Day Trading

Deregulation of Day Trading of Securities on the Spot Market

General Overview

To provide investors with a complete range of hedging instruments and trading mechanisms, beginning from 30 June 2014, investors will be permitted to engage in long (buy first, sell later) and short (sell first, buy later) day trading of securities on the spot market.

For a further introduction to day trading of securities and related laws and regulations, official orders, and explanatory materials, please visit the websites of the Taiwan Stock Exchange Corporation (TWSE) and the GreTai Securities Market (GTSM):

TWSE https://www.twse.com.tw/en/

GTSM http://www.tpex.org.tw/en/

Introduction to the Day Trading System

I. Day Trading Defined

Day trading of securities means trading, by the normal settlement method, in which, by agreement of the investor and the securities broker, with respect to a TWSE (or GTSM) listed security designated by the competent authority, after a buy order or sell order for the security is executed on the cash (spot) market, an equal quantity of the security is offset through the same brokerage account within the same trading day, and the settlement of funds is conducted based on the price difference after the offsetting of the opposite trades.

II. Investor Eligibility:

Considering that day trading of securities on the spot market involves risk, it is open only to investors with a certain level of trading experience. To engage in day trading, an investor must meet the following requirements:

- The investor must have had a brokerage account for at least three full months and must have had at least 10 trades executed within the past year, provided that these restrictions do not apply to investors that have opened a margin account or to professional institutional investors.*

- An investor must first sign a general authorization agreement with the securities broker, stipulating that after an order has been executed to buy or sell securities in the cash (spot) market, and an equal quantity of the same type of securities is then offset through the same brokerage account on the same day, the settlement of funds will be conducted based on the price difference after the offsetting of the opposite trades. Unless the investor is a professional institutional investor, the investor must also sign a risk disclosure statement before the securities broker may accept the investor's orders for day trades.

*"Professional institutional investor" means a foreign or domestic bank, insurance company, bills finance company, securities firm, fund management company, government investment institution, government fund, pension fund, mutual fund, unit trust, securities investment trust company, securities investment consulting company, trust enterprise, futures commission merchant, futures service enterprise, and any other institution approved by the competent authority.

III. Securities Eligible for Day Trading:

Day trading has been permitted since 2014, and currently components stocks of the Taiwan 50 Index, Taiwan

Mid-Cap 100 Index and Taipei Exchange’s TPEx 50 Index are eligible for securities day trading. From June

1st, 2015, besides components stocks of the Taiwan 50 Index, Taiwan Mid-Cap 100 Index and the Taipei

Exchange’s TPEx 50 Index, underlying stocks of warrants (including underlying stocks of warrants allowed

to be issued by Class A issuers) announced by the Taiwan Stock Exchange or Taipei Exchange and all ETFs

listed on the Taiwan Stock Exchange or Taipei Exchange will also be eligible for day trading.

However, securities for which an altered trading method or disposition measures have been announced under the rules of the TWSE or the GTSM are not eligible for day trading. Also the securities listing on Taiwan Innovative Board(TIB) or Pioneer Stock Board(PSB) are not eligible for day trading.

For more detail information,please see the attachment.

IV. Trading Hours:

Investors may engage in day trading by buying first and selling later, or selling first and buying later, securities of the same type and quantity during regular trading hours (09:00-13:30). They also may engage in day trading by buying during regular trading hours and then selling in after-hours fixed-price trading, or by selling during regular trading hours and then buying in after-hours fixed-price trading.

Day trading may not be used for odd-lot trades, block trades, trades conducted under Article 74 of the TWSE Operating Rules, and trades conducted through over-the-counter price negotiation under Article 32-1, and trades under Article 39, of the GTSM Rules Governing Securities Trading on the GTSM.

V. Procedures for Handling Shortfalls in Securities Deliverable in Day Trading

●Procedures for Sell-First, Buy-Later Day Trading

- If the quantity of an investor's orders to sell securities on the spot market exceeds the sum of the balance of those securities deposited in the investor's depository account and the quantity of the investor's purchases of the stock executed on the spot market on the same day, the securities broker must conduct risk management, and confirm whether there is a sufficient source of the securities available for lending.

- If an investor first sells spot securities during regular trading hours and then buys the securities during regular trading hours or in after-hours fixed-price trading, the investor has completed a (sell-first, buy-later) day trade.

- If, after an investor has sold securities on the spot market, the investor fails to complete an opposite purchase to close out the day trade, the investor may change the status of the trade from a day trade to a short sale of securities borrowed on margin or through a securities loan, or may use the procedures for Lending of Securities to Cover Shortfalls in Securities Deliverable in Day Trading. Under the latter procedures, the securities broker will borrow securities from the inventory of investors who are willing to lend them, and the broker will then lend them to the investor who sold the spot securities but failed to complete an opposite purchase to close out the day trade.

- When a day trade cannot be completed for a position, if the investor fails to successfully borrow securities on the trade date (T) through the procedures for Lending of Securities to Cover Shortfalls in Securities Deliverable in Day Trading, the securities broker will authorize a financial enterprise to bid or negotiate for the borrowing of securities on the first business day after the trade date (T+1). If a sufficient quantity of securities cannot be borrowed through bidding or negotiation procedures, the TWSE or GTSM will arrange for the borrowing of the securities through the settlement-driven securities borrowing and lending (SBL) system on the second business day after the trade date (T+2) in order to settle the transaction.

- When an investor has sold spot securities but fails to complete an opposite purchase, the securities broker will purchase the securities during regular trading hours on the first business day after the trade date (T+1) through a special account set up by the broker's headquarters (securities trading account: 8899999) for purposes of returning the securities.

●Lending of Securities to Cover a Shortfall in Securities Deliverable in Day Trading

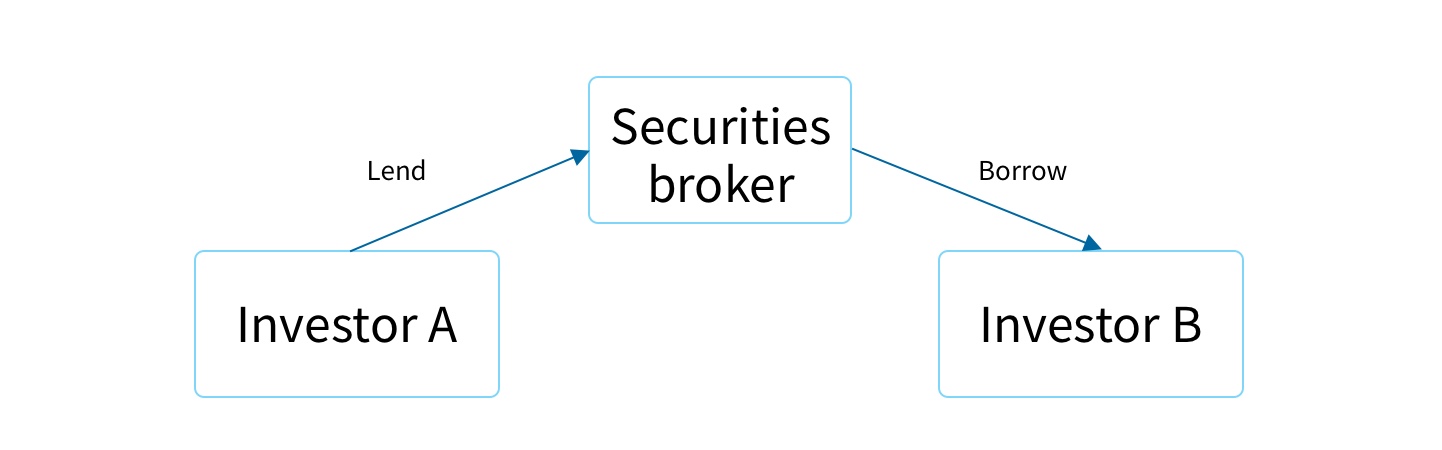

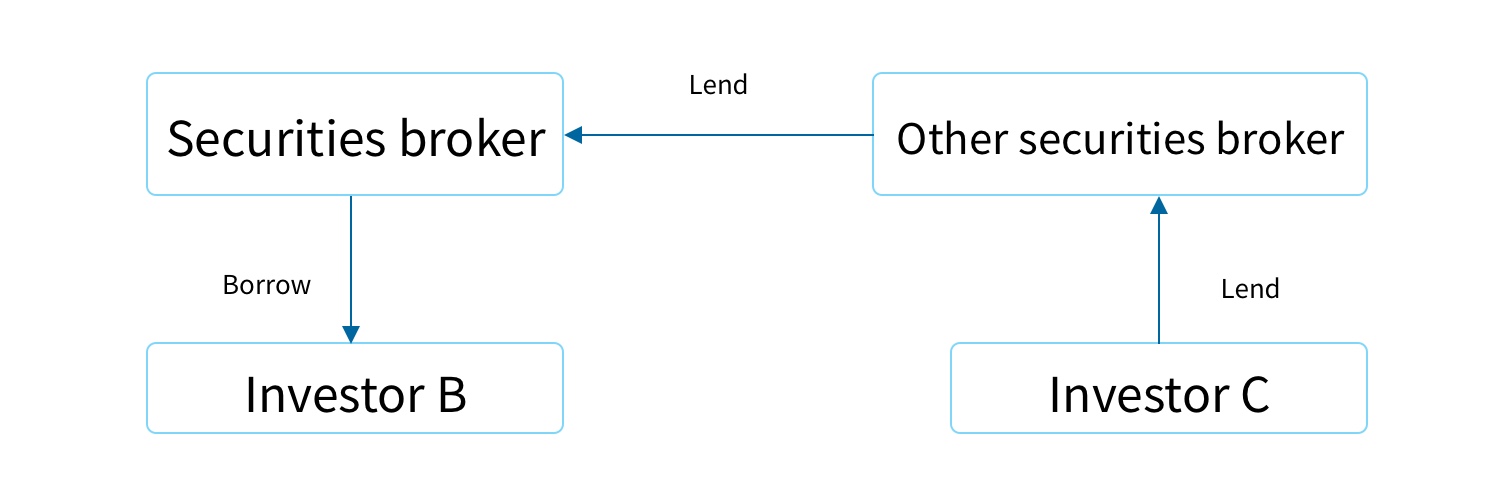

- A securities firm is permitted to use only the following sources to obtain securities to loan to an investor: 1) borrowing the securities from a customer of the broker, or 2) borrowing the securities from another securities broker that has borrowed the securities from a customer of its own. (See illustration.)

Or

- The rate charged for Lending of Securities to Cover a Shortfall in Securities Deliverable in Day Trading shall not exceed 7 percent of the closing price of the securities on the day of their sale by the investor.

- The securities broker must first sign a Contract for Securities Lending to Cover Shortfalls in Securities Deliverable in Day Trading with the customer or the other securities broker that lends the securities and with the investor that borrows the securities, respectively. The securities broker also must open a Special Account for Handling Shortfalls in Securities Deliverable in Day Trading before the broker may handle business in connection with securities lending to cover shortfalls in securities deliverable in day trading.

When there is book closure by an issuer of a security eligible for day trading, all sell-first buy-later day trading of that security and all operations for lending of that security to cover shortfalls in day trading shall be suspended beginning from 5 business days before the book closure date. This restriction shall not apply, however, if the cause for the book closure by the issuer has no effect on the exercise of shareholder rights.

● Fee Obligations

When an investor has sold securities on the spot market but then fails to complete an opposite purchase to close out the day trade, the investor will be solely liable for all fees incurred in connection with any borrowing of securities, or bidding or price negotiation for the borrowing of securities, to cover any shortfall in securities deliverable in day trading, or with borrowing of securities required for settlement, and any related processing fees and any price difference and other fees incurred in connection with a forced purchase.

Before 5 p.m. on the first business day after a forced purchase for the return of borrowed securities, the investor must pay in full the price difference and other fees incurred in connection with the forced purchase, and will be deemed in default if the payment is late.

VI. Risk Management

- Limit management: The monetary amount of an investor's initial buy and initial sell orders executed in day trading are included in the calculation toward the single-day trading limit, but the monetary amounts of the opposite offsetting orders executed in day trading are not included in the calculation toward the single-day trading limit. Trading limit amounts may not be credited back for revolving use on the same day after being offset in day trading.

- Advance collection of funds by the securities broker: The securities broker may collect funds in advance from the investor in full or in a certain percentage as the circumstances merit, and the Operational Directions for Advance Collection of Funds and Securities by Securities Brokers in Brokerage Trading shall apply.

- Daily assessment of trading limits based on an investor's profit or loss in day trading: The securities broker shall, after the closing of the market each business day, assess whether to increase, or decrease, an investor's single-day trading limit or day trading limit, based on the investor's profit or loss in day trading.

- Monthly assessment of an investor's cumulative loss: If the investor's cumulative loss from day trades of the preceding month reaches half of the single-day trading limit or day trading limit, the securities broker shall suspend day trading by the investor. The securities broker shall reassess the investor's single-day trading limit or day trading limit after the investor has submitted proof of adequate financial capability, unless the investor is a professional institutional investor.

Q&A

●Day Trading Principles

-

(Buy first, sell later): At 9 a.m. on 6 January 2014, an investor buys in cash 1,000 shares of XYZ Stock (a component stock of the Taiwan 50 Index) and the purchase is executed at NT$100,000. At 11 a.m. the investor sells 1,000 shares of XYZ Stock on the spot market and the sale is executed at NT$110,000. Does this comply with day trading principles?

In the trade described above, the investor first buys the shares in cash (purchase executed at 9 a.m.) and then sells the shares on the spot market (sale executed at 11 a.m.), and the shares furthermore are shares of TWSE listed stock designated as eligible for day trading by the competent authority. So the trade complies with the principles for a buy-first, sell-later day trade on the cash (spot) market.

To report these two trades as a day trade, the securities broker must make the report through the TWSE system before 6 p.m. on 6 January 2014, and the investor must settle the price difference of NT$10,000. After the purchased and sold shares are offset against each other, no further securities settlement is required.

If before the closing of the market on 6 January, the investor instructs the securities broker not to offset the two trades against each other, then the securities broker does not need to report the two trades as a day trade through the TWSE system. In that case, the investor will be required to carry out the settlement of funds and securities for the two trades individually.

-

(Sell first, buy later): At 9 a.m. on 30 June 2014, an investor sells 1,000 shares of XYZ Stock (a component stock of the Taiwan 50 Index) on the spot market and the sale is executed at NT$100,000. At 11 a.m. the investor buys in cash 1,000 shares of XYZ Stock and the purchase is executed at NT$110,000. Does this comply with day trading principles?

Beginning from 30 June 2014, investors are permitted to engage in both long (buy first, sell later) and short (sell first, buy later) day trades of component stocks of the Taiwan 50 Index, Taiwan Mid-Cap 100 Index, and GreTai 50 Index.

When a securities broker accepts an investor's order to sell shares on the spot market, the broker is required to confirm whether the order quantity exceeds the sum of the balance of those securities deposited in the investor's depository account and the quantity of the investor's spot purchases of the stock executed the same day. If the order exceeds that sum, the securities broker must confirm whether a sufficient source of securities is available for lending. Then, if the investor fails to complete an opposite purchase to close out the day trade, the broker can lend the securities to the investor for settlement.

The example above complies with the principles for a sell-first, buy-later day trade on the cash (spot) market. The securities broker must report the trade as a day trade by 6 p.m. on 30 June 2014, in accordance with day trade reporting procedures.

-

An investor makes multiple purchases and sales of shares of XYZ Stock (a component stock of the Taiwan 50 Index) on the cash (spot) market during regular trading hours, as shown in the table below. What method is used to determine how the trades will be mutually offset for day trading purposes?Trade timeBuysSells

9:00 1,000 shares 10:00 2,000 shares 11:00 3, 000 shares 12:00 2,000 shares Total 4,000 shares 4,000 shares Below are examples of methods by which the above trades can be designated for offsetting as day trades:

Method 1: "9 a.m. buys 1,000 shares" is offset by "10 a.m. sells 1,000 shares"; "10 a.m. sells 1,000 shares" is offset by "11 a.m. buys 1,000 shares"; and "11 a.m. buys 2,000 shares" is offset by "12 p.m. sells 2,000 shares".

Method 2: "9 a.m. buys 1,000 shares" is offset by "12 p.m. sells 1,000 shares "; "10 a.m. sells 2,000 shares" is offset by "11 a.m. buys 2,000 shares"; "11 a.m. buys 1,000 shares" is offset by "12 p.m. sells 1,000 shares ".

The investor can freely decide how to pair up the offsetting trades in day trading, as long as day trading principles are complied with.

-

Can an investor's cash purchases or spot sales of shares during regular trading hours be offset against the investor's spot sales or cash purchases of shares in after-hours fixed-price trading, and reported as day trades?

Yes. After initially purchasing or selling shares during regular trading hours, an investor can then sell or purchase the shares in after-hours fixed-price trading and declare the trades as day trades. However, an investor cannot report a trade as a day trade if the initial purchase or sale is made in after-hours fixed-price trading.

Day trading may not be used for odd-lot trades, block trades, or trading done by auction, reverse auction, or over-the-counter price negotiation.

-

If an investor sells securities through a borrowed account in accordance with Article 82-1 of the Operating Rules of the TWSE, can the sale through the borrowed account be offset and reported as a day trade with an opposite purchase made through the same account?No. Because the holder of the account is not the owner of the securities, the sale through the borrowed account may not be reported together with a purchase through the same account as a day trade.

-

An investor opened an account at Securities Broker X on 1 March 2014 and has executed over ten trades. Is the investor qualified to engage in day trading on 30 June 2014?Because the investor has had the brokerage account for over three months and has executed ten transactions as of 30 June 2014, the investor is eligible for day trading. The investor may engage in day trading after signing a risk disclosure statement and a general authorization agreement with the securities broker and after the securities broker has entered its updated list of qualified investors into the computer system designated by the TWSE and GTSM. To execute the risk disclosure statement and general authorization agreement, the securities broker's staff and the principal may sign or affix their seal in the signature column.

-

An investor opened an account at Securities Broker X on 27 June 2014 and has not yet started trading, but the investor has a margin account at Securities Broker Y. Is the investor eligible to apply to engage in day trading through securities broker X on 30 June 2014?Yes. Although the investor has not yet had the account at securities broker X for three months as of 30 June 2014, the investor has a margin account at securities broker Y, which entails certain qualifications, and from which it can be inferred that the investor has a certain level of investment experience and is eligible for day trading. The investor may engage in day trading after signing a risk disclosure statement and a general authorization agreement with the securities broker, and after the securities broker has entered its updated list of qualified investors into the computer system designated by the TWSE and GTSM.

-

Regarding a general authorization agreement signed between a professional institutional investor and the securities broker, is it permissible to include provisions in addition to those contained in the TWSE version of the general authorization agreement?As long as the content of the TWSE version of the general authorization agreement is not changed, the professional institutional investor and the securities broker may enter into their own additional arrangements according to their practical needs.

-

May an investor conduct day trading through an omnibus trading account?An investor may not conduct day trading through an omnibus trading account. Neither trades allocated from trading through an omnibus trading account, nor trades for which the account number is corrected after allocation from trading through an omnibus account, may be offset in day trading.

-

If an investor has previously signed a risk disclosure statement and general authorization agreement for buy-first, sell-later day trading, is the investor required to sign a new risk disclosure statement and general authorization agreement before the investor may engage in sell-first, buy-later day trading?Yes. An investor that has previously signed a risk disclosure statement and general authorization agreement for buy-first, sell-later day trading must sign a new, updated risk disclosure statement and general authorization agreement that includes provisions for sell-first, buy-later day trading, before the investor may engage in sell-first day trading. If an investor has not yet signed a new risk disclosure statement and general authorization agreement, the securities broker must limit that investor's day trading to buy-first, sell-later day trading, and remind the investor to promptly sign the new risk disclosure statement and general authorization agreement.

-

How is the Rate Calculated for Lending of Securities to Cover Shortfalls in Securities Deliverable in Day Trading?The rate charged for lending of securities to cover a shortfall in securities deliverable in day trading shall not exceed 7 percent of the closing price of those securities on the day of their sale by the investor. On the trade day (T), after a securities broker has made an itemized report of a securities loan through the platform for reporting shortfalls in securities deliverable in day trading, the TWSE or GTSM will forward the information to the Taiwan Depository & Clearing Corporation to carry out transfer procedures. If, on the first business day after the trade date (T+1), a forced purchase is made to cover the position with the shortfall, the lender will then be free to sell on the second business day after the trade date (T+2), and the forced purchase position can be returned to the lender on the third business day after the trade date (T+3). Consequently, the rate for lending of securities to cover shortfalls in securities deliverable in day trading in principal is calculated per one day of lending.

-

If the securities broker has already signed with the lender a contract for securities lending to cover shortfalls in securities deliverable in day trading, does the broker need to notify the lender again at the actual time of borrowing?Although the securities broker has already signed with the lender a contract for securities lending to cover shortfalls in securities deliverable in day trading, once securities have been loaned, there will be one or more days on which the lender will be unable to sell the securities (if a forced purchase is not successfully made on T+1, the loan will be continued). It is therefore recommended that the securities broker notify the lender whenever it actually borrows securities. The timing and method for such notifications can be freely agreed upon between the securities broker and the lender.

-

If, after selling securities on the spot market, an investor fails to make an opposite cash purchase of the securities, apart from the procedures for the Lending of Securities to Cover Shortfalls in Securities Deliverable in Day Trading, is there any other mechanism by which the investor can conclude settlement?If, after selling securities on the spot market, the investor fails to make an opposite purchase of the securities to close out the day trade, the investor also has the option of using preexisting mechanisms to change the status of the trade from a day trade to a short sale of securities borrowed on margin or through a securities loan.

-

If, after selling securities on the spot market, an investor fails to complete an opposite purchase of the securities, and also is unable to use the procedures for Lending of Securities to Cover Shortfalls in Securities Deliverable in Day Trading, what follow-up measures should be taken?

When a securities broker accepts an investor's order to sell securities on the spot market, the broker is required to check whether a sufficient supply of the securities is available for sale. So in principle, if an investor fails to make an opposite purchase of the securities, it should always be possible to use the procedures for Lending of Securities to Cover Shortfalls in Securities Deliverable in Day Trading.

If, in extraordinary circumstances, it is impossible to complete the procedures for Lending of Securities to Cover Shortfalls in Securities Deliverable in Day Trading on the trade date (T), then the securities broker must authorize a financial enterprise to bid or negotiate for the borrowing of securities on the first business day after the trade date (T+1). If a sufficient quantity of securities cannot be borrowed through bidding or negotiation procedures, the TWSE or GTSM will arrange on the broker's behalf for the borrowing of the securities through the settlement-driven securities borrowing and lending (SBL) system on the second business day after the trade date (T+2) in order to settle the transaction.

-

If, after selling securities on the spot market, an investor fails to complete an opposite purchase of the securities, is the investor responsible for securities borrowing fees and fees incurred in connection with forced purchase?

If an investor has sold securities on the spot market and fails to complete an opposite purchase to close out the day trade, the investor will be solely liable for all fees incurred in connection with any borrowing of securities, or bidding or price negotiation for the borrowing of securities, to cover any shortfall in securities deliverable in day trading, or with borrowing of securities required for settlement and any related processing fees, and any price difference and other fees incurred in connection with a forced purchase.

Before 5 p.m. on the first business day after a forced purchase for the return of borrowed securities, the investor must pay in full the price difference and other fees incurred in connection with the forced purchase, and will be deemed in default if the payment is late.

-

How is an investor's day trading counted toward the single-day trading limit?The monetary amount of an investor's initial buy and initial sell orders executed in day trading are included in the calculation toward the single-day trading limit. However, the monetary amounts of the opposite offsetting orders executed in day trading are not included in the calculation toward the single-day trading limit. Trading limit amounts may not be credited back for revolving use on the same day after being offset in day trading.

-

Are securities brokers required to adopt any risk management measures for day trading in addition to the single-day trading limit and the day trading limit?

In addition to the single-day trading limit and day trading limit, the securities brokers are required to enforce the following risk management measures:

- The securities brokers may collect funds in advance from the investor in full or in a specific percentage as the circumstances merit, and the Operational Directions for Advance Collection of Funds and Securities by Securities Brokers in Brokerage Trading shall apply.

- The securities broker shall, after the closing of the market each business day, assess whether to increase, or decrease, an investor's single-day trading limit or the day trading limit, based on the investor's profit or loss in day trading.

- If the investor's cumulative loss from day trading of the preceding month reaches half of the single-day trading limit or day trading limit, the securities broker shall suspend day trading by the investor. The securities broker shall reassess the investor's single-day trading limit or day trade limit after the investor has submitted proof of adequate financial capability, unless the investor is a professional institutional investor.