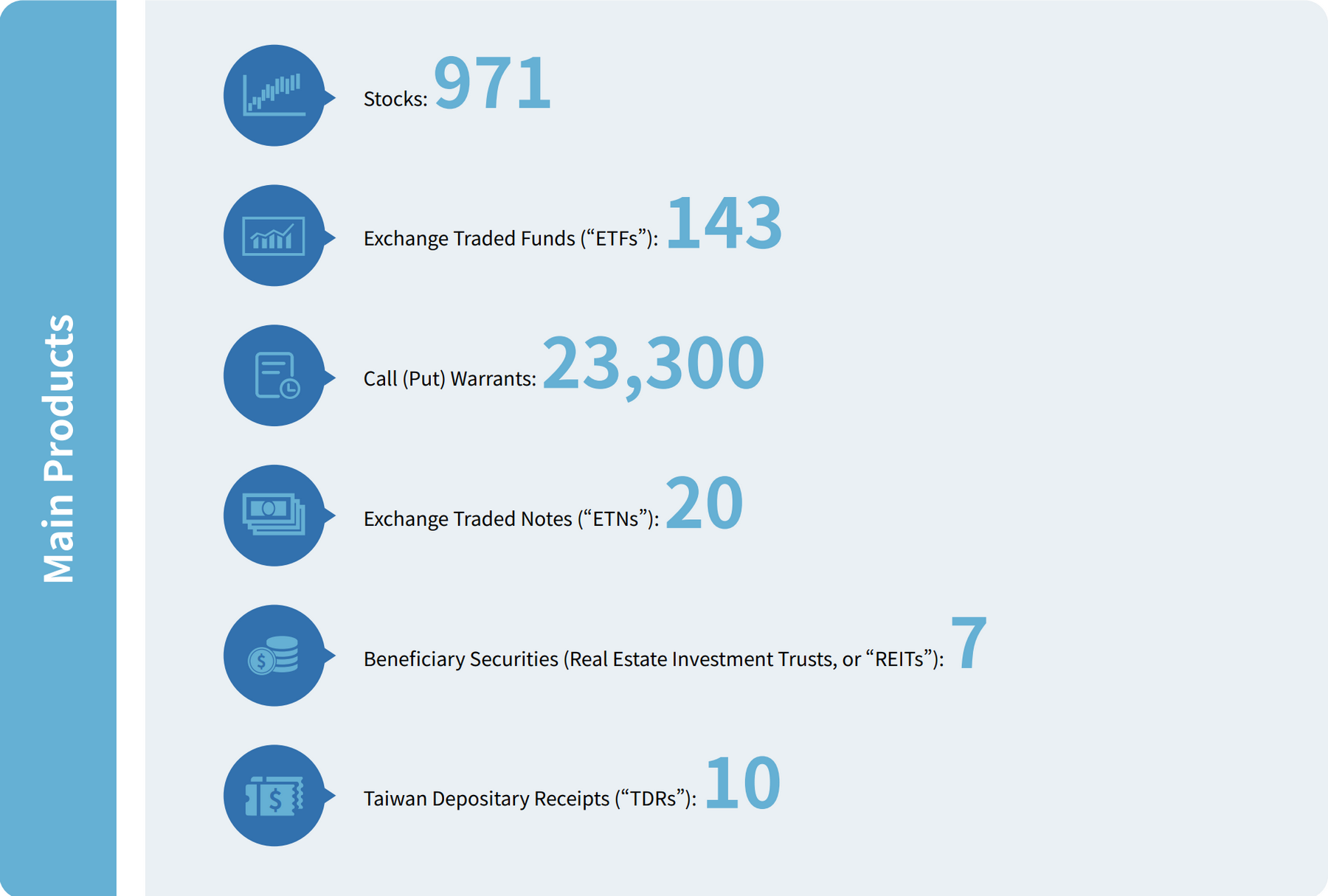

Despite volatile financial conditions, the number of listed companies rose from 959 in year-end 2021 to 971 in year-end 2022. The total assets under management of listed ETFs soared from TWD 849 billion to TWD 1.16 trillion, a strong showing of Taiwan's market resilience.

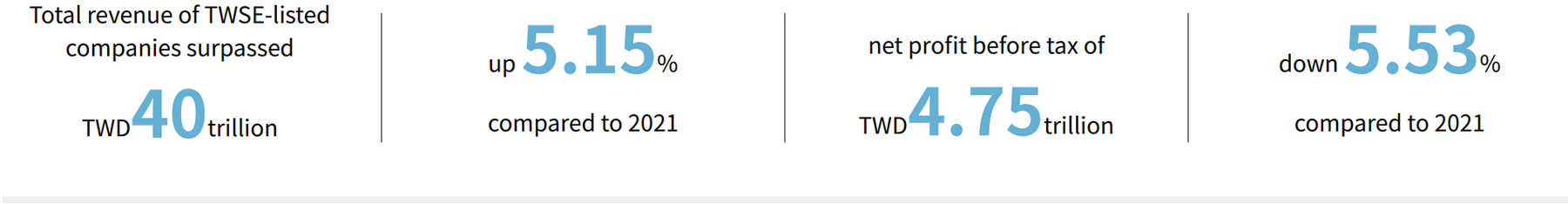

The total operating revenue of all TWSE-listed companies exceeded TWD 40 trillion in 2022, up 5.15% against headwinds compared to 2021. However, the impacts of rising interest rates, inflation, and commodity prices have pushed aggregate net profit before tax down 5.53% compared to 2021 to TWD 4.75 trillion.

In 2022, the total capital raised reached TWD 550 billion (inclusive of bonds), of which TWD 268.7 billion were raised through stocks, highlighting the market's central function of fundraising.

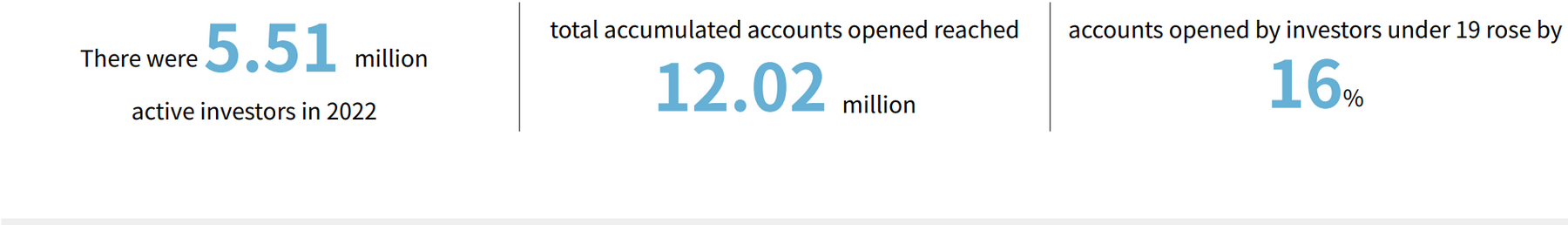

There were 5.51 million active investors and 12.02 million accumulated accounts opened in 2022, both up slightly from the previous year. Accounts opened by investors under 19 years of age rose by 16%, showing growing interest by the young.

Foreign investors held an average of 40% of the market capitalization in recent years. With most of those investments held over a longer period, it is a clear sign that TWSE-listed companies boast sound fundamentals and are attractive to international capital.

Business Performance