Introduction

Definition

An exchange traded note, or ETN, is a security issued by a securities firm that pays return at maturity based on the performance of the underlying index. It is traded in the securities market, and is subscribed and sold back in cash by investors.

Features

- ETNs do not hold any assets. They are not principal-guaranteed, secured, or guaranteed by any third party.

- An ETN tracks the return of an underlying index. The return of an ETN is based on the provisions in the prospectus and the credit rating of the issuing securities firms.

- The funds raised by issuing an ETN are to be used at the issuer's discretion. They can be used to expand the business operation, fund an acquisition or merger, buy or sell the constituents in the underlying index, or hedge risks.

- What an investor holds is the issuer's promise to pay a rate of return identical to the performance of the underlying index minus a fixed fee at maturity. There is no tracking error in theory.

- ETNs can be traded via simple procedure and the investment threshold is low. ETNs can be applied to more flexible and diversified area of investment. The information of value is transparent.

Indicative value

- An ETN does not hold the constituents of the underlying index, and so a net asset value cannot be calculated. The issuing securities firm calculates a value based on the underlying index. This is known as the indicative value.

- The issuer is required to report the indicative value of the last business day before the market opens on each business day. In addition, the "intraday indicative value" per unit has to be updated on the TWSE Market Information System (MIS) at least every 15 seconds during trading hours for investors.

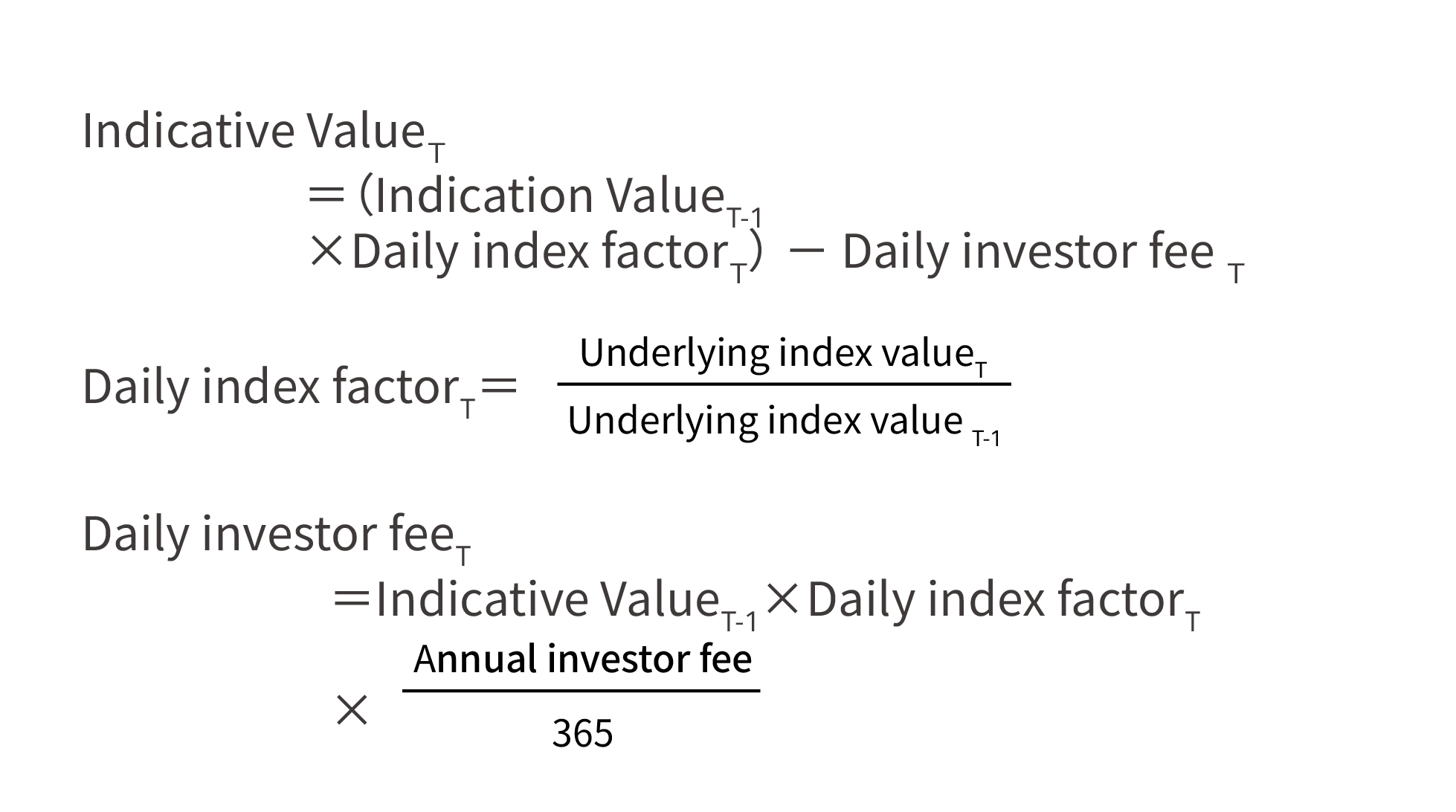

- The formula is as follows:

Investment risks

When trading ETNs or applying to the issuing securities firm to buy or sell ETNs, an investor is required to sign a risk disclosure statement before the securities firm may accept the order. The risks associated with ETNs are the following:

- Issuer’s credit risk: an ETN is an unsecured debt security without having any asset as collateral. It relies completely on the issuer's ability to pay.

- Market risk of underlying index (non-principal-guaranteed): Return received by a ETNs investor is determined by increase or decrease in the underlying index. If the index falls during the period of investment, investment loss may erode the principal.

- Discount/Premium risk (ETNs transaction price being lower/higher than the indicative value): There is no tracking error in ETNs in theory. However, ETNs are inevitably traded at discount or premium. Given ETNs reopening is decided solely by the issuer and the subscription and sellback mechanisms in the primary market may not work as efficiently as expected, it may be possible to remove discount and premium quickly under certain circumstances.

- Delisting risk: An ETN may be delisted due to maturity, early redemption, or other material reasons.

- Liquidity risk: An ETN may be vulnerable to liquidity risk due to imbalances in demand and supply, trading time difference, or the liquidity provider not playing an active role in market making.

- Leverage risk (in leveraged or inverse ETNs): As leveraged and inverse ETFs, multiplied return and inverse return of leveraged and inverse ETNs are calculated on a daily basis. With daily compound interest, the long-term rate of return of an ETN will deviate from the positive or negative multiple of return of the underlying index.

ETN vs. ETF

| ETN | ETF | |

|---|---|---|

| Similarities | ||

| Traded on TWSE | Yes | Yes |

| Return | Tracking an underlying index (less fixed fees) |

Tracking an underlying index |

| Investment threshold | Low | Low |

| Transparency | High | High |

| Transaction tax | 0.1% | 0.1% (Securities transaction tax suspended for bond ETFs) |

| Transaction fee | same as for stock, up to 0.1425% | same as for stock, up to 0.1425% |

| Differences | ||

| Issuer | Securities firms | SITEs |

| Structure | Other securities (debt securities) |

Fund |

| Maturity | Yes (1-20 years) | None |

| Return structure | Securities firm promises to pay index performance at maturity. | Assets are held to track an underlying index. |

| Issuer’s credit risk | Yes | No |

| Holding underlying constituents | No | Yes |

| Portfolio transparency | No (Fund utilization by the issuer not disclosed)) |

Transparent and disclosed (Portfolio composition file disclosed on a daily basis) |

| Transaction method | Same as stock with the following restrictions:

|

Same as stock |

| Subscription/Redemption mechanisms | Cash | In kind/cash |

| Liquidity provider | Yes (usually the issuer) | Yes (at least 1 proprietary trader) |

| Tracking error | None in theory | Yes |